Question: Financial Management Question, please answer both _14. You are comparing two annuities which offer quarterly payments of $3,500 for five years and pay 0.80 percent

Financial Management Question, please answer both

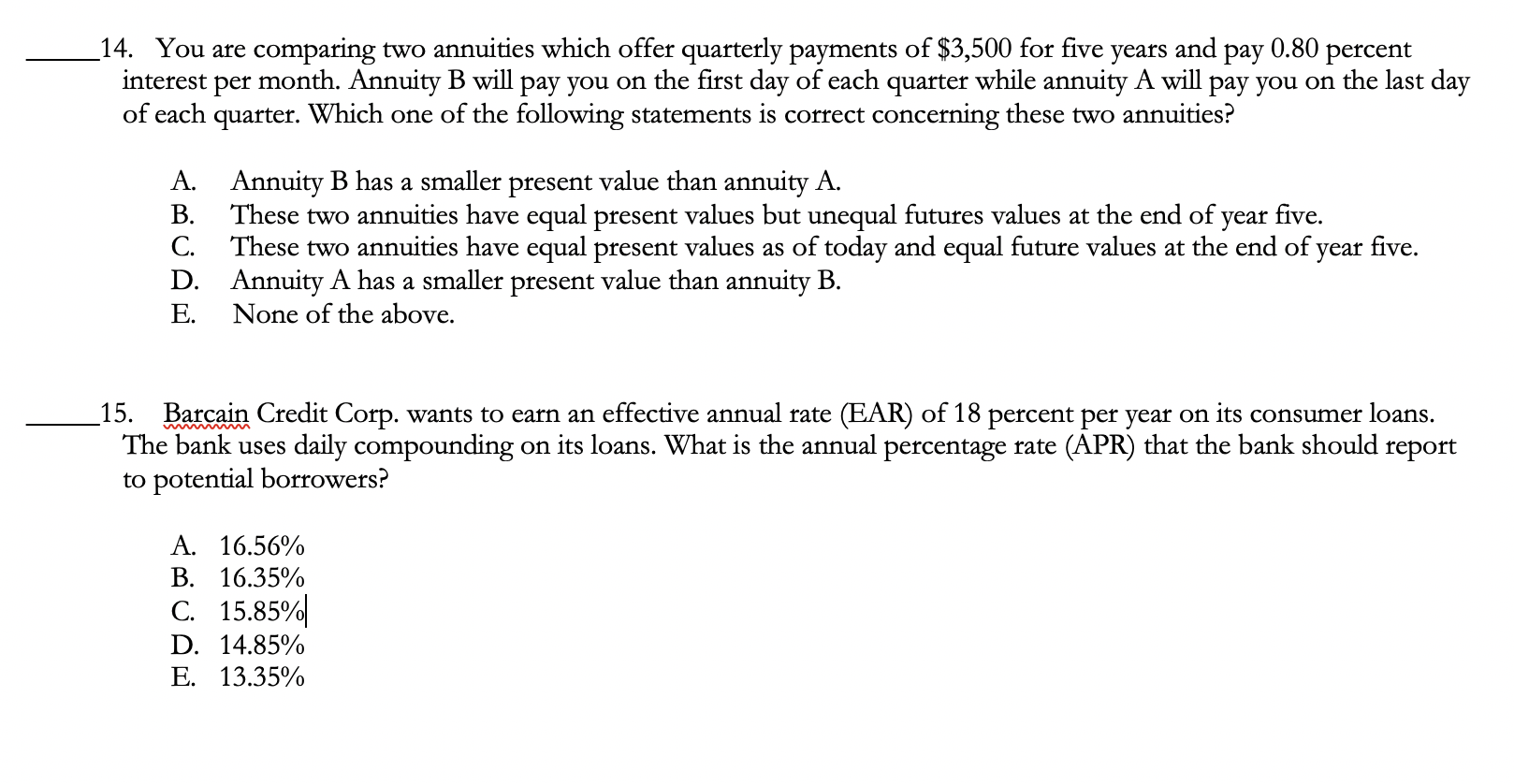

_14. You are comparing two annuities which offer quarterly payments of $3,500 for five years and pay 0.80 percent interest per month. Annuity B will pay you on the first day of each quarter while annuity A will pay you on the last day of each quarter. Which one of the following statements is correct concerning these two annuities? A. Annuity B has a smaller present value than annuity A. B. These two annuities have equal present values but unequal futures values at the end of year five. C. These two annuities have equal present values as of today and equal future values at the end of year five. D. Annuity A has a smaller present value than annuity B. E. None of the above. 15. Barcain Credit Corp. wants to earn an effective annual rate (EAR) of 18 percent per year on its consumer loans. The bank uses daily compounding on its loans. What is the annual percentage rate (APR) that the bank should report to potential borrowers? A. 16.56% B. 16.35% C. 15.85% D. 14.85% E. 13.35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts