Question: Financial ratios computed for Whittaker Inc. include the following: Current ratio 1.9 to 1 Acid-test ratio 1.3 to 1 Debt/Equity ratio 2.0 to 1 Inventory

Financial ratios computed for Whittaker Inc. include the following:

Financial ratios computed for Whittaker Inc. include the following:

| Current ratio | 1.9 | to 1 | |

| Acid-test ratio | 1.3 | to 1 | |

| Debt/Equity ratio | 2.0 | to 1 | |

| Inventory turnover | 4.0 | times | |

| Accounts receivable turnover | 6.8 | times | |

| Times interest earned | 4.45 | times | |

| Gross profit ratio | 40 | % | |

| Return on investment | 12 | % | |

| Earnings per share | $ | 5.52 | |

All sales during the year were made on account. Cash collections during the year exceeded sales by $28,000, and no uncollectible accounts were written off.

The balance of the accounts receivable account was $114,000 on January 1, 2020.

No common stock was issued during the year.

Dividends declared and paid during the year were $15,200.

The balance of the inventory account was $96,000 on January 1, 2020.

Interest expense on the income statement relates to the 15% bonds payable; $20,000 of these bonds were issued on May 1, 2020; the remaining amount of bonds payable were outstanding throughout the year. All bonds were issued at face amount.

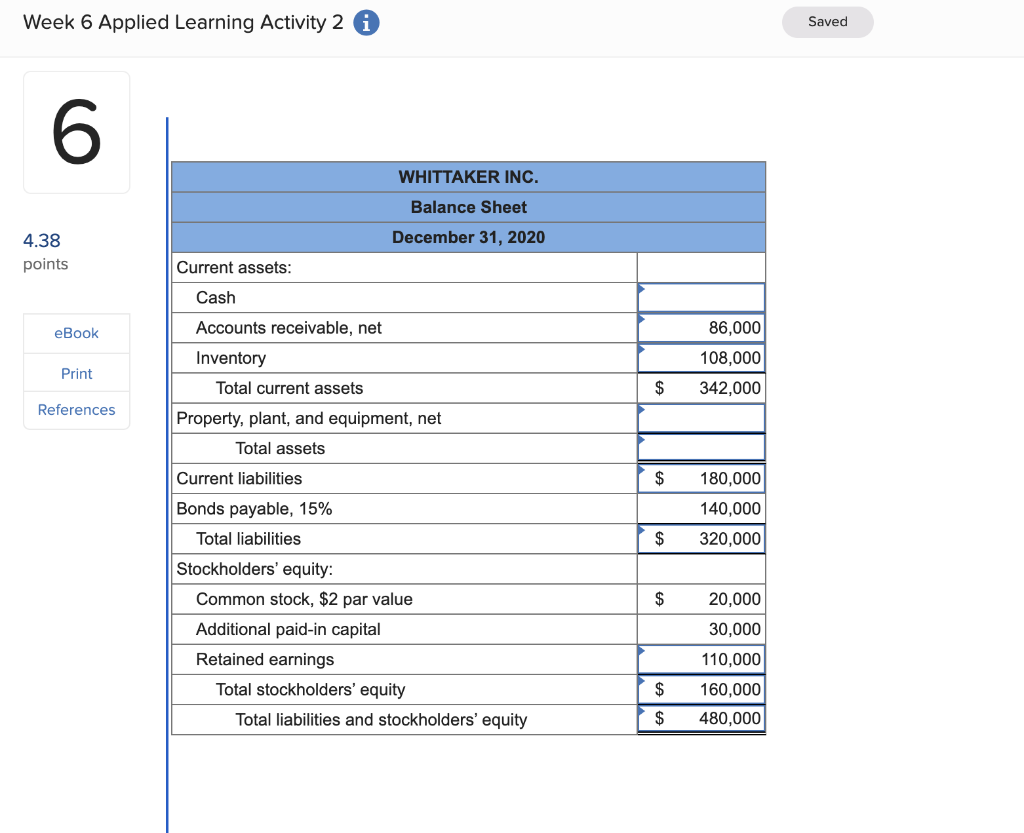

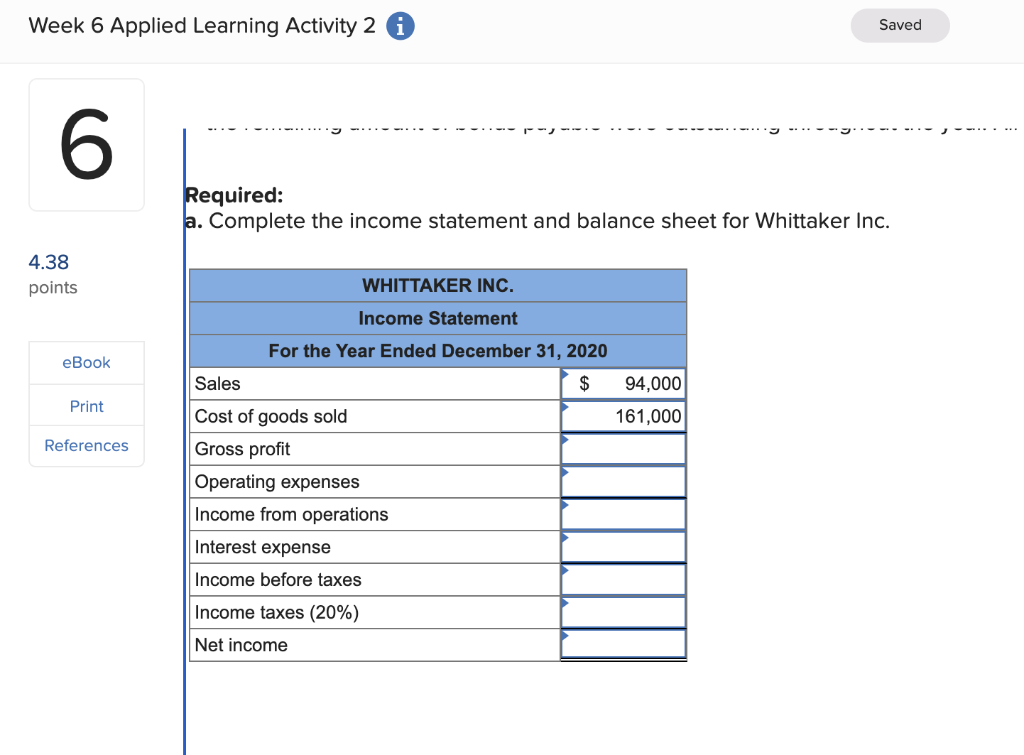

Required: a. Complete the income statement and balance sheet for Whittaker Inc.

Week 6 Applied Learning Activity 2 Week 6 Applied Learning Activity 2 i Required: a. Complete the income statement and balance sheet for Whittaker Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts