Question: financial math cane someone please clearly explain in detail, step by step how to solve this problem. (be sure to set calculator to beginning) thank

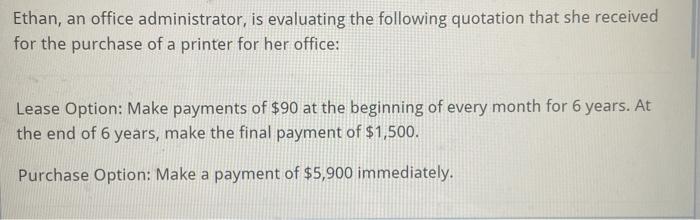

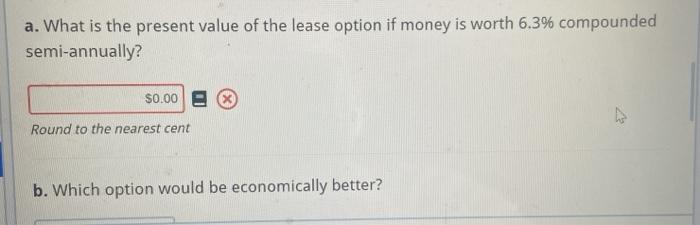

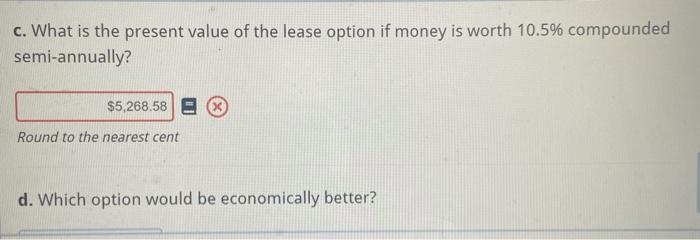

Ethan, an office administrator, is evaluating the following quotation that she received for the purchase of a printer for her office: Lease Option: Make payments of $90 at the beginning of every month for 6 years. At the end of 6 years, make the final payment of $1,500. Purchase Option: Make a payment of $5,900 immediately. a. What is the present value of the lease option if money is worth 6.3% compounded semi-annually? $0.00 Round to the nearest cent b. Which option would be economically better? c. What is the present value of the lease option if money is worth 10.5% compounded semi-annually? $5,268.58 E 3 Round to the nearest cent d. Which option would be economically better

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts