Question: Financial ratio analysis is a tool that is often used to evaluate the internal strengths and weaknesses of a company. Potential investors and shareholders look

Financial ratio analysis is a tool that is often used to evaluate the internal strengths and weaknesses of a company. Potential investors and shareholders look closely at a firm's financial ratios and compare it to industry averages.

Post how Andrews is doing against their competitors from a financial standpoint.

It is expected that you will provide outside sources and examples to support your response. Use the current APA format for your citations.

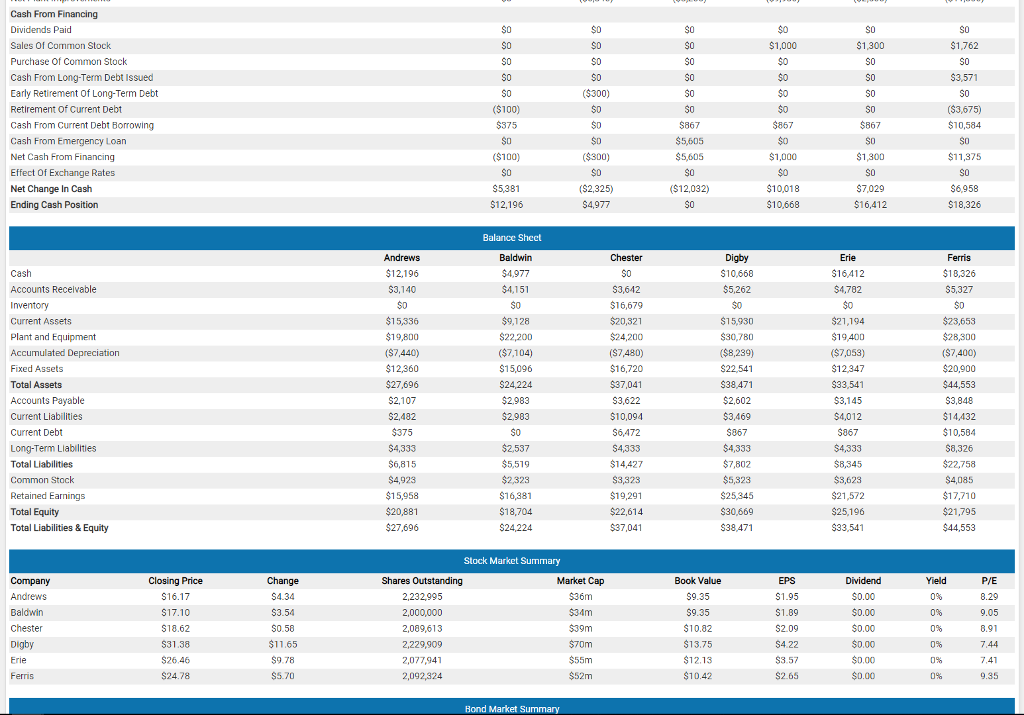

Some reference- Observations on Andrews will focus on Liquity "Current" Ratio =6.2, Solvency "Debts to assets" ratio = 2.5 and Profitability "Gross profit margin" = 7%. Some calculations might be off but can be backed up with comments, example...Andrews Liquidity "Current" ratio 6.2, is strong relative to our peers.

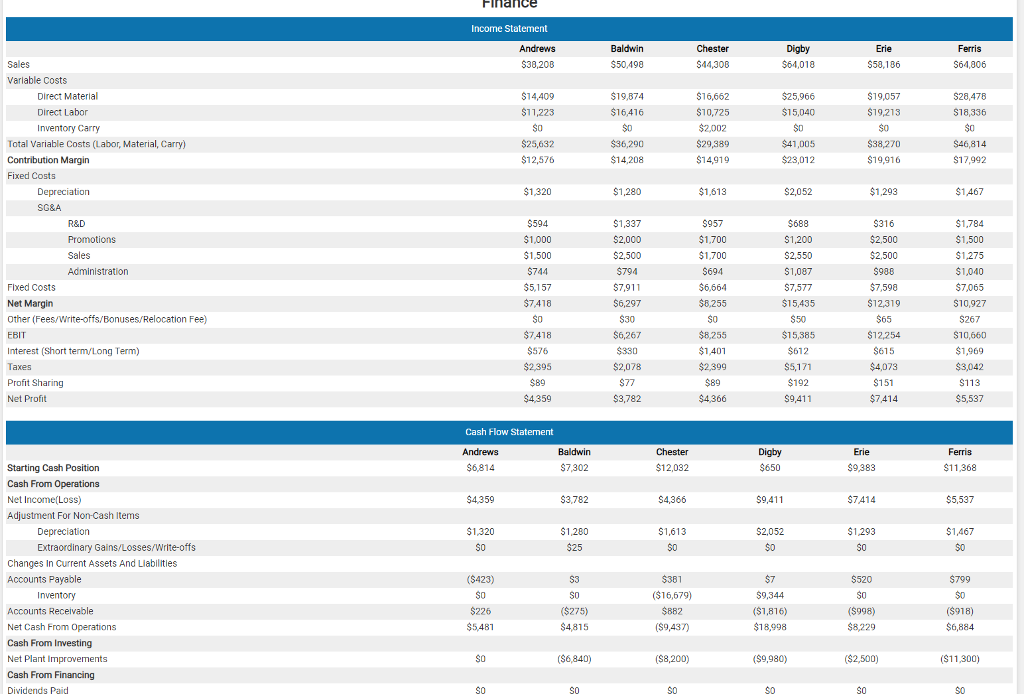

Finance Income Statement Digby $64,018 $30,208 $50,498 S53,186 S64,806 Varlable Costs 14,409 $11,223 $19,874 $16,416 $D $16,662 $10,725 $25,966 $15,040 SD $41,005 $23,012 $19,057 $19,213 $0 $38,270 $19,916 Direct Labor Inventory Carry $18,336 Total Variable Costs (Labor, Material, Carry) Contribution Margin Fixed Costs $25,632 $12,576 $29,389 $46,814 $17,992 $14,208 $1,320 $1,613 $2,052 $1,293 $1,467 SG&A $594 $1.84 $1,500 $1.275 $1,040 $7065 $10,927 $1,337 $1,500 $1,700 S2,550 $1,087 $7,577 $15,435 $2,500 Administration Fixed Costs Net Margin Other (Fees/Write-offs/Bonuses/Relocation Fee) $7,911 $7,598 $7418 $6,267 $15,385 $12,254 $10,660 $1,401 $1,969 $5,171 $192 $4,073 $151 $7414 $2,078 Profit Sharing Net Profit $4,359 $3,782 $5,537 Cash Flow Statement $12,032 Starting Cash Position Cash From Operations 7,302 9,383 $11,368 3,782 S7414 $5,537 Adjustment For NonCash Items $1320 s0 1293 S0 $1,467 $0 $1.220 Depreciation Extraordinary Gains/Losses/Write-offs s0 $0 Changes In Current Assets And Liabilities Accounts Payable S3 SO ($16,679) $9,344 ($1,816) $18,998 S0 (S998) $8,229 $0 Accounts Receivable Net Cash From Operations Cash From Investing Net Plant Improvements Cash From Financing $5481 (S9,437) ($2,500) ($11,300) Sales Of Common Stock Purchase Of Common Stock Cash From Long-Term Debt Issued Early Retirement Of Long-Term Debt Cash From Emergency Loan ($300) Effect Of Exchange Rates Net Change In Cash ($12,032) $10,018 $10,668 Balance Shect Current Liabilities Long-Term Liabillties Retained Earnings Total Liabilities & Equity $27,696 Stock Market Summary Shares Outstanding 2,232,995 2,000,000 2,089,613 Closing Price Change Market Cap Book Value Dividend Baldwin 2,077941 2,092,324 Bond Market Summary Finance Income Statement Digby $64,018 $30,208 $50,498 S53,186 S64,806 Varlable Costs 14,409 $11,223 $19,874 $16,416 $D $16,662 $10,725 $25,966 $15,040 SD $41,005 $23,012 $19,057 $19,213 $0 $38,270 $19,916 Direct Labor Inventory Carry $18,336 Total Variable Costs (Labor, Material, Carry) Contribution Margin Fixed Costs $25,632 $12,576 $29,389 $46,814 $17,992 $14,208 $1,320 $1,613 $2,052 $1,293 $1,467 SG&A $594 $1.84 $1,500 $1.275 $1,040 $7065 $10,927 $1,337 $1,500 $1,700 S2,550 $1,087 $7,577 $15,435 $2,500 Administration Fixed Costs Net Margin Other (Fees/Write-offs/Bonuses/Relocation Fee) $7,911 $7,598 $7418 $6,267 $15,385 $12,254 $10,660 $1,401 $1,969 $5,171 $192 $4,073 $151 $7414 $2,078 Profit Sharing Net Profit $4,359 $3,782 $5,537 Cash Flow Statement $12,032 Starting Cash Position Cash From Operations 7,302 9,383 $11,368 3,782 S7414 $5,537 Adjustment For NonCash Items $1320 s0 1293 S0 $1,467 $0 $1.220 Depreciation Extraordinary Gains/Losses/Write-offs s0 $0 Changes In Current Assets And Liabilities Accounts Payable S3 SO ($16,679) $9,344 ($1,816) $18,998 S0 (S998) $8,229 $0 Accounts Receivable Net Cash From Operations Cash From Investing Net Plant Improvements Cash From Financing $5481 (S9,437) ($2,500) ($11,300) Sales Of Common Stock Purchase Of Common Stock Cash From Long-Term Debt Issued Early Retirement Of Long-Term Debt Cash From Emergency Loan ($300) Effect Of Exchange Rates Net Change In Cash ($12,032) $10,018 $10,668 Balance Shect Current Liabilities Long-Term Liabillties Retained Earnings Total Liabilities & Equity $27,696 Stock Market Summary Shares Outstanding 2,232,995 2,000,000 2,089,613 Closing Price Change Market Cap Book Value Dividend Baldwin 2,077941 2,092,324 Bond Market Summary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts