Question: financial management Problem 10-35 Common stock value based on PV calculations [LO10-5) Beasley Ball Bearings paid a $4 dividend last year. The dividend is expected

financial management

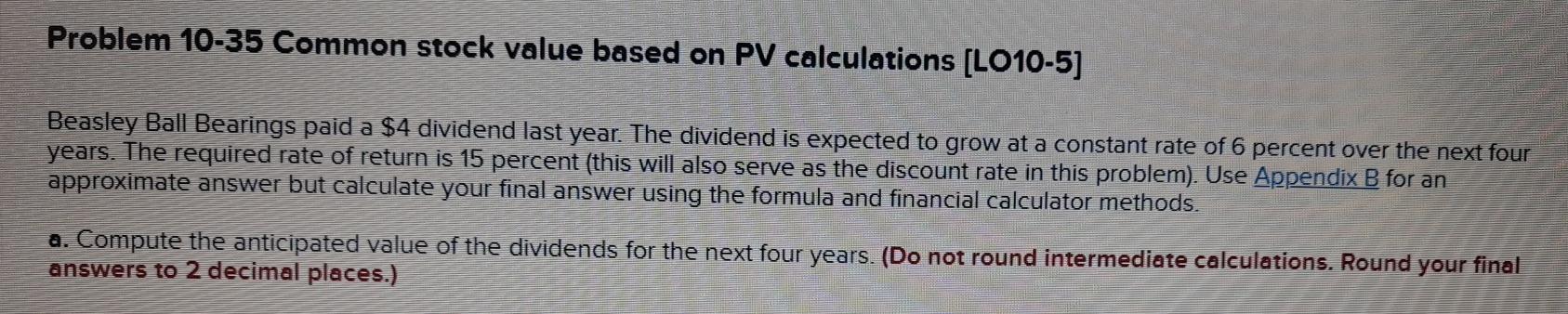

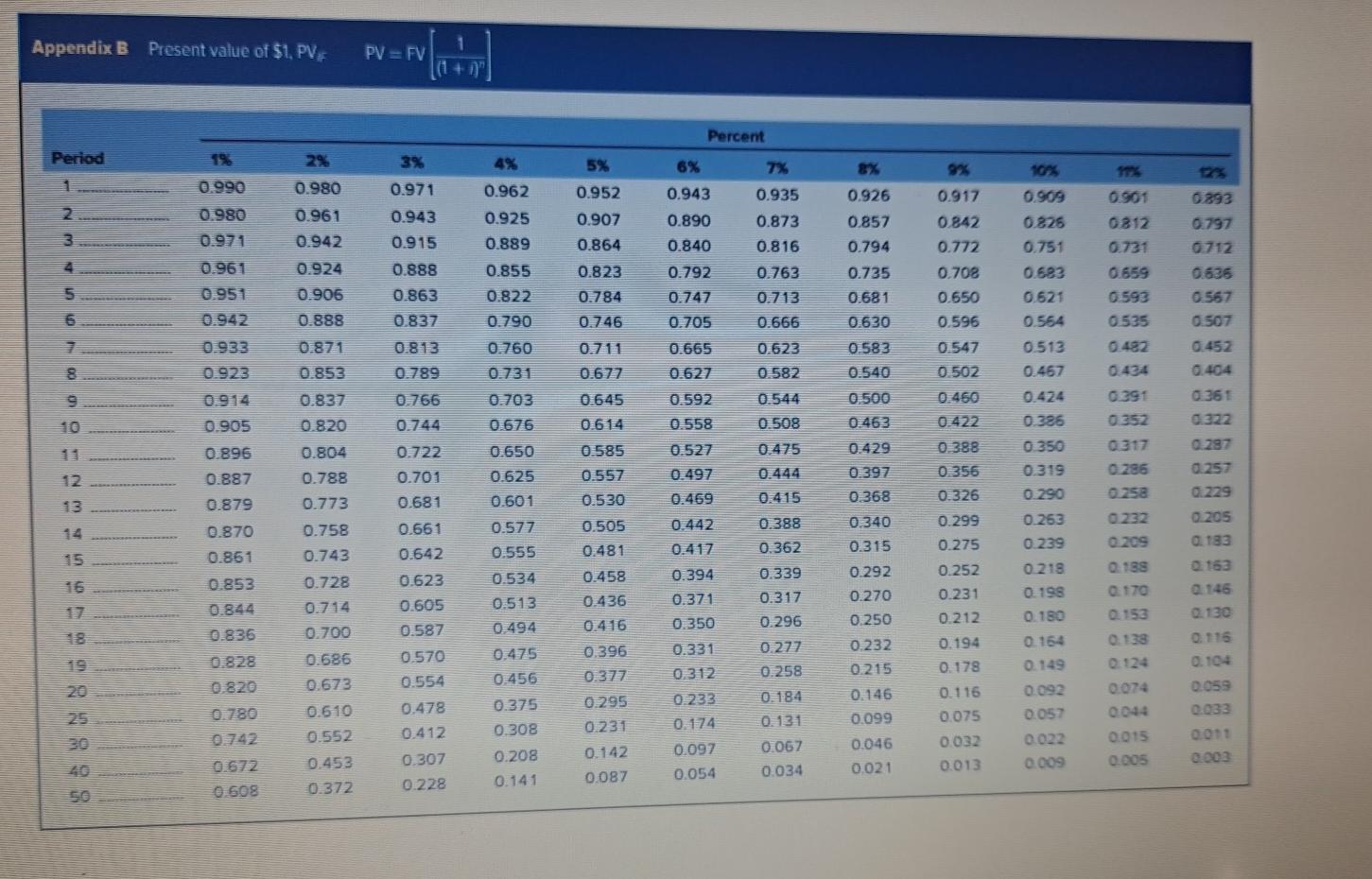

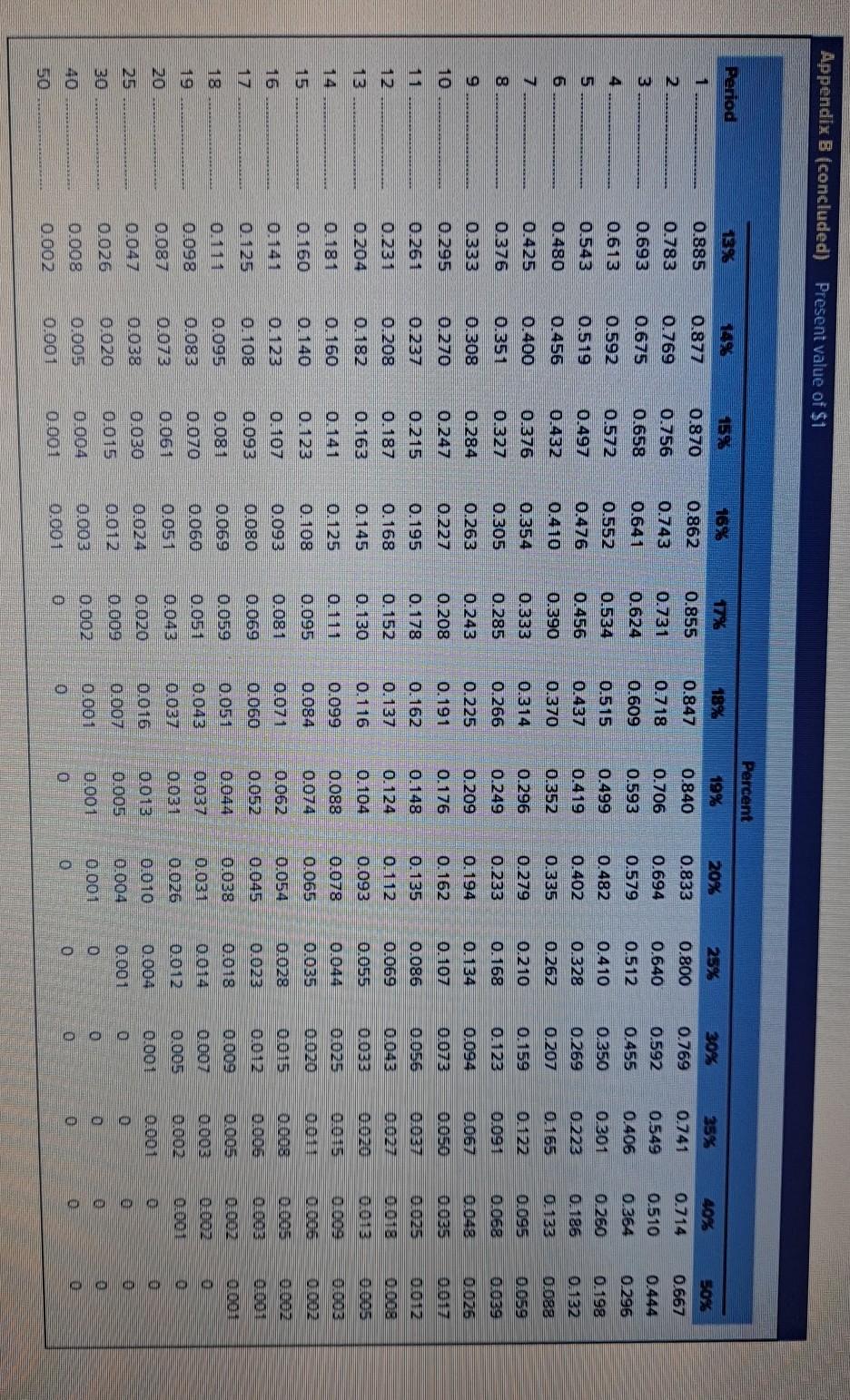

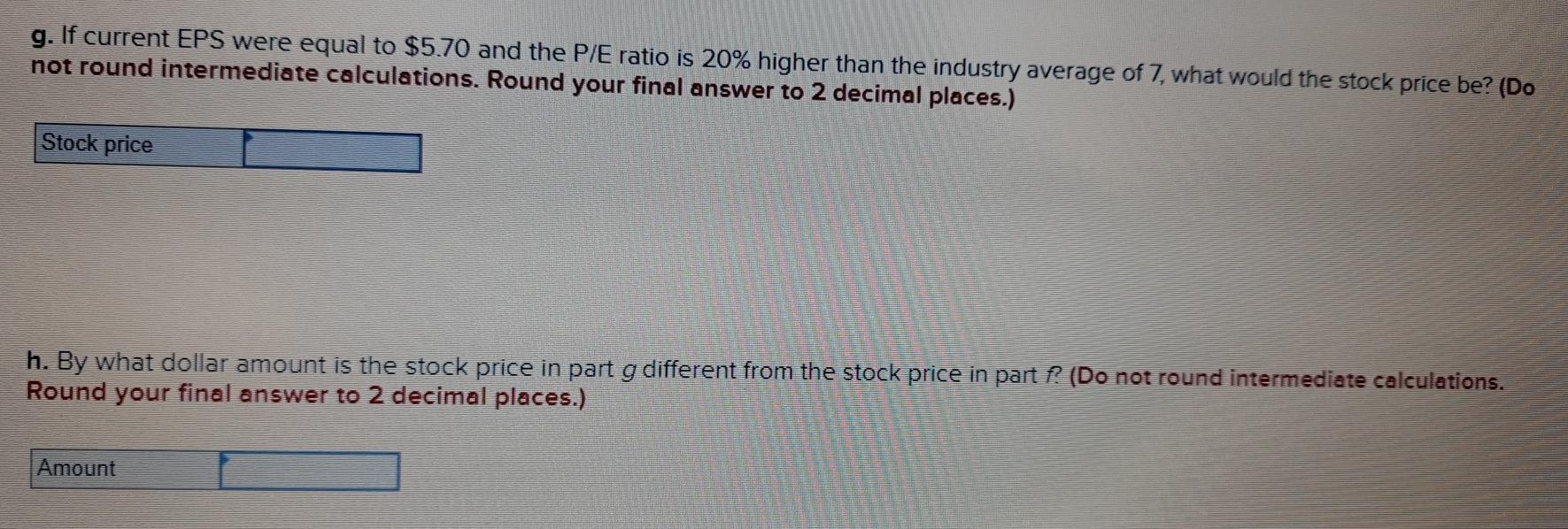

Problem 10-35 Common stock value based on PV calculations [LO10-5) Beasley Ball Bearings paid a $4 dividend last year. The dividend is expected to grow at a constant rate of 6 percent over the next four years. The required rate of return is 15 percent (this will also serve as the discount rate in this problem). Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. a. Compute the anticipated value of the dividends for the next four years. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Appendix B (concluded) Present value of $1 Percent Period 16% 19% 20% 30% 25% 1 40% 0.885 18% 0.847 50% 0.877 0.870 0.855 0.840 0.833 25% 0.800 0.640 0.741 2 0.714 0.667 0.756 0.769 0.675 0.718 0.769 0.592 0.706 0.694 0.731 0.624 0.549 3 0.444 0.658 0.609 0.579 0.512 0.455 0.406 0.296 0.783 0.693 0.613 0.543 0.480 4 0.510 0.364 0.260 0.572 0.534 0.515 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.593 0.499 0.419 0.482 0.410 0.350 0.592 0.519 0.456 0.301 5 0.497 0.456 0.198 0.132 0.437 0.328 0.269 0.223 0.186 6 0.402 0.335 0.390 0.370 0.352 0.262 0.207 0.165 0.133 0.088 0.400 0.432 0.376 0.327 0.333 0.314 0.296 0.425 0.376 0.279 0.095 8 0.210 0.168 0.159 0.123 0.122 0.091 0.351 0.285 0.266 0.249 0.233 0039 9 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.134 0.067 0.048 0.194 0.162 10 0.295 0.247 0.227 0.208 0.191 0.176 0.107 0073 0.270 0.237 0.215 0.178 0.162 0.148 0.135 0.261 0.231 0.208 0.187 0.163 2018 0.152 0.130 0.195 0.168 0.145 0.125 0.108 0.086 0.069 0.055 0.124 0.104 0.204 0.182 0.093 0.137 0.116 0.099 0.084 0.181 0.088 0.025 0.078 0.065 0.160 0.095 0.160 0.140 0.123 0.108 0.093 0.081 16 0.062 0.028 0.071 0.060 0.054 0.045 0015 0.012 0.125 0.080 0.069 0.052 0.023 0.059 0.018 0.044 0.14 0.123 0.107 0.093 0.081 0.070 0.061 0.030 0.015 0.005 0.095 0.083 0.073 0.069 0.060 0.051 0.098 0.087 0.051 0.043 0.037 0.016 0.038 0.031 0.0.26 0.031 0.051 0.012 0.002 0.024 0.020 0.038 0.0.20 25 0.010 0.004 0.013 0.005 0.001 oooooo 0.001 0.026 0.012 0.009 0.002 O O 0.001 0.001 CO 0 0 0 0 0.008 0.005 0.001 O 0 0 0.001 o 0.002 g. If current EPS were equal to $5.70 and the P/E ratio is 20% higher than the industry average of 7, what would the stock price be? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Stock price h. By what dollar amount is the stock price in part g different from the stock price in part f? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts