Question: Financial Management HW 4 ( week 7 ) Answer the following questions. Please show all steps of your work. Percy Motors has a target capital

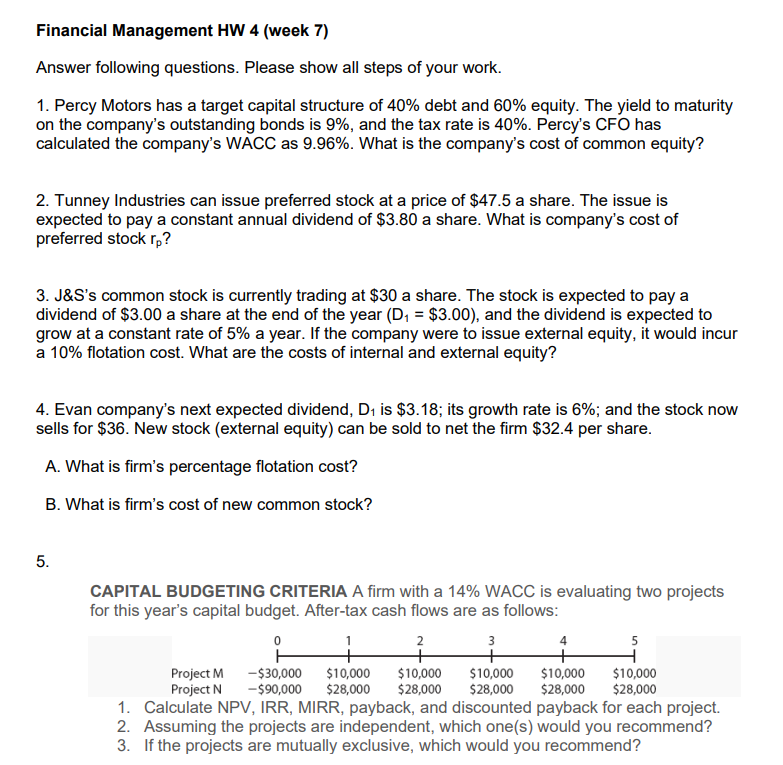

Financial Management HW week

Answer the following questions. Please show all steps of your work.

Percy Motors has a target capital structure of debt and equity. The yield to maturity

on the company's outstanding bonds is and the tax rate is Percy's CFO has

calculated the company's WACC as What is the company's cost of common equity?

Tunney Industries can issue preferred stock at a price of $ a share. The issue is

expected to pay a constant annual dividend of $ a share. What is company's cost of

preferred stock rp

J&Ss common stock is currently trading at $ a share. The stock is expected to pay a

dividend of $ a share at the end of the year D$ and the dividend is expected to

grow at a constant rate of a year. If the company were to issue external equity, it would incur

a flotation cost. What are the costs of internal and external equity?

Evan company's next expected dividend, D is $; its growth rate is ; and the stock now

sells for $ New stock external equity can be sold to net the firm $ per share.

A What is firm's percentage flotation cost?

B What is firm's cost of new common stock?

CAPITAL BUDGETING CRITERIA A firm with a WACC is evaluating two projects

for this year's capital budget. Aftertax cash flows are as follows:

Calculate NPV IRR, MIRR, payback, and discounted payback for each project.

Assuming the projects are independent, which ones would you recommend?

If the projects are mutually exclusive, which would you recommend?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock