Question: Financial Math Problem Problem 4 The following table shows the actual expected return and beta of 5 funds Fund Actual Beta expected Bim return A

Financial Math Problem

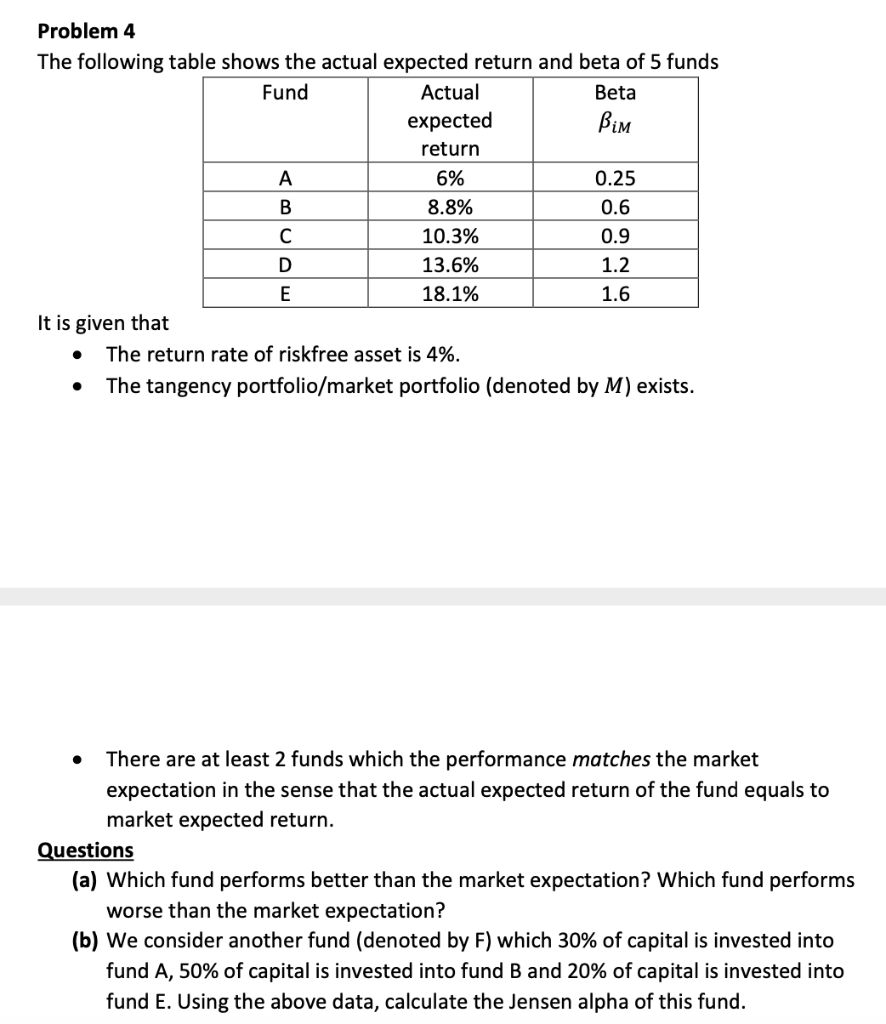

Problem 4 The following table shows the actual expected return and beta of 5 funds Fund Actual Beta expected Bim return A 6% 0.25 B 8.8% 0.6 10.3% 0.9 D 13.6% 1.2 E 18.1% 1.6 It is given that The return rate of riskfree asset is 4%. The tangency portfolio/market portfolio (denoted by M) exists. . There are at least 2 funds which the performance matches the market expectation in the sense that the actual expected return of the fund equals to market expected return. Questions (a) Which fund performs better than the market expectation? Which fund performs worse than the market expectation? (b) We consider another fund (denoted by F) which 30% of capital is invested into fund A, 50% of capital is invested into fund B and 20% of capital is invested into fund E. Using the above data, calculate the Jensen alpha of this fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts