Question: Financial Statement Analysis (Help please!) 1. Comment on Apple's Liquidity and Efficiency ratios (e.g. current ratio, acid-test ratio, etc.). You should not necessarily comment on

Financial Statement Analysis (Help please!)

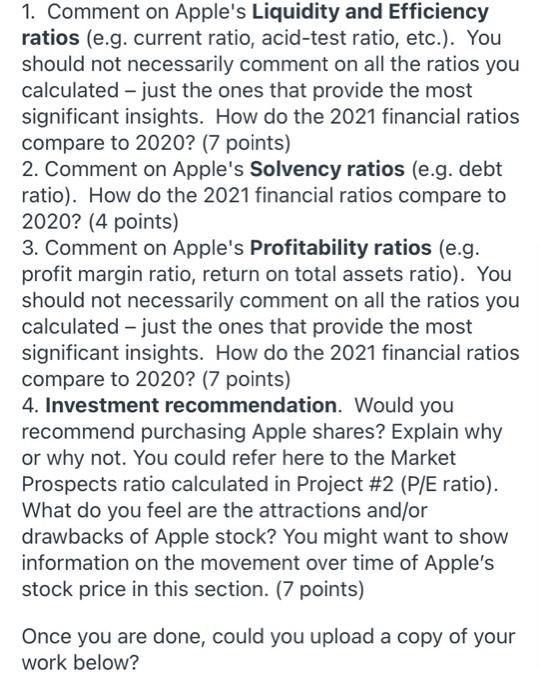

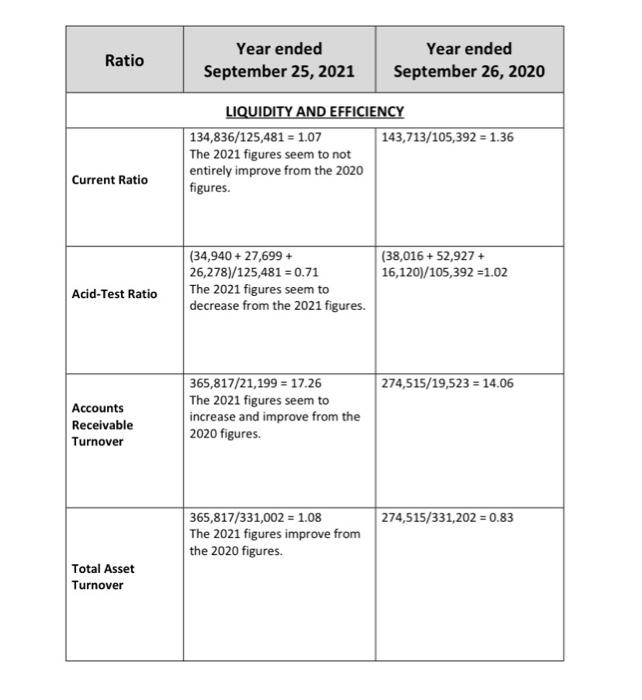

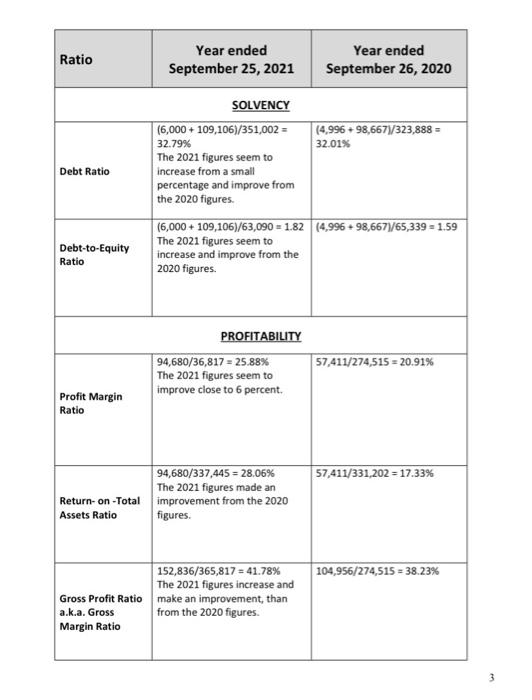

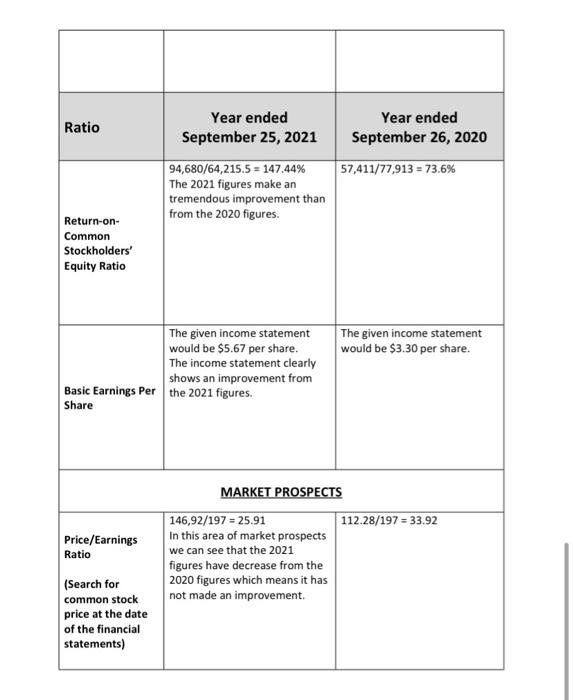

1. Comment on Apple's Liquidity and Efficiency ratios (e.g. current ratio, acid-test ratio, etc.). You should not necessarily comment on all the ratios you calculated - just the ones that provide the most significant insights. How do the 2021 financial ratios compare to 2020? (7 points) 2. Comment on Apple's Solvency ratios (e.g. debt ratio). How do the 2021 financial ratios compare to 2020? (4 points) 3. Comment on Apple's Profitability ratios (e.g. profit margin ratio, return on total assets ratio). You should not necessarily comment on all the ratios you calculated - just the ones that provide the most significant insights. How do the 2021 financial ratios compare to 2020? (7 points) 4. Investment recommendation. Would you recommend purchasing Apple shares? Explain why or why not. You could refer here to the Market Prospects ratio calculated in Project #2 (P/E ratio). What do you feel are the attractions and/or drawbacks of Apple stock? You might want to show information on the movement over time of Apple's stock price in this section. (7 points) Once you are done, could you upload a copy of your work below? Ratio Year ended September 25, 2021 Year ended September 26, 2020 LIQUIDITY AND EFFICIENCY 134,836/125,481 = 1.07 143,713/105,392 = 1.36 The 2021 figures seem to not entirely improve from the 2020 figures. Current Ratio (38,016 + 52,927 + 16,120)/105,392 =1.02 (34,940 + 27,699 + 26,278)/125,481 = 0.71 The 2021 figures seem to decrease from the 2021 figures. Acid-Test Ratio 274,515/19,523 = 14.06 Accounts Receivable Turnover 365,817/21,199 = 17.26 The 2021 figures seem to increase and improve from the 2020 figures. 274,515/331,202 = 0.83 365,817/331,002 = 1.08 The 2021 figures improve from the 2020 figures. Total Asset Turnover Ratio Year ended September 25, 2021 Year ended September 26, 2020 Debt Ratio SOLVENCY (6,000 + 109,106)/351,002 = (4,996 +98,6677/323,888 32.79% 32.01% The 2021 figures seem to increase from a small percentage and improve from the 2020 figures (6,000 + 109,106)/63,090 = 1.82 (4,996 +98,667)/65,339 = 1.59 The 2021 figures seem to increase and improve from the 2020 figures. Debt-to-Equity Ratio PROFITABILITY 94,680/36,817 = 25.88% The 2021 figures seem to improve close to 6 percent 57,411/274,515 = 20.91% Profit Margin Ratio 57,411/331,202 = 17.33% 94,680/337,445 = 28.06% The 2021 figures made an Return-on-Total improvement from the 2020 Assets Ratio figures 104,956/274,515 = 38.23% 152,836/365,817 = 41.78% The 2021 figures increase and Gross Profit Ratio make an improvement, than a.k.a. Gross from the 2020 figures Margin Ratio 3 Ratio Year ended September 25, 2021 94,680/64,215.5 = 147.44% The 2021 figures make an tremendous improvement than from the 2020 figures. Year ended September 26, 2020 57,411/77,913 = 73.6% Return-on- Common Stockholders' Equity Ratio The given income statement would be $3.30 per share. The given income statement would be $5.67 per share. The income statement clearly shows an improvement from Basic Earnings per the 2021 figures. Share Price/Earnings Ratio MARKET PROSPECTS 146,92/197 = 25.91 112.28/197 = 33.92 In this area of market prospects we can see that the 2021 figures have decrease from the 2020 figures which means it has not made an improvement (Search for common stock price at the date of the financial statements)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts