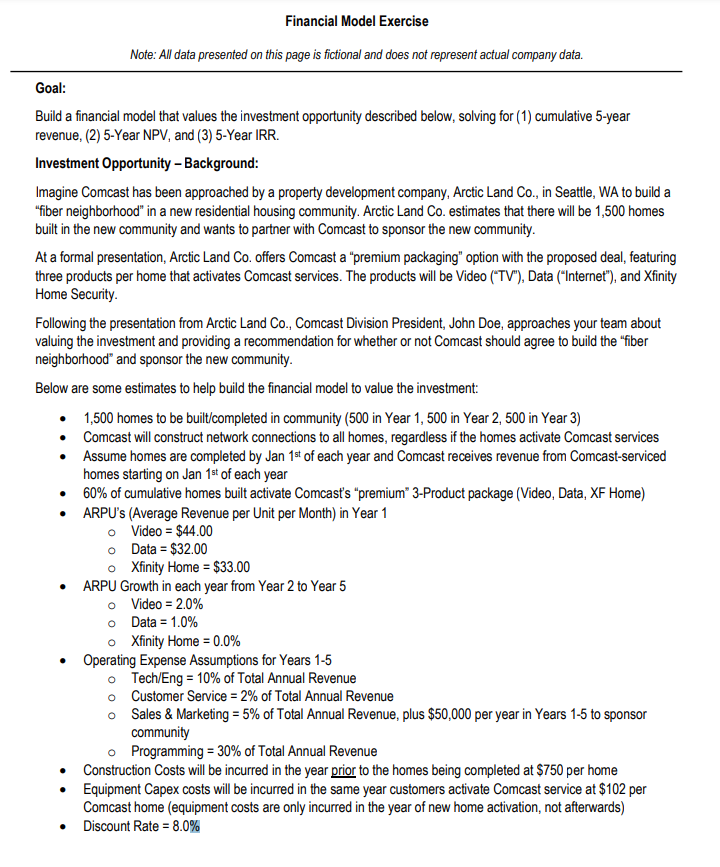

Question: Financial Model Exercise Note: All data presented on this page is fictional and does not represent actual company data. Goal: Build a financial model that

Financial Model Exercise

Note: All data presented on this page is fictional and does not represent actual company data.

Goal:

Build a financial model that values the investment opportunity described below, solving for cumulative year

revenue, Year NPV and Year IRR.

Investment Opportunity Background:

Imagine Comcast has been approached by a property development company, Arctic Land Co in Seattle, WA to build a

"fiber neighborhood" in a new residential housing community. Arctic Land Co estimates that there will be homes

built in the new community and wants to partner with Comcast to sponsor the new community.

At a formal presentation, Arctic Land Co offers Comcast a "premium packaging" option with the proposed deal, featuring

three products per home that activates Comcast services. The products will be Video TV Data Internet and Xfinity

Home Security.

Following the presentation from Arctic Land Co Comcast Division President, John Doe, approaches your team about

valuing the investment and providing a recommendation for whether or not Comcast should agree to build the "fiber

neighborhood" and sponsor the new community.

Below are some estimates to help build the financial model to value the investment:

homes to be builtcompleted in community in Year in Year in Year

Comcast will construct network connections to all homes, regardless if the homes activate Comcast services

Assume homes are completed by Jan of each year and Comcast receives revenue from Comcastserviced

homes starting on Jan of each year

of cumulative homes built activate Comcast's "premium" Product package Video Data, XF Home

ARPU's Average Revenue per Unit per Month in Year

Video $

Data $

Xfinity Home $

ARPU Growth in each year from Year to Year

Video

Data

Xfinity Home

Operating Expense Assumptions for Years

TechEng of Total Annual Revenue

Customer Service of Total Annual Revenue

Sales & Marketing of Total Annual Revenue, plus $ per year in Years to sponsor

community

Programming of Total Annual Revenue

Construction Costs will be incurred in the year prior to the homes being completed at $ per home

Equipment Capex costs will be incurred in the same year customers activate Comcast service at $ per

Comcast home equipment costs are only incurred in the year of new home activation, not afterwards

Discount Rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock