Question: Financial Math Answer choices: a. 0.60 b. 4.61 c. 0.1 d. none of the above Assume the Black-Scholes model. The current price of a particular

Financial Math

Answer choices:

Answer choices:

a. 0.60

b. 4.61

c. 0.1

d. none of the above

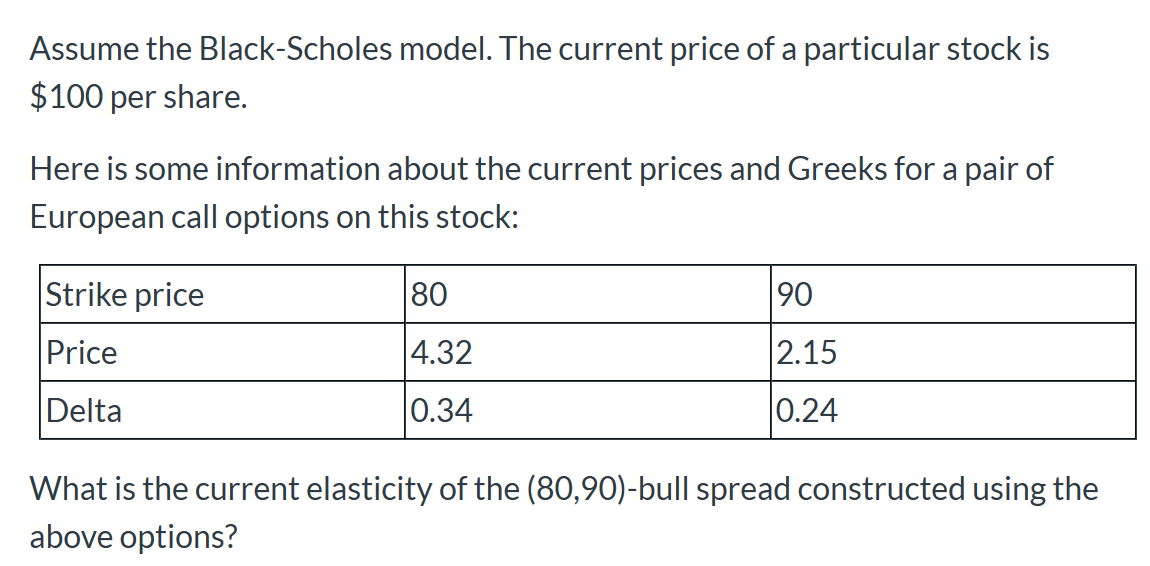

Assume the Black-Scholes model. The current price of a particular stock is $100 per share. Here is some information about the current prices and Greeks for a pair of European call options on this stock: Strike price 80 4.32 90 2.15 Price Delta 0.34 0.24 What is the current elasticity of the (80,90)-bull spread constructed using the above options

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts