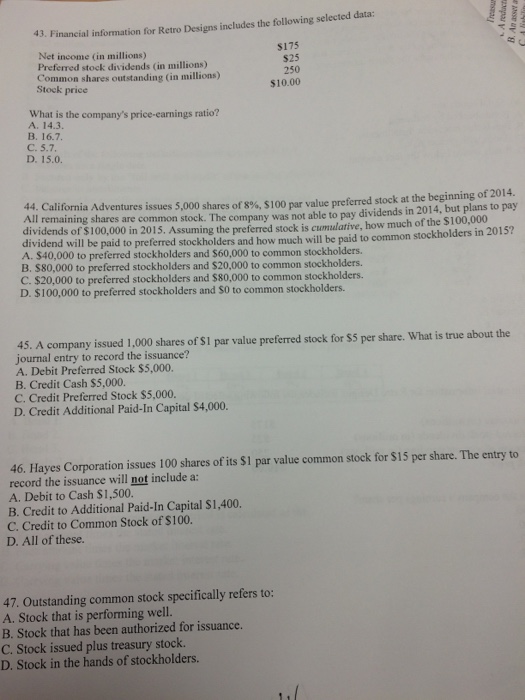

Question: Financial information for Retro Designs includes the following selected data: What is the company's price-earnings ratio? 14.3. 16.7. 5.7. 15.0 California Adventures issues 5,000 shares

Financial information for Retro Designs includes the following selected data: What is the company's price-earnings ratio? 14.3. 16.7. 5.7. 15.0 California Adventures issues 5,000 shares of 8%, $100 par value preferred stock at the beginning of 2014. All remaining shares are common stock. The company was not able to pay dividends in 2014, but plans to pay dividends of $100,000 in 2015. Assuming the preferred stock is cumulative, how much of the $100,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders in 2015? $40,000 to preferred stockholders and $60,000 to common stockholders. $80,000 to preferred stockholders and $20,000 to common stockholders. $20,000 to preferred stockholders and $80,000 to common stockholders. $ 100,000 to preferred stockholders and $0 to common stockholders. A company issued 1,000 shares of $1 par value preferred stock for $5 per share. What is true about the journal entry to record the issuance? Debit Preferred Stock $5,000. Credit Cash $5,000. Credit Preferred Stock $5,000. Credit Additional Paid-In Capital $4,000. Hayes Corporation issues 100 shares of its $1 par value common stock for $15 per share. The entry to record the issuance will not include a: Debit to Cash $1,500. Credit to Additional Paid-In Capital $1,400. Credit to Common Stock of $100. All of these. Outstanding common stock specifically refers to: Stock that is performing well. Stock that has been authorized for issuance. Stock issued plus treasury stock. Stock in the hands of stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts