Question: Financial Mathematics Problem Set 2 Problem 4: In the arbitrage-free T-periodic Cox-Ross-Rubinstein model, consider the model for fixed to E {1,...,T 1} - a so-called

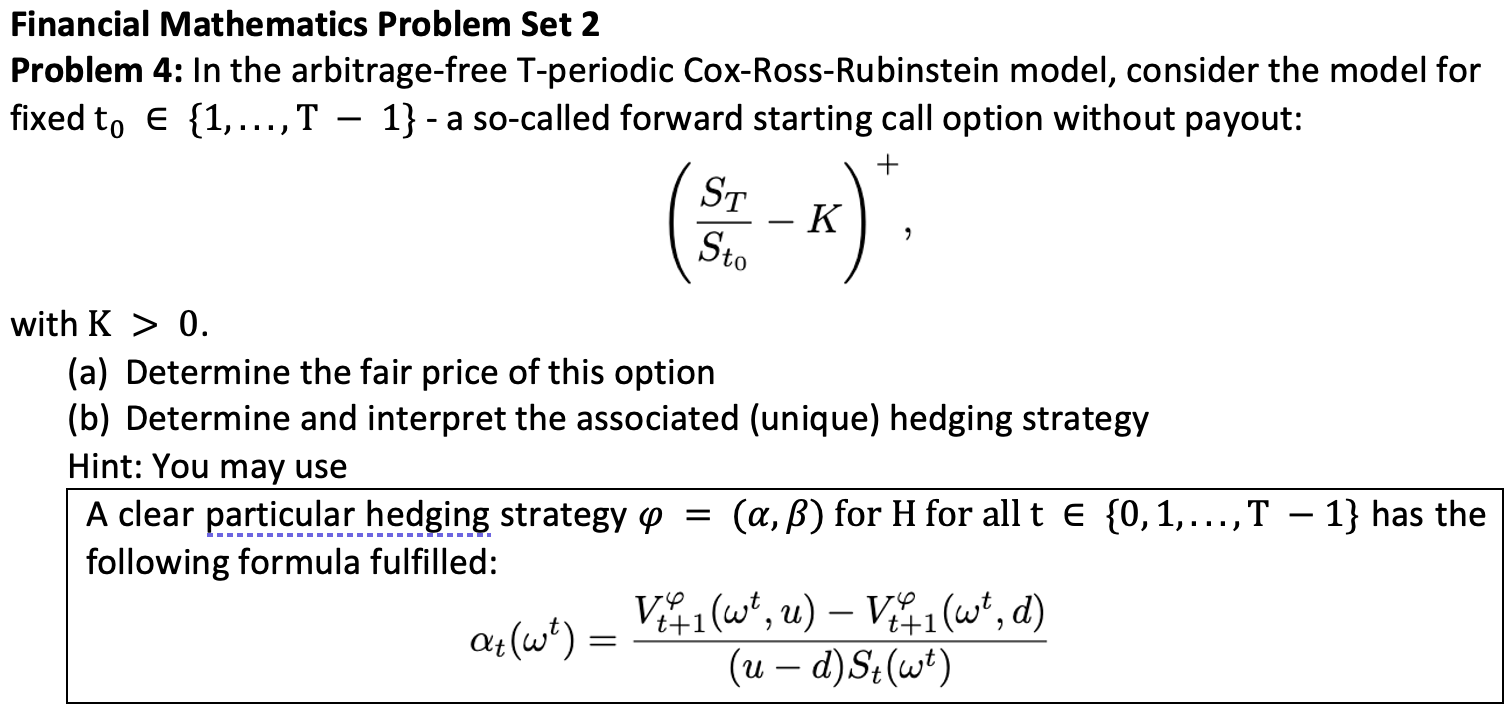

Financial Mathematics Problem Set 2 Problem 4: In the arbitrage-free T-periodic Cox-Ross-Rubinstein model, consider the model for fixed to E {1,...,T 1} - a so-called forward starting call option without payout: ) + ST K 1) 2 Sto with K > 0. (a) Determine the fair price of this option (b) Determine and interpret the associated (unique) hedging strategy Hint: You may use A clear particular hedging strategy & (a,b) for H for all t E {0, 1,...,T following formula fulfilled: , (u - d) St(wt) = - 1} has the 0+(w) = V/41(w*, u) V.41 (w*, d) t71 Financial Mathematics Problem Set 2 Problem 4: In the arbitrage-free T-periodic Cox-Ross-Rubinstein model, consider the model for fixed to E {1,...,T 1} - a so-called forward starting call option without payout: ) + ST K 1) 2 Sto with K > 0. (a) Determine the fair price of this option (b) Determine and interpret the associated (unique) hedging strategy Hint: You may use A clear particular hedging strategy & (a,b) for H for all t E {0, 1,...,T following formula fulfilled: , (u - d) St(wt) = - 1} has the 0+(w) = V/41(w*, u) V.41 (w*, d) t71

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts