Question: Financial Reporting Problem: The Proctor & Gamble Company (P&G) The financial statements of P&G are presented in Appendix B: Specimen Financial Statements: The Proctor &

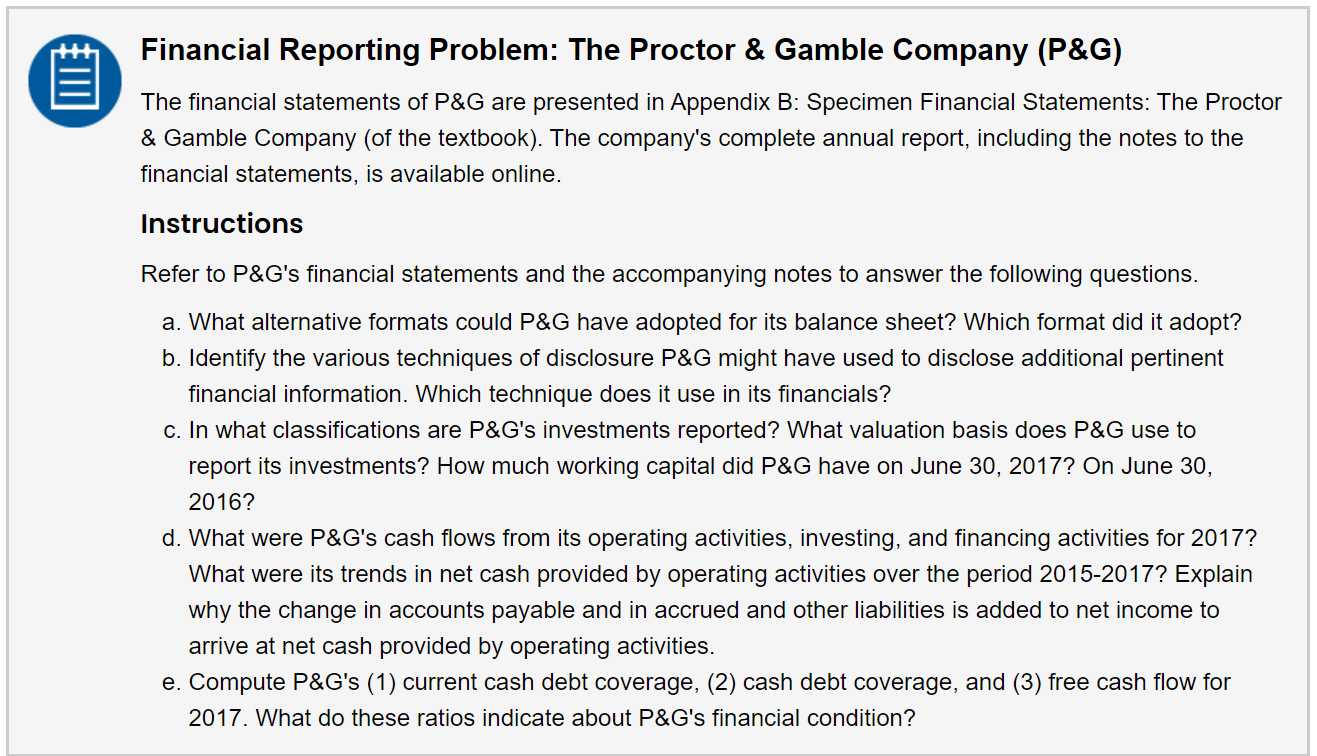

Financial Reporting Problem: The Proctor & Gamble Company (P&G) The financial statements of P&G are presented in Appendix B: Specimen Financial Statements: The Proctor & Gamble Company (of the textbook). The company's complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G's financial statements and the accompanying notes to answer the following questions. a. What alternative formats could P&G have adopted for its balance sheet? Which format did it adopt? b. Identify the various techniques of disclosure P&G might have used to disclose additional pertinent financial information. Which technique does it use in its financials? c. In what classifications are P&G's investments reported? What valuation basis does P&G use to report its investments? How much working capital did P&G have on June 30, 2017? On June 30, 2016? d. What were P&G's cash flows from its operating activities, investing, and financing activities for 2017? What were its trends in net cash provided by operating activities over the period 2015-2017? Explain why the change in accounts payable and in accrued and other liabilities is added to net income to arrive at net cash provided by operating activities. e. Compute P&G's (1) current cash debt coverage, (2) cash debt coverage, and (3) free cash flow for 2017. What do these ratios indicate about P&G's financial condition? Financial Reporting Problem: The Proctor & Gamble Company (P&G) The financial statements of P&G are presented in Appendix B: Specimen Financial Statements: The Proctor & Gamble Company (of the textbook). The company's complete annual report, including the notes to the financial statements, is available online. Instructions Refer to P&G's financial statements and the accompanying notes to answer the following questions. a. What alternative formats could P&G have adopted for its balance sheet? Which format did it adopt? b. Identify the various techniques of disclosure P&G might have used to disclose additional pertinent financial information. Which technique does it use in its financials? c. In what classifications are P&G's investments reported? What valuation basis does P&G use to report its investments? How much working capital did P&G have on June 30, 2017? On June 30, 2016? d. What were P&G's cash flows from its operating activities, investing, and financing activities for 2017? What were its trends in net cash provided by operating activities over the period 2015-2017? Explain why the change in accounts payable and in accrued and other liabilities is added to net income to arrive at net cash provided by operating activities. e. Compute P&G's (1) current cash debt coverage, (2) cash debt coverage, and (3) free cash flow for 2017. What do these ratios indicate about P&G's financial condition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts