Question: Financial Risk Management-Financial Engineering Explain the difference between buying a forward contract for delivery at $100 in one year, buying a call option struck at

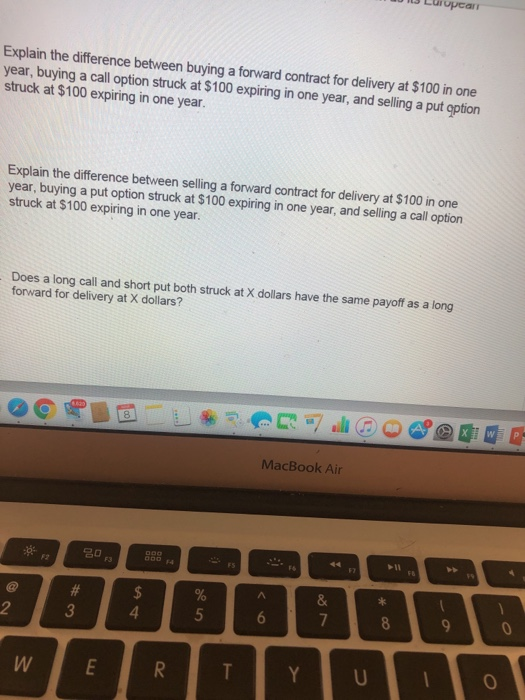

Explain the difference between buying a forward contract for delivery at $100 in one year, buying a call option struck at $100 expiring in one year, and selling a put option struck at $100 expiring in one year Explain the difference between selling a forward contract for delivery at $100 in one year, buying a put option struck at $100 expiring in one year, and selling a call option struck at $100 expiring in one year. Does a long call and short put both struck at X dollars have the same payoff as a long forward for delivery at X dollars? MacBook Air 20 2 3 4 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts