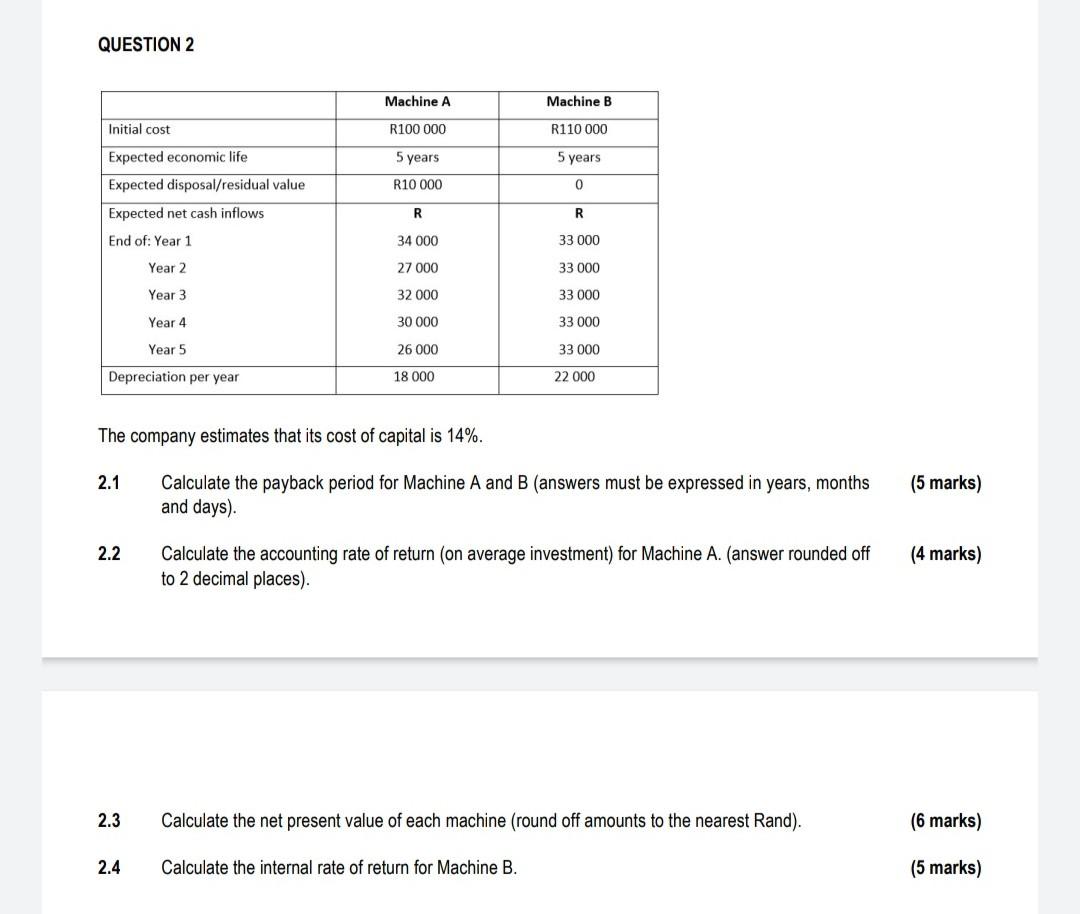

Question: Financial planning q2 QUESTION 2 Machine A Machine B Initial cost R100 000 R110 000 5 years 5 years Expected economic life Expected disposal/residual value

Financial planning q2

QUESTION 2 Machine A Machine B Initial cost R100 000 R110 000 5 years 5 years Expected economic life Expected disposal/residual value R10 000 0 R R Expected net cash inflows End of: Year 1 34 000 33 000 Year 2 27 000 33 000 Year 3 32 000 33 000 Year 4 30 000 33 000 Year 5 26 000 33 000 Depreciation per year 18 000 22 000 The company estimates that its cost of capital is 14%. 2.1 Calculate the payback period for Machine A and B (answers must be expressed in years, months and days) (5 marks) 2.2 Calculate the accounting rate of return on average investment) for Machine A. (answer rounded off to 2 decimal places). (4 marks) 2.3 Calculate the net present value of each machine (round off amounts to the nearest Rand). (6 marks) 2.4 Calculate the internal rate of return for Machine B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts