Question: Financial leverage Max Small has outstanding school loans that require a monthly payment of $1.010. He needs to buy a new car for work and

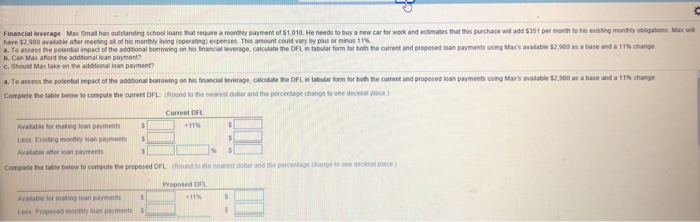

Financial leverage Max Small has outstanding school loans that require a monthly payment of $1.010. He needs to buy a new car for work and essmates that this purchase wil add $351 per month to his xsting monthily obligations. Max w have s 2.900 avatable afer meeong a" of his montly hngOperang) expenses this amount could eary Sy pan onna ts a. Te assess me pole tal impact ofthe adde 0 al bo owrg on his fnanaal leverage ca iate the DFL n tablar form tr toe he o re" and preosed loan payments Man mla e au base a d at 1% charge b. Can Max c. Should Max take on the addtional loan payment? aford the addtional loan payment? a. To assess the potential impact of the aositional borrowing on his inancial leverage, calculate the DFL in tabular fom for both the curent and proposed loan payments using Mar's avalable $2,900 as a base and a 11% change Complete the table below to compute the ament DFL Rund to the nearest dalar and the percentage change 5a one deamal place ] Current DFL Available for making loan payments Less Existing monthly loan paryments Available after loan payments Complete the table below to compute the preposed OFLRound to the nearest dollar and the percentage change to one decimal place Proposed DEL Available for making loan payments Less Proposed montily loan payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts