Question: Financial Markets Chapter 6 Questions and Problems: (Note: students will be responsible for checking each question to make sure it is free of mistakes with

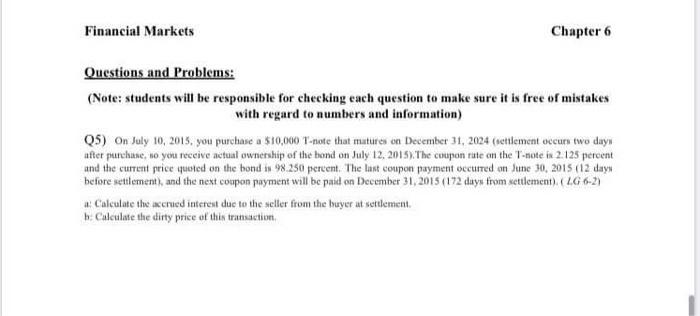

Financial Markets Chapter 6 Questions and Problems: (Note: students will be responsible for checking each question to make sure it is free of mistakes with regard to numbers and information) Q5) On July 10, 2015, you purchase a $10,000 T-mote that matures on December 31, 2024 (settlement occur two days after purchinse, so you receive actual ownership of the bond on July 12, 2015). The coupon rite on the T-note i 2.125 percent and the current price quoted on the bond in 98.250 percent. The last coupon payment occurred on June 10, 2015 (12 days before settlement), and the next coupon payment will be paid on December 31, 2015 (172 days from settlement). (LG 6-2) Calculate the accrued interest duc to the seller from the buyer at settlement b. Calculate the dirty price of this transaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts