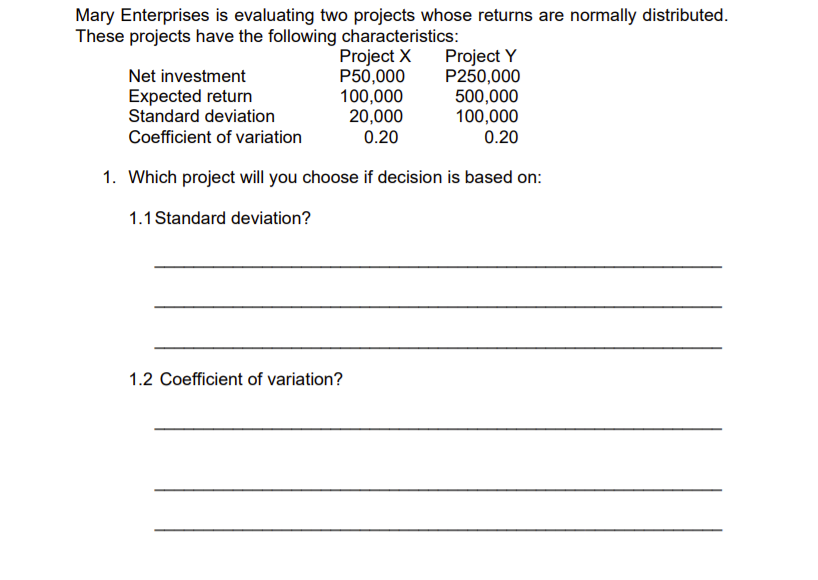

Question: FINANCIAL MARKET Mary Enterprises is evaluating two projects whose returns are normally distributed. These projects have the following characteristics: Project X Project Y Net investment

FINANCIAL MARKET

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock