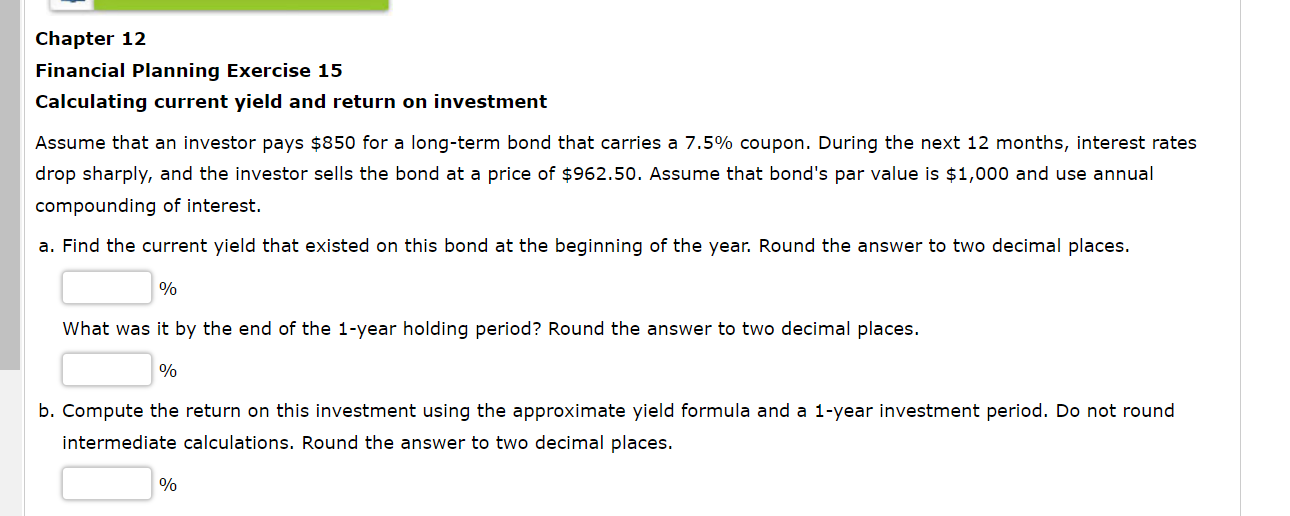

Question: Financial Planning Exercise 15 Calculating current yield and return on investment Assume that an investor pays ( $ 850 ) for a long-term bond that

Financial Planning Exercise 15 Calculating current yield and return on investment Assume that an investor pays \\( \\$ 850 \\) for a long-term bond that carries a \7.5 coupon. During the next 12 months, interest rates drop sharply, and the investor sells the bond at a price of \\( \\$ 962.50 \\). Assume that bond's par value is \\( \\$ 1,000 \\) and use annual compounding of interest. a. Find the current yield that existed on this bond at the beginning of the year. Round the answer to two decimal places. \ What was it by the end of the 1-year holding period? Round the answer to two decimal places. \ b. Compute the return on this investment using the approximate yield formula and a 1-year investment period. Do not round intermediate calculations. Round the answer to two decimal places. \

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts