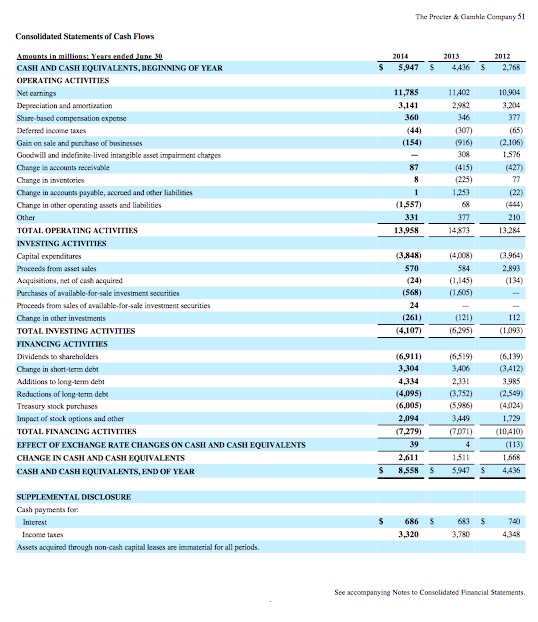

Question: Financial Reporting Problem The Procter & Gamble Company (P&G) Instructions Refer to P&G's 2014 financial statements and the accompanying notes to answer the following questions.

Financial Reporting Problem

The Procter & Gamble Company (P&G)

Instructions

Refer to P&G's 2014 financial statements and the accompanying notes to answer the following questions.

(a)

What cash outflow obligations related to the repayment of long-term debt does P&G have over the next 5 years?

(b)

P&G indicates that it believes that it has the ability to meet business requirements in the foreseeable future. Prepare an assessment of its liquidity, solvency, and financial flexibility using ratio analysis.

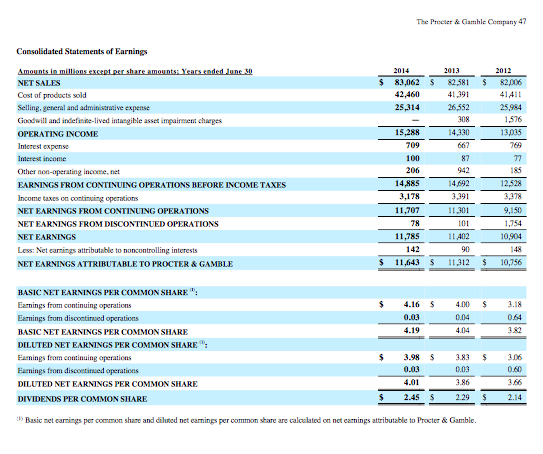

The Proeser & Gamble Company 47 $ 83,062 $ 82581 82006 42,460 41.391 Selling, geteral and admitisaaive expense Goodwill and indeie-lived intuegible asset impairmem chaeges EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes on continuing operations NET EARNINGS FROM CONTINUING OPERATIONS NET EARNINGS FROMDISCONTINUED OPERATIONS 1402 NET EARNINGS ATTRIBUTABLE TO PROCTER& GAMBLE $ 11,643 11312 10,756 BASIC NET EARNINGS PER COMMON SHARE BASIC NET EARNINGS PER COMMON SHARE DILUTED NET EARNINGS PER COMMON SHARE 5 3.98 383 306 DILUTED NET EARNINGS PER COMMON SHARE DIVIDENDS PER COMMON SHARE $ 2.45 $ Basic net earings per common share and diluted net earnings per common share are calculated on net earmings attributable to Procter& Gamble

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts