Question: Financial Math Problem Answer it with full step and calculation please Bonus Problem 2 (Optional, 25 marks) The following table shows the information of various

Financial Math Problem

Answer it with full step and calculation please

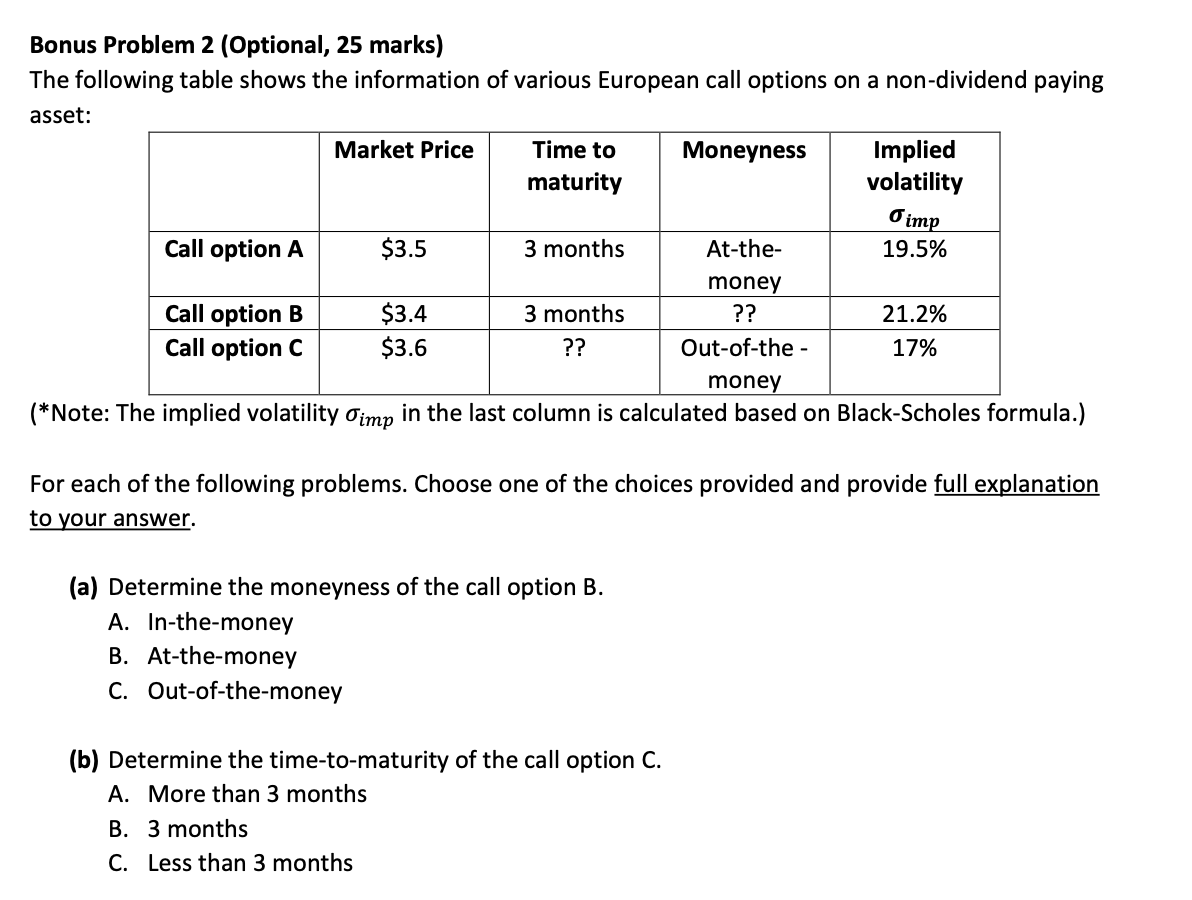

Bonus Problem 2 (Optional, 25 marks) The following table shows the information of various European call options on a non-dividend paying asset: Market Price Time to Moneyness Implied maturity volatility O imp Call option A $3.5 3 months At-the- 19.5% money Call option B $3.4 3 months ?? 21.2% Call option C $3.6 ?? Out-of-the- 17% money (*Note: The implied volatility Oimp in the last column is calculated based on Black-Scholes formula.) For each of the following problems. Choose one of the choices provided and provide full explanation to your answer. (a) Determine the moneyness of the call option B. A. In-the-money B. At-the-money C. Out-of-the-money (b) Determine the time-to-maturity of the call option C. A. More than 3 months B. 3 months C. Less than 3 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts