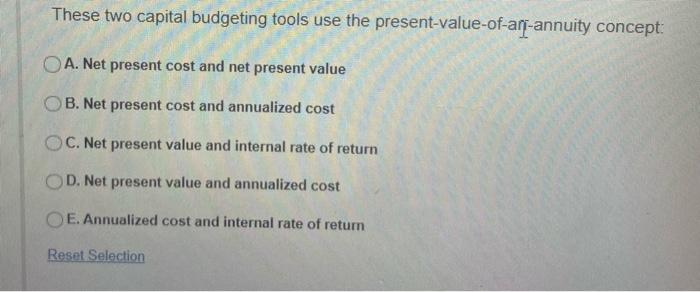

Question: Financial Management. Answer quickly please These two capital budgeting tools use the present-value-of-ari-annuity concept: A. Net present cost and net present value B. Net present

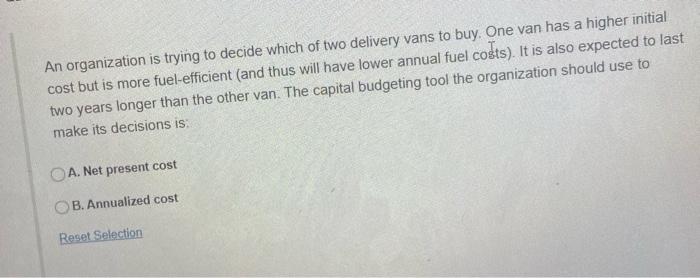

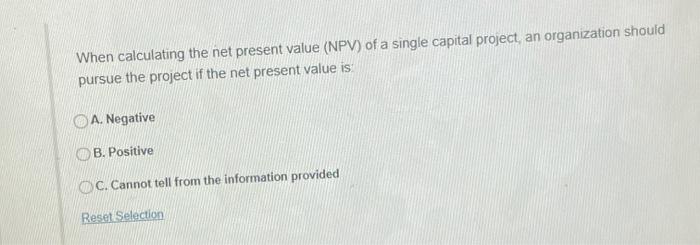

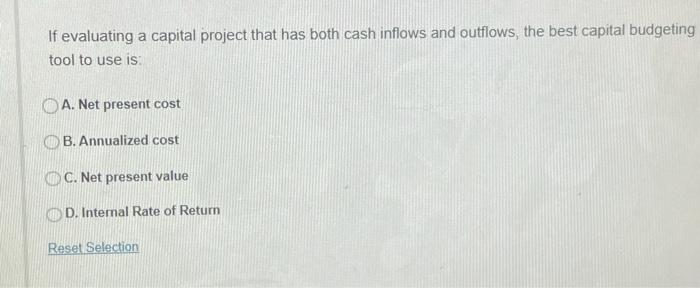

These two capital budgeting tools use the present-value-of-ari-annuity concept: A. Net present cost and net present value B. Net present cost and annualized cost C. Net present value and internal rate of return D. Net present value and annualized cost E. Annualized cost and internal rate of retum Reset Selection An organization is trying to decide which of two delivery vans to buy. One van has a higher initial cost but is more fuel-efficient (and thus will have lower annual fuel cots). It is also expected to last two years longer than the other van. The capital budgeting tool the organization should use to make its decisions is: A. Net present cost B. Annualized cost Reset Selection When calculating the net present value (NPV) of a single capital project, an organization should pursue the project if the net present value is: A. Negative B. Positive C. Cannot tell from the information provided Reset Selection If evaluating a capital project that has both cash inflows and outflows the best capital budgeting tool to use is A. Net present cost B. Annualized cost C. Net present value D. Internal Rate of Return Reset Selection Intemal rate of return (IRR) can sometimes lead to a wrong conclusion because it is insensitive to project scale True False Reset Selection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts