Question: FINANCIAL PLANNING CASE A Lesson from the Past Back in 2010, Mary Goldberg, a 34-year-old widow, got a telephone call from a Wall Street account

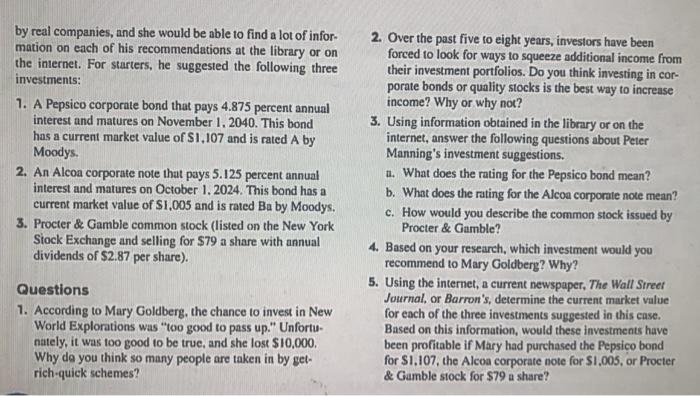

FINANCIAL PLANNING CASE A Lesson from the Past Back in 2010, Mary Goldberg, a 34-year-old widow, got a telephone call from a Wall Street account executive who said that one of his other clients had given him her name. Then he told her his brokerage firm was selling a new corporate bond issue in New World Explorations, a company heavily engaged in oil exploration in the western United States. The bonds in this issue paid investors 8.9 percent a year. He then said that the minimum investment was $10,000 and that if she wanted to take advantage of this "once in a lifetime" opportunity, she had to move fast. To Mary, it was an opportunity that was too good to pass up, and she bit hook, line, and sinker. She sent the account executive a check-and never heard from him again. When she went to the library to research her bond investment, she found there was no such company as New World Explo- rations. She lost her $10,000 and quickly vowed she would never invest in bonds again. From now on, she would put her money in the bank, where it was guaranteed. Over the years, she continued to deposit money in the bank and accumulated more than $62,000. Things seemed to be pretty much on track until her certificate of deposit (CD) matured. When she went to renew the CD, the bank officer told her interest rates had fallen and current CD interest rates ranged between 1 and 3 percent. To make matters worse, the bunker Told Mary that only the bank's 60-month CD offered the 3 percent interest rate. CDs with shorter maturities paid lower interest rates. Faced with the prospects of lower interest rates. Mary decided to shop around for higher rates. She called several local banks and got pretty much the same answer. Then a friend suggested that she talk to Peter Manning, an account executive for Fidelity Investments. Manning told her there were conservative corporate bonds and quality stock Issues that offered higher returns. But, he warned her, these investe ments were not guaranteed. If she wanted higher returns, she would have to take some risks. While Mary wanted higher returns, she also remembered how she had lost $10,000 investing in corporate bonds. When she told Peter Manning about her bond investment in the ficti- tious New World Explorations, he pointed out that she made some pretty serious mistakes. For starters, she bought the bonds over the phone from someone she didn't know, and she bought them without doing any research. He assured her that the bonds and stocks he would recommend would be issued by real companies, and she would be able to find a lot of infor mation on each of his recommendations at the library or on the internet. For starters, he suggested the following three investments: 1. A Pepsico corporate bond that pays 4.875 percent annual interest and matures on November 1, 2040. This bond has a current market value of $1,107 and is rated A by Moodys. 2. An Alcon corporate note that pays 5.125 percent annual interest and matures on October 1, 2024. This bond has a current market value of S1,005 and is rated Ba by Moodys. 3. Procter & Gamble common stock (listed on the New York Stock Exchange and selling for $79 a share with annual dividends of $2.87 per share). 2. Over the past five to eight years, investors have been forced to look for ways to squeeze additional income from their investment portfolios. Do you think investing in cor- porate bonds or quality stocks is the best way to increase income? Why or why not? 3. Using information obtained in the library or on the internet, answer the following questions about Peter Manning's investment suggestions. a. What does the rating for the Pepsico bond mean? b. What does the rating for the Alcoa corporate note mean? c. How would you describe the common stock issued by Procter & Gamble? 4. Based on your research, which investment would you recommend to Mary Goldberg? Why? 5. Using the internet, a current newspaper, The Wall Street Journal, or Barron's, determine the current market value for each of the three investments suggested in this case. Based on this information, would these investments have been profitable if Mary had purchased the Pepsico bond for S1,107, the Alcoa corporate note for $1,005, or Procter & Gamble stock for $79 a share? Questions 1. According to Mary Goldberg, the chance to invest in New World Explorations was "too good to pass up." Unfortu. nately, it was too good to be true, and she lost $10,000, Why do you think so many people are taken in by gel- rich-quick schemes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts