Question: Financial Statement Analysis (FIN621) ASSIGNMENT NO. 01 Assignment: - Haider Inc. is in a business of manufacturing leather bags. Being the finance manager of the

Financial Statement Analysis (FIN621) ASSIGNMENT NO. 01

Assignment: -

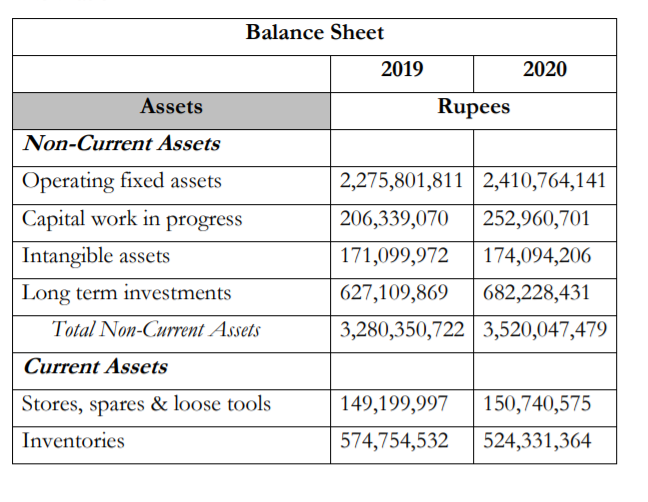

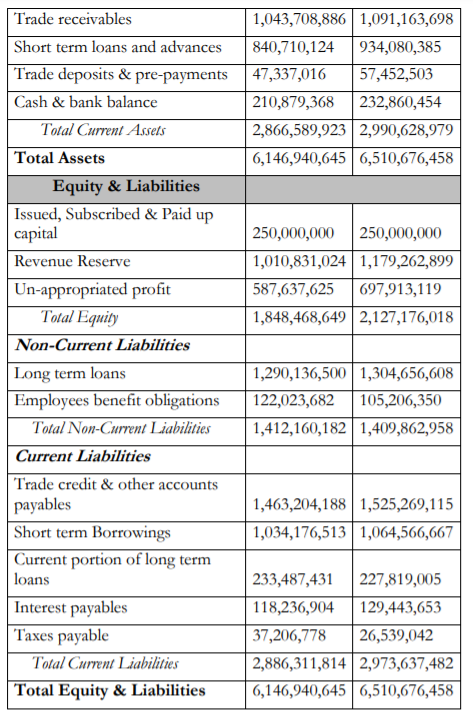

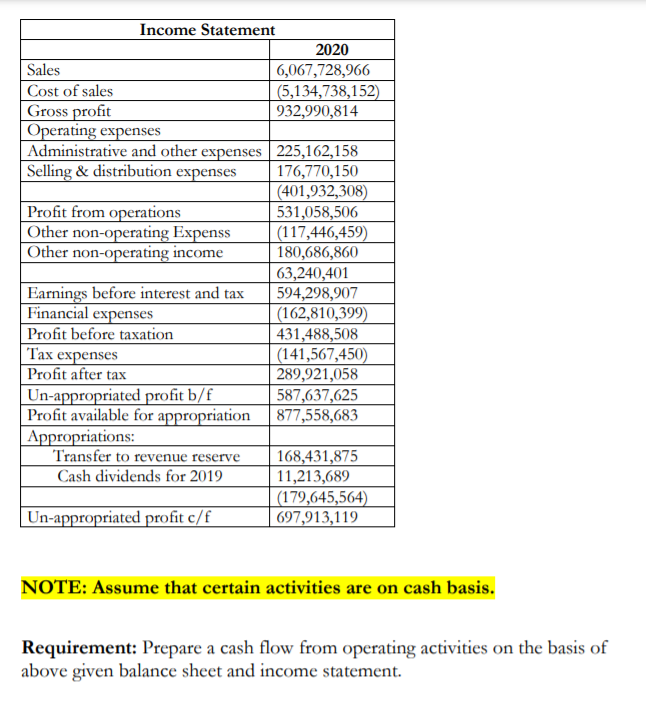

Haider Inc. is in a business of manufacturing leather bags. Being the finance manager of the company you are asked to prepare cash flow statement with help of following information.

Balance Sheet 2019 2020 Assets Rupees Non-Current Assets Operating fixed assets 2,275,801,811 2,410,764,141 Capital work in progress 206,339,070 252,960,701 Intangible assets 171,099,972 174,094,206 Long term investments 627,109,869 682,228,431 Total Non-Current Assets 3,280,350,722 3,520,047,479 Current Assets Stores, spares & loose tools 149,199,997 150,740,575 Inventories 574,754,532 524,331,364 Trade receivables Short term loans and advances 1,043,708,886 1,091,163,698 840,710,124 934,080,385 47,337,016 57,452,503 Trade deposits & pre-payments Cash & bank balance 210,879,368 232,860,454 Total Current Assets 2,866,589,9232,990,628,979 Total Assets 6,146,940,645 6,510,676,458 Equity & Liabilities Issued, Subscribed & Paid up capital 250,000,000 250,000,000 1,010,831,024 1,179,262,899 Revenue Reserve 587,637,625 697,913,119 1,848,468,649 2,127,176,018 Un-appropriated profit Total Equity Non-Current Liabilities Long term loans Employees benefit obligations Total Non-Current Liabilities 1,290,136,500 1,304,656,608 122,023,682 105,206,350 1,412,160,1821,409,862,958 Current Liabilities 1,463,204,188 1,525,269,115 1,034,176,513 1,064,566,667 233,487,431 Trade credit & other accounts payables Short term Borrowings Current portion of long term loans Interest payables Taxes payable Total Current Liabilities Total Equity & Liabilities 227,819,005 118,236,904 129,443,653 37,206,778 26,539,042 2,886,311,8142,973,637,482 6,146,940,645 6,510,676,458 Income Statement 2020 Sales 6,067,728,966 Cost of sales (5,134,738,152) Gross profit 932,990,814 Operating expenses Administrative and other expenses 225,162,158 Selling & distribution expenses 176,770,150 (401,932,308) Profit from operations 531,058,506 Other non-operating Expenss (117,446,459) Other non-operating income 180,686,860 63,240,401 Earnings before interest and tax 594,298,907 Financial expenses (162,810,399) Profit before taxation 431,488,508 Tax expenses (141,567,450) Profit after tax 289,921,058 Un-appropriated profit b/f 587,637,625 Profit available for appropriation 877,558,683 Appropriations: Transfer to revenue reserve 168,431,875 Cash dividends for 2019 11,213,689 (179,645,564) Un-appropriated profit c/f 697,913,119 NOTE: Assume that certain activities are on cash basis. Requirement: Prepare a cash flow from operating activities on the basis of above given balance sheet and income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts