Question: Financial Math Problem: Mean-Variance Portfolio Selection Theory (25 marks) (*Short-selling is allowed in this problem) We consider an investment problem with 1 riskfree asset and

Financial Math Problem: Mean-Variance Portfolio Selection Theory (25 marks)

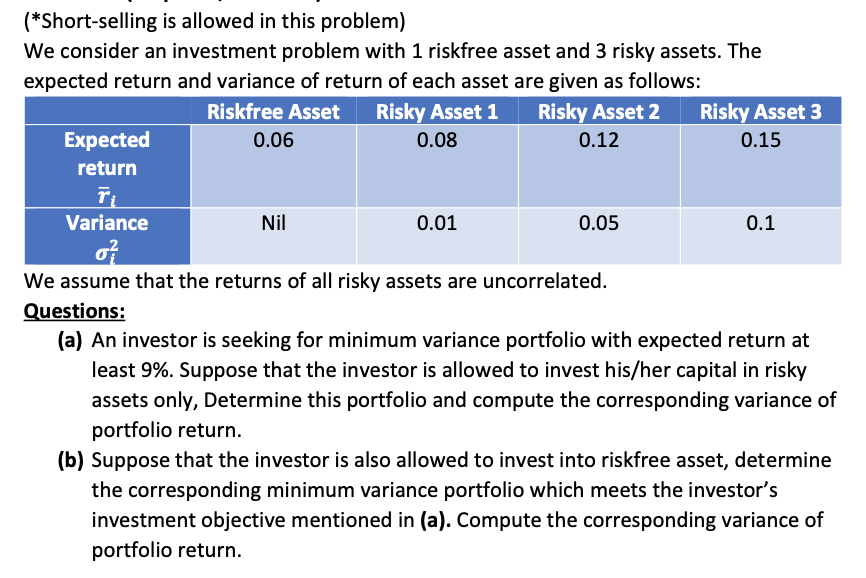

(*Short-selling is allowed in this problem) We consider an investment problem with 1 riskfree asset and 3 risky assets. The expected return and variance of return of each asset are given as follows: Riskfree Asset Risky Asset 1 Risky Asset 2 Risky Asset 3 Expected 0.06 0.08 0.12 0.15 return Variance Nil 0.01 0.05 0.1 o? We assume that the returns of all risky assets are uncorrelated. Questions: (a) An investor is seeking for minimum variance portfolio with expected return at least 9%. Suppose that the investor is allowed to invest his/her capital in risky assets only, Determine this portfolio and compute the corresponding variance of portfolio return. (b) Suppose that the investor is also allowed to invest into riskfree asset, determine the corresponding minimum variance portfolio which meets the investor's investment objective mentioned in (a). Compute the corresponding variance of portfolio return. (*Short-selling is allowed in this problem) We consider an investment problem with 1 riskfree asset and 3 risky assets. The expected return and variance of return of each asset are given as follows: Riskfree Asset Risky Asset 1 Risky Asset 2 Risky Asset 3 Expected 0.06 0.08 0.12 0.15 return Variance Nil 0.01 0.05 0.1 o? We assume that the returns of all risky assets are uncorrelated. Questions: (a) An investor is seeking for minimum variance portfolio with expected return at least 9%. Suppose that the investor is allowed to invest his/her capital in risky assets only, Determine this portfolio and compute the corresponding variance of portfolio return. (b) Suppose that the investor is also allowed to invest into riskfree asset, determine the corresponding minimum variance portfolio which meets the investor's investment objective mentioned in (a). Compute the corresponding variance of portfolio return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts