Question: Financial Reporting, Financial Statement Analysis, and Valuation: A STRATEGIC PERSPECTIVE 9e 11.11 Calculating the Cost of Capital. Whirlpool manufactures and sells home appliances under various

Financial Reporting, Financial Statement Analysis, and Valuation: A STRATEGIC PERSPECTIVE 9e

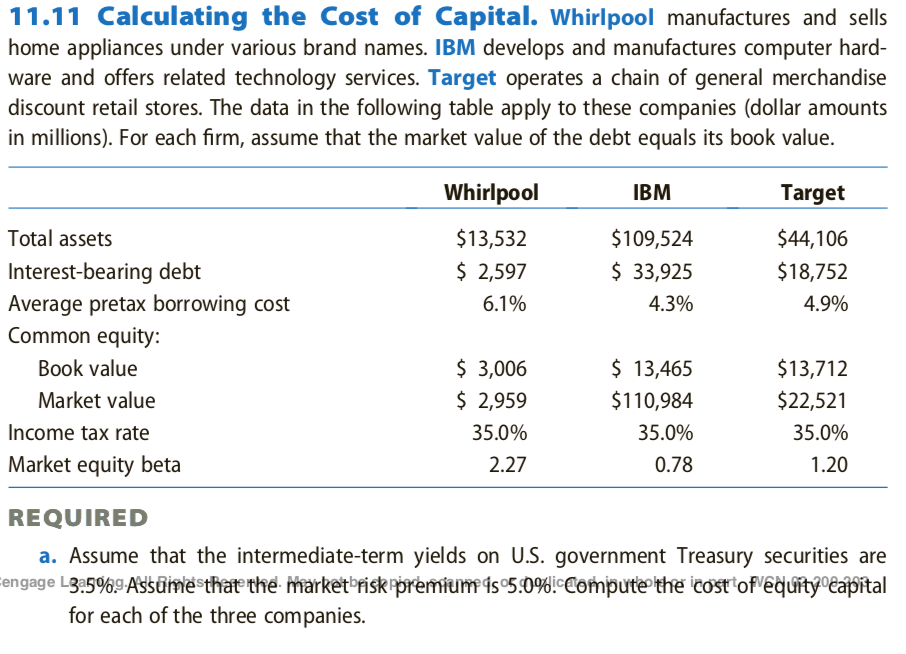

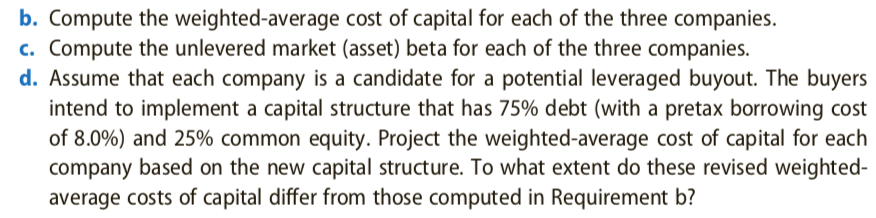

11.11 Calculating the Cost of Capital. Whirlpool manufactures and sells home appliances under various brand names. IBM develops and manufactures computer hard- ware and offers related technology services. Target operates a chain of general merchandise discount retail stores. The data in the following table apply to these companies (dollar amounts in millions). For each firm, assume that the market value of the debt equals its book value. Total assets Interest-bearing debt Average pretax borrowing cost Common equity: Whirlpool $13,532 $ 2,597 IBM 109,524 S 33,925 Target $44,106 $18,752 45% 6.1% 4.3% S3,006 S 2,959 35.0% 2.27 S 13,465 $110,984 35.0% 0.78 Book value Market value Income tax rate Market equity beta $13,712 $22,521 35.0% 1.20 REQUIRED a. Assume that the intermediate-term yields on U.S. government Treasury securities are engage L3:5969 Assure that the market fiskpremium 1:5:0% ompute the cost of ed it ea ital for each of the three companies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts