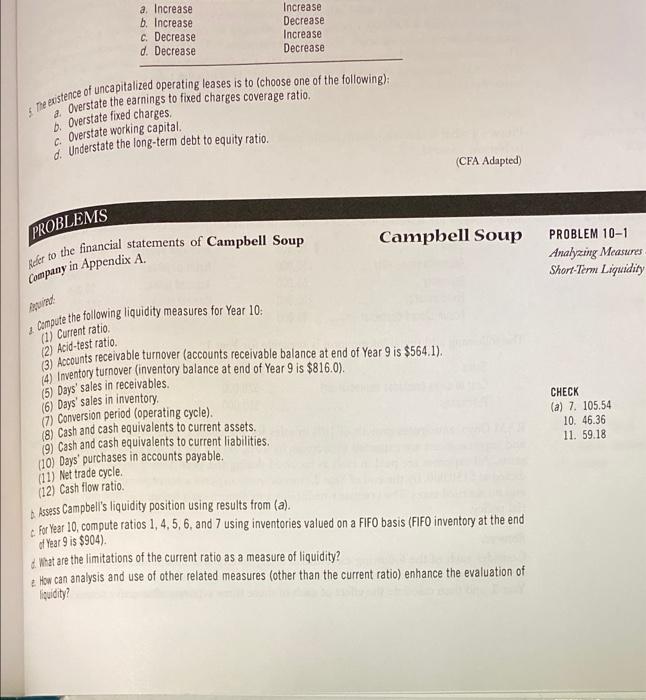

Question: Financial statement Analysis 11th edition K. R. Subramanyam a. Increase b. Increase c. Decrease d. Decrease Increase Decrease Increase Decrease the existence of uncapitalized operating

a. Increase b. Increase c. Decrease d. Decrease Increase Decrease Increase Decrease the existence of uncapitalized operating leases is to choose one of the following): 2. Overstate the earnings to fixed charges coverage ratio. b. Overstate fixed charges c Overstate working capital Understate the long-term debt to equity ratio. (CFA Adapted) PROBLEMS Campbell Soup Refer to the financial statements of Campbell Soup PROBLEM 10-1 Anahing Measures Short-Term Liquidity Company in Appendix A. An Compute the following liquidity measures for Year 10: (1) Current ratio (2) Acid-test ratio. CHECK (a) 7. 105.54 10. 46.36 11. 59.18 3) Accounts receivable turnover (accounts receivable balance at end of Year 9 is $564.1). 4) Inventory turnover (inventory balance at end of Year 9 is $816.0). (5) Days' sales in receivables. (6) Days' sales in inventory (7) Conversion period (operating cycle). (8) Cash and cash equivalents to current assets. 19) Cash and cash equivalents to current liabilities (10) Days' purchases in accounts payable. (11) Net trade cycle. (12) Cash flow ratio. A Assess Campbell's liquidity position using results from (a). For Year 10, compute ratios 1,4,5,6, and 7 using inventories valued on a FIFO basis (FIFO inventory at the end of Year 9 is $904). What are the limitations of the current ratio as a measure of liquidity? How can analysis and use of other related measures (other than the current ratio) enhance the evaluation of quidity? a. Increase b. Increase c. Decrease d. Decrease Increase Decrease Increase Decrease the existence of uncapitalized operating leases is to choose one of the following): 2. Overstate the earnings to fixed charges coverage ratio. b. Overstate fixed charges c Overstate working capital Understate the long-term debt to equity ratio. (CFA Adapted) PROBLEMS Campbell Soup Refer to the financial statements of Campbell Soup PROBLEM 10-1 Anahing Measures Short-Term Liquidity Company in Appendix A. An Compute the following liquidity measures for Year 10: (1) Current ratio (2) Acid-test ratio. CHECK (a) 7. 105.54 10. 46.36 11. 59.18 3) Accounts receivable turnover (accounts receivable balance at end of Year 9 is $564.1). 4) Inventory turnover (inventory balance at end of Year 9 is $816.0). (5) Days' sales in receivables. (6) Days' sales in inventory (7) Conversion period (operating cycle). (8) Cash and cash equivalents to current assets. 19) Cash and cash equivalents to current liabilities (10) Days' purchases in accounts payable. (11) Net trade cycle. (12) Cash flow ratio. A Assess Campbell's liquidity position using results from (a). For Year 10, compute ratios 1,4,5,6, and 7 using inventories valued on a FIFO basis (FIFO inventory at the end of Year 9 is $904). What are the limitations of the current ratio as a measure of liquidity? How can analysis and use of other related measures (other than the current ratio) enhance the evaluation of quidity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts