Question: Financial Statement Analysis: Homework Problem Based on the Statement of Financial Position as of December 31, 20X9, the Income Statement for the year-ended December 31,

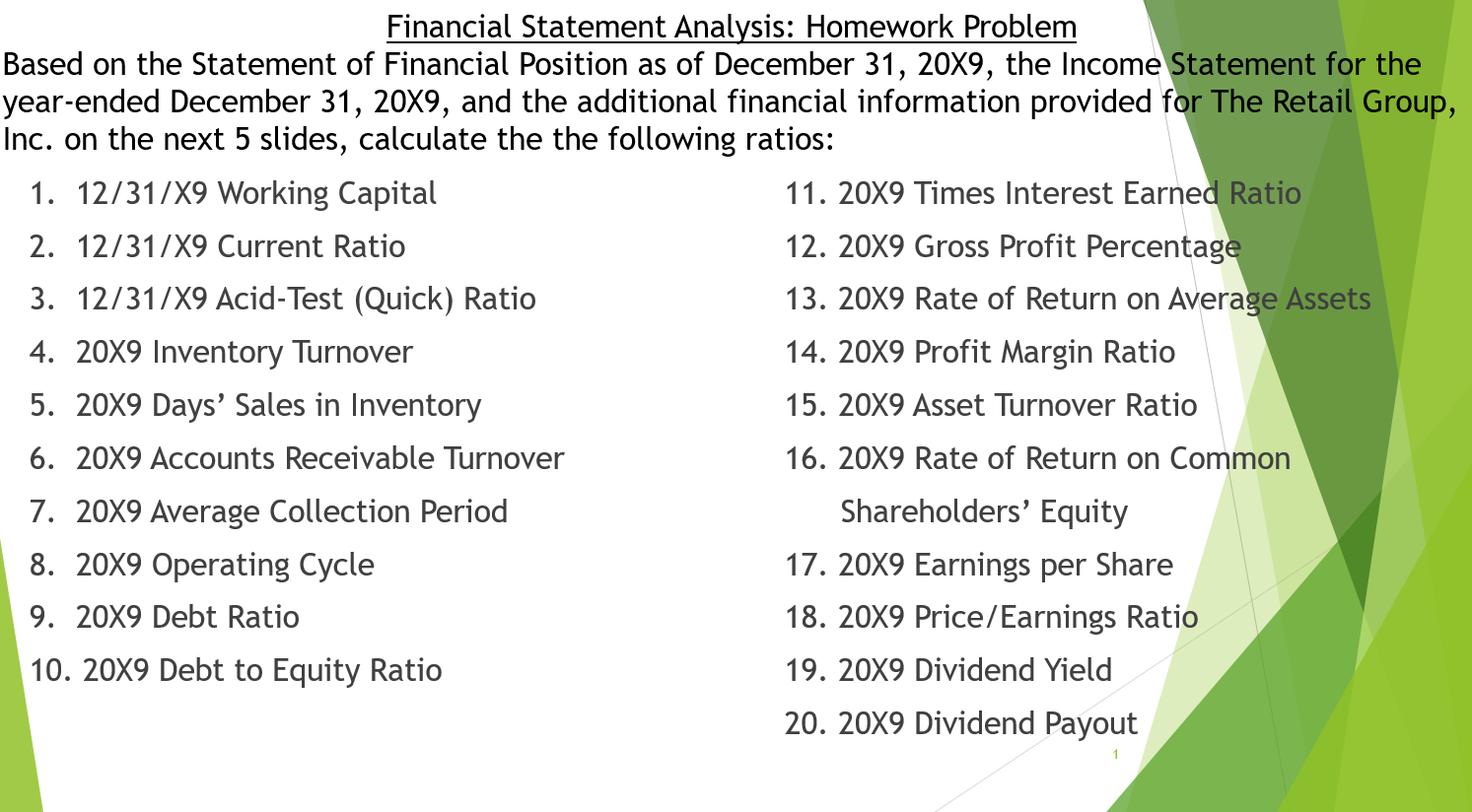

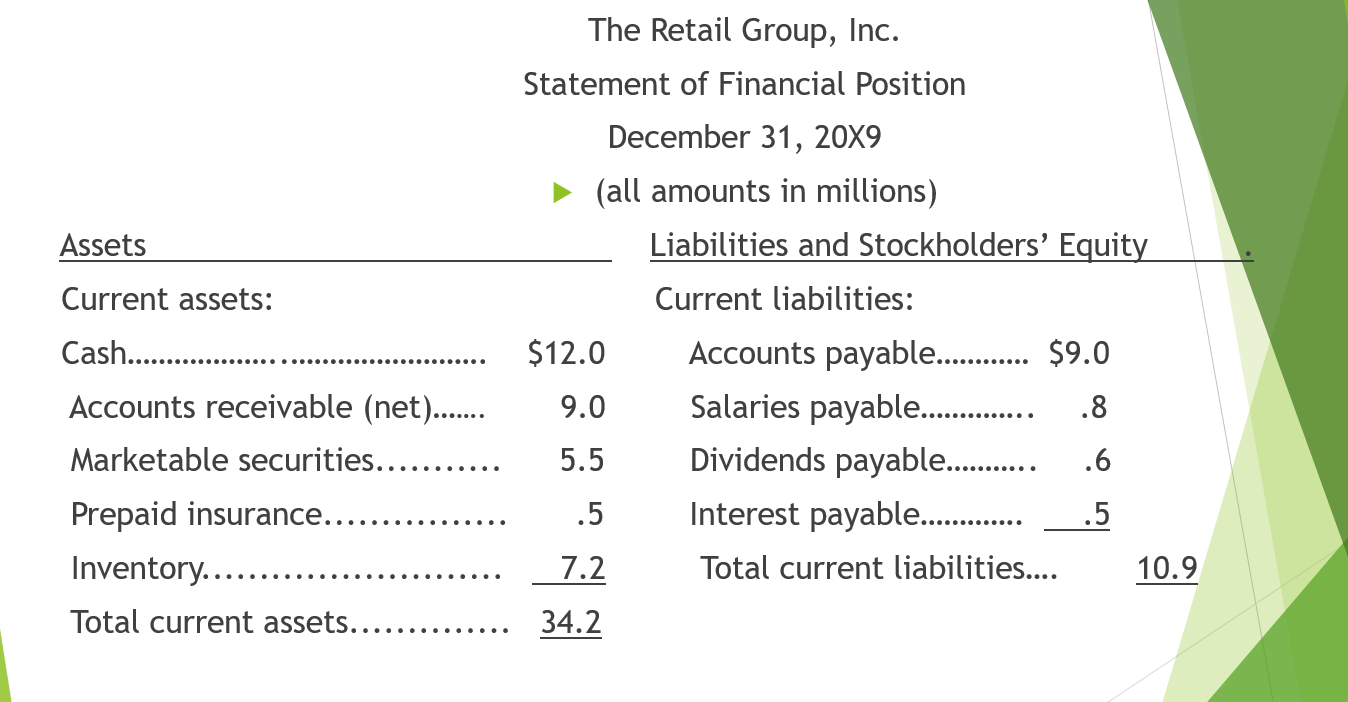

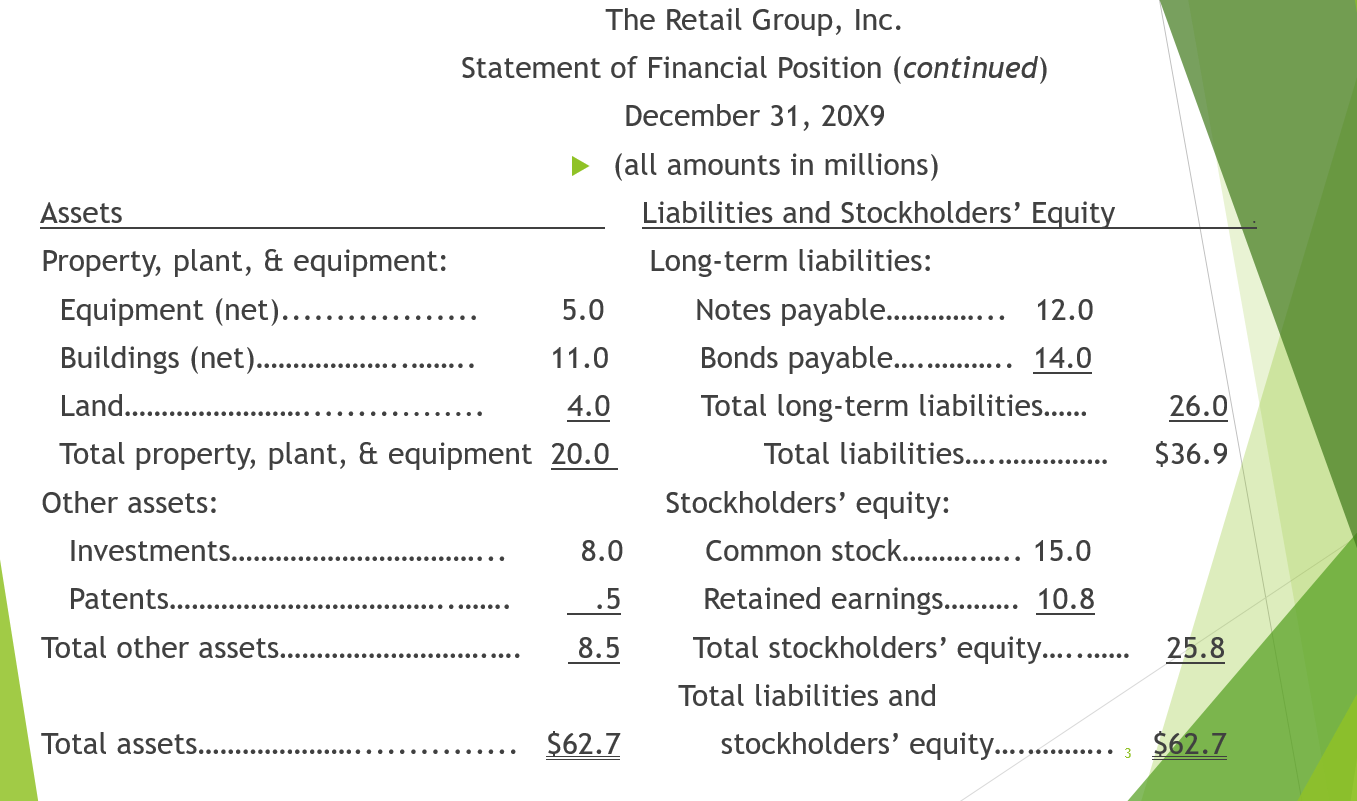

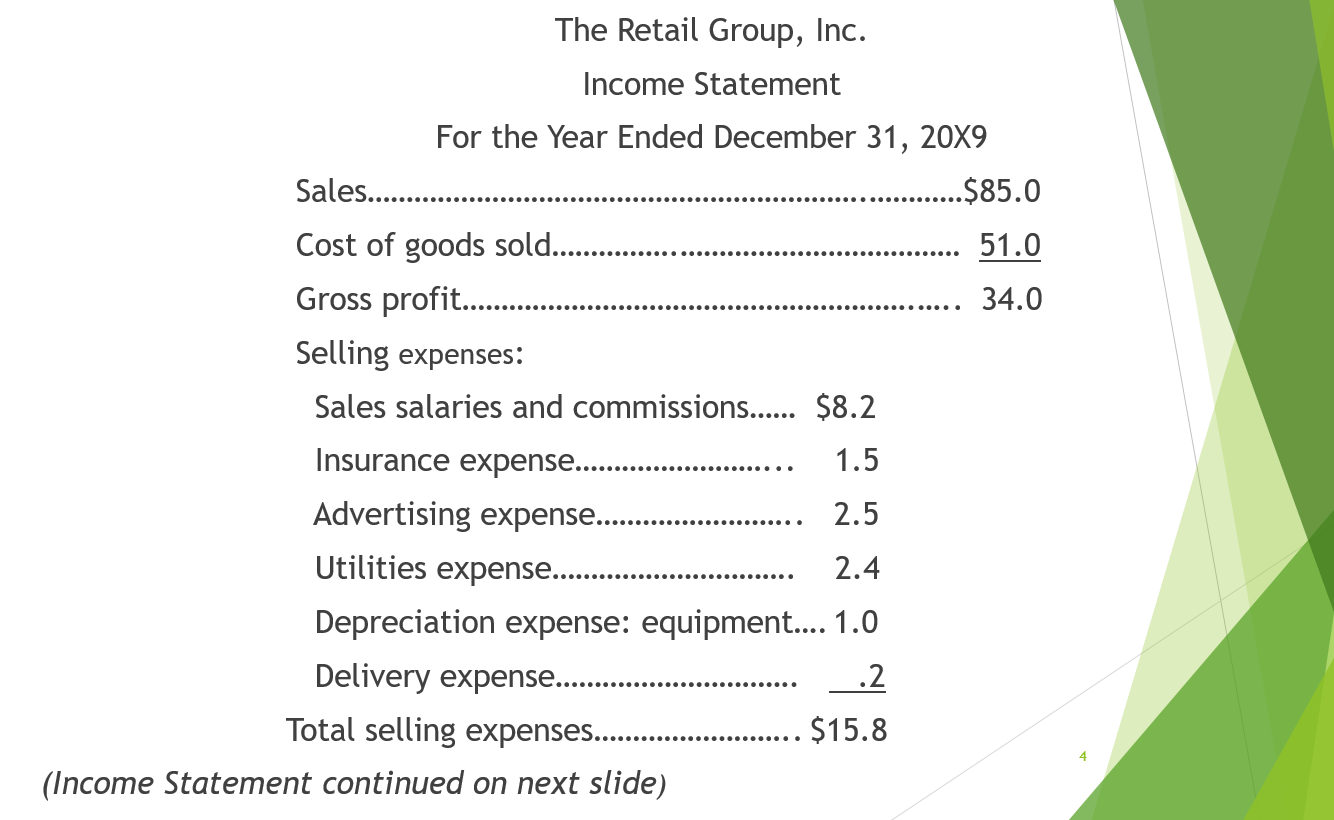

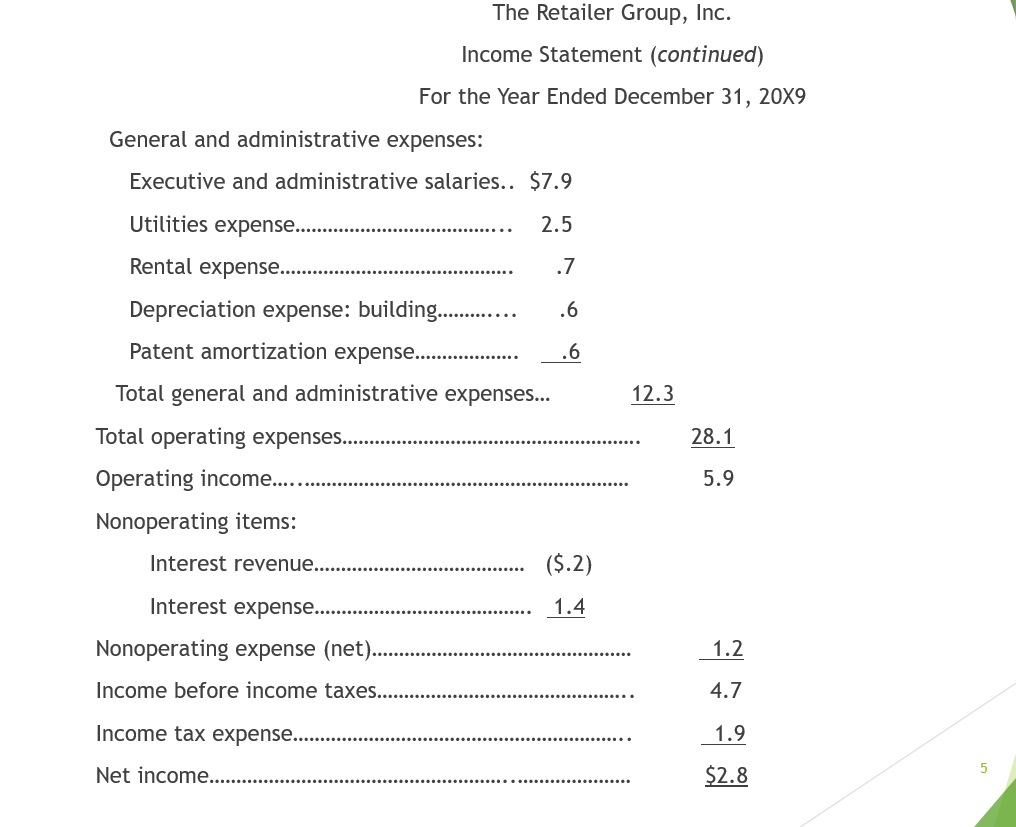

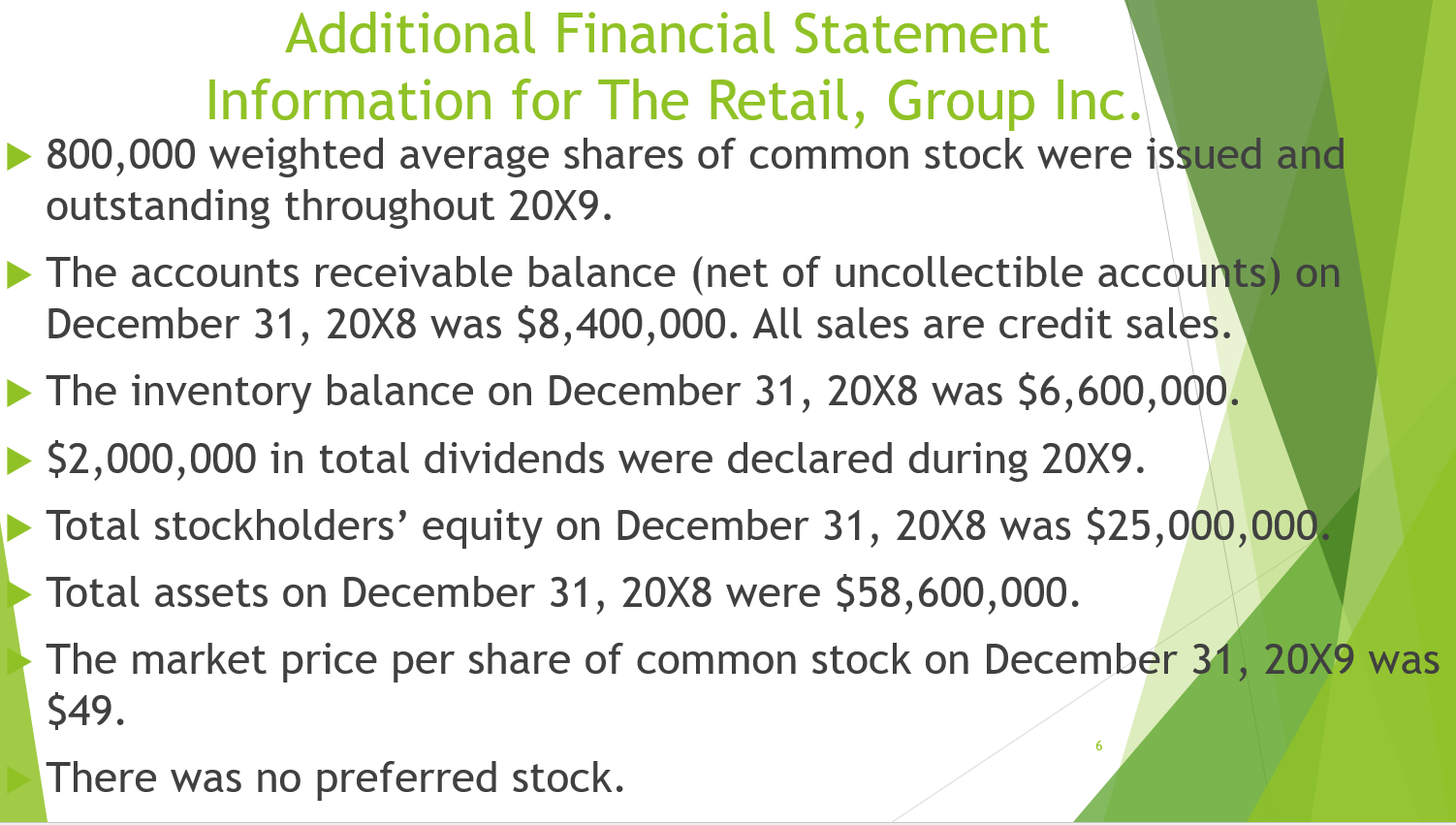

Financial Statement Analysis: Homework Problem Based on the Statement of Financial Position as of December 31, 20X9, the Income Statement for the year-ended December 31, 20X9, and the additional financial information provided for The Retail Group, Inc. on the next 5 slides, calculate the the following ratios: 1. 12/31/X9 Working Capital 11. 20X9 Times Interest Earned Ratio 2. 12/31/X9 Current Ratio 12. 209 Gross Profit Percentage 3. 12/31/X9 Acid-Test (Quick) Ratio 13. 20X9 Rate of Return on Average Assets 4. 209 Inventory Turnover 14. 20X9 Profit Margin Ratio 5. 20X9 Days' Sales in Inventory 15. 209 Asset Turnover Ratio 6. 209 Accounts Receivable Turnover 16. 209 Rate of Return on Common 7. 209 Average Collection Period Shareholders' Equity 8. 20X9 Operating Cycle 17. 20X9 Earnings per Share 9. 209 Debt Ratio 18. 20X9 Price/Earnings Ratio 10. 20X9 Debt to Equity Ratio 19. 20X9 Dividend Yield 20. 20X9 Dividend Payout The Retail Group, Inc. Statement of Financial Position December 31, 20X9 The Retail Group, Inc. The Retail Group, Inc. The Retailer Group, Inc. Income Statement (continued) For the Year Ended December 31, 20X9 General and administrative expenses: Executive and administrative salaries.. \$7.9 Utilities expense...................................... 2.5 Rental expense........................................... 8.7 Depreciation expense: building............. .6 Patent amortization expense................... .6 Nonoperating items: Interest revenue...................................... ($.2) Interest expense....................................... 1.4 Nonoperating expense (net). 1.2 Income before income taxes. 4.7 Income tax expense. Net income. Additional Financial Statement Information for The Retail, Group Inc. 800,000 weighted average shares of common stock were issued and outstanding throughout 209. The accounts receivable balance (net of uncollectible accounts) on December 31, 20X8 was $8,400,000. All sales are credit sales. The inventory balance on December 31,208 was $6,600,000. $2,000,000 in total dividends were declared during 209. Total stockholders' equity on December 31,208 was $25,000,000. Total assets on December 31,208 were $58,600,000. The market price per share of common stock on December 31, 20X9 wa $49. There was no preferred stock. Financial Statement Analysis: Homework Problem Based on the Statement of Financial Position as of December 31, 20X9, the Income Statement for the year-ended December 31, 20X9, and the additional financial information provided for The Retail Group, Inc. on the next 5 slides, calculate the the following ratios: 1. 12/31/X9 Working Capital 11. 20X9 Times Interest Earned Ratio 2. 12/31/X9 Current Ratio 12. 209 Gross Profit Percentage 3. 12/31/X9 Acid-Test (Quick) Ratio 13. 20X9 Rate of Return on Average Assets 4. 209 Inventory Turnover 14. 20X9 Profit Margin Ratio 5. 20X9 Days' Sales in Inventory 15. 209 Asset Turnover Ratio 6. 209 Accounts Receivable Turnover 16. 209 Rate of Return on Common 7. 209 Average Collection Period Shareholders' Equity 8. 20X9 Operating Cycle 17. 20X9 Earnings per Share 9. 209 Debt Ratio 18. 20X9 Price/Earnings Ratio 10. 20X9 Debt to Equity Ratio 19. 20X9 Dividend Yield 20. 20X9 Dividend Payout The Retail Group, Inc. Statement of Financial Position December 31, 20X9 The Retail Group, Inc. The Retail Group, Inc. The Retailer Group, Inc. Income Statement (continued) For the Year Ended December 31, 20X9 General and administrative expenses: Executive and administrative salaries.. \$7.9 Utilities expense...................................... 2.5 Rental expense........................................... 8.7 Depreciation expense: building............. .6 Patent amortization expense................... .6 Nonoperating items: Interest revenue...................................... ($.2) Interest expense....................................... 1.4 Nonoperating expense (net). 1.2 Income before income taxes. 4.7 Income tax expense. Net income. Additional Financial Statement Information for The Retail, Group Inc. 800,000 weighted average shares of common stock were issued and outstanding throughout 209. The accounts receivable balance (net of uncollectible accounts) on December 31, 20X8 was $8,400,000. All sales are credit sales. The inventory balance on December 31,208 was $6,600,000. $2,000,000 in total dividends were declared during 209. Total stockholders' equity on December 31,208 was $25,000,000. Total assets on December 31,208 were $58,600,000. The market price per share of common stock on December 31, 20X9 wa $49. There was no preferred stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts