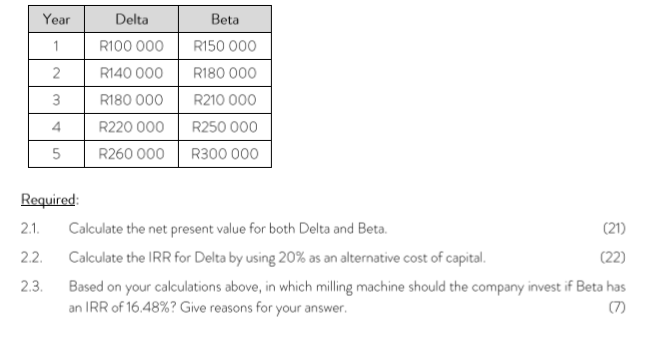

Question: Financial Management 101 Question 2 [50] Press Start (Pty) Ltd considers investing in a new milling machine that will possibly increase the company's profit margins.

Financial Management 101

![Financial Management 101 Question 2 [50] Press Start (Pty) Ltd considers investing](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe60989996b_90466fe60983a5aa.jpg)

Question 2 [50] Press Start (Pty) Ltd considers investing in a new milling machine that will possibly increase the company's profit margins. The operations manager suggested two possible machines to consider, namely Delta and Beta. The company intends purchasing only one of the two machines. The initial cost is R520 000 for Delta and R670 000 for Beta. The operations manager prepared a table of future cash flows that each project will generate and calculated the company's cost of capital at 12%. Year Delta Beta 1 2 3 R100 000 R140 000 R180 000 R220 000 R260 000 R150 000 R180 000 R210 000 R250 000 R300 000 4 5 Required 2.1. Calculate the net present value for both Delta and Beta. (21) 2.2. Calculate the IRR for Delta by using 20% as an alternative cost of capital. (22) 2.3 Based on your calculations above, in which milling machine should the company invest if Beta has an IRR of 16.48%? Give reasons for your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts