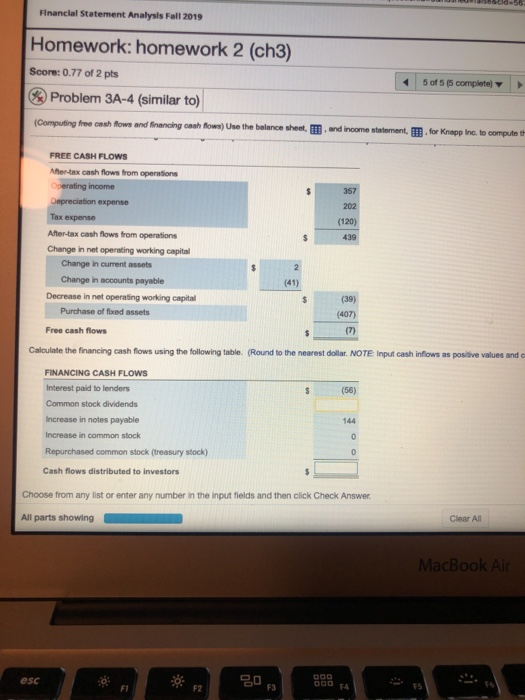

Question: Financial Statement Analysis Fall 2019 Homework: homework 2 (ch3) Score: 0.77 of 2 pts Problem 3A-4 (similar to) 1 5 of 5 (5 complete Computing

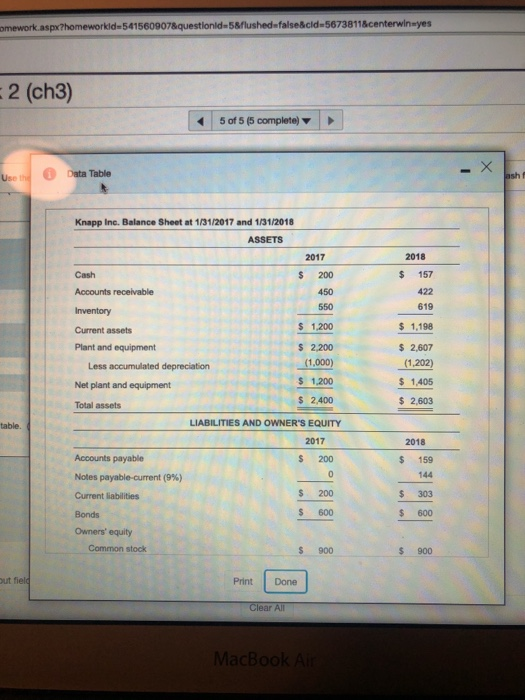

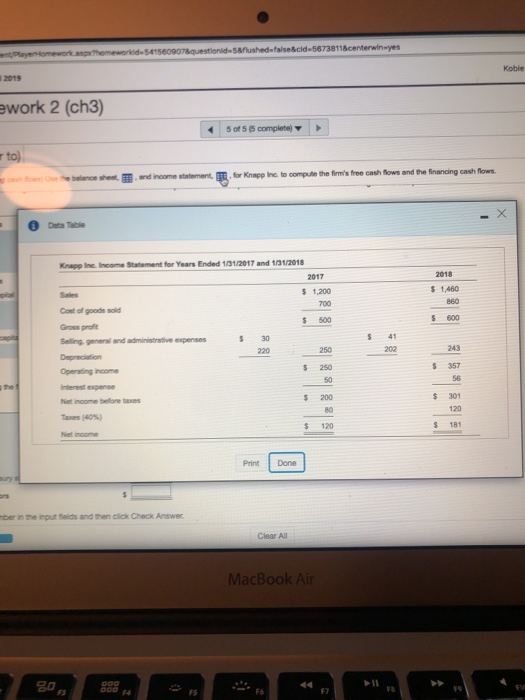

Financial Statement Analysis Fall 2019 Homework: homework 2 (ch3) Score: 0.77 of 2 pts Problem 3A-4 (similar to) 1 5 of 5 (5 complete Computing free cash fows and financing cash flows) Use the balance sheet and income statement for Knep Inc. to computer FREE CASH FLOWS A tax cash flows from operations 357 (120) 439 Operating income Depreciation expense Tax expense After-tax cash flows from operations Change in net operating working capital Change in current assets Change in accounts payable Decrease in net operating working capital Purchase of fixed assets (407 Free cash flows Calculate the financing cash flows using the following table. (Round to the nearest dollar. NOTE Input cash inflows as positive values and FINANCING CASH FLOWS Interest paid to lenders Common stock dividends Increase in notes payable Increase in common stock Repurchased common stock (treasury stock) Cash flows distributed to investors Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear All MacBook Air mework.aspx homeworkld-541560907&questionid=5&flushed false&cid=5673811¢erwineyes 2 (ch3) 5 of 5 (5 complete) Data Table Knapp Inc. Balance Sheet at 1/31/2017 and 1/31/2018 ASSETS 2017 $ 157 422 619 $ 1,198 $ 2,607 (1,202) $ 1.405 1.200 $ - $ 2.400 $ 2,603 Cash $ 200 Accounts receivable Inventory 550 Current assets $ 1.200 Plant and equipment $ 2,200 Less accumulated depreciation (1.000) Net plant and equipment Total assets LIABILITIES AND OWNER'S EQUITY 2017 Accounts payable $ 200 Notes payable-current (9%) - Current liabilities $ 200 Bonds $ 600 Owners' equity Common 2018 0 ut fel I Done Clear All MacBook Air he rid54156000 question des Mushed-false&cid=56738118 centerwinyes ework 2 (ch3) 4 5 55 complete to) ww. and income toment, for Knapp Inc. to compute the firm's free cash flows and the financing cash flows. De Table Knapp Inc. Income Statement for Years Ended 11/2017 and 18/2018 1.200 $ Sales Cost of good old 1.450 150 500 $ Selling general and administrative expenses Depreciation Operating home 357 Nincome sono 40% ber in the routes and then click Check Answer Clear All MacBook Air Financial Statement Analysis Fall 2019 Homework: homework 2 (ch3) Score: 0.77 of 2 pts Problem 3A-4 (similar to) 1 5 of 5 (5 complete Computing free cash fows and financing cash flows) Use the balance sheet and income statement for Knep Inc. to computer FREE CASH FLOWS A tax cash flows from operations 357 (120) 439 Operating income Depreciation expense Tax expense After-tax cash flows from operations Change in net operating working capital Change in current assets Change in accounts payable Decrease in net operating working capital Purchase of fixed assets (407 Free cash flows Calculate the financing cash flows using the following table. (Round to the nearest dollar. NOTE Input cash inflows as positive values and FINANCING CASH FLOWS Interest paid to lenders Common stock dividends Increase in notes payable Increase in common stock Repurchased common stock (treasury stock) Cash flows distributed to investors Choose from any list or enter any number in the input fields and then click Check Answer. All parts showing Clear All MacBook Air mework.aspx homeworkld-541560907&questionid=5&flushed false&cid=5673811¢erwineyes 2 (ch3) 5 of 5 (5 complete) Data Table Knapp Inc. Balance Sheet at 1/31/2017 and 1/31/2018 ASSETS 2017 $ 157 422 619 $ 1,198 $ 2,607 (1,202) $ 1.405 1.200 $ - $ 2.400 $ 2,603 Cash $ 200 Accounts receivable Inventory 550 Current assets $ 1.200 Plant and equipment $ 2,200 Less accumulated depreciation (1.000) Net plant and equipment Total assets LIABILITIES AND OWNER'S EQUITY 2017 Accounts payable $ 200 Notes payable-current (9%) - Current liabilities $ 200 Bonds $ 600 Owners' equity Common 2018 0 ut fel I Done Clear All MacBook Air he rid54156000 question des Mushed-false&cid=56738118 centerwinyes ework 2 (ch3) 4 5 55 complete to) ww. and income toment, for Knapp Inc. to compute the firm's free cash flows and the financing cash flows. De Table Knapp Inc. Income Statement for Years Ended 11/2017 and 18/2018 1.200 $ Sales Cost of good old 1.450 150 500 $ Selling general and administrative expenses Depreciation Operating home 357 Nincome sono 40% ber in the routes and then click Check Answer Clear All MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts