Question: financial statement analysis Old Co. was acquired by Raptor for cash, at a significant premium to book value, on January 1, 2004. Since that time,

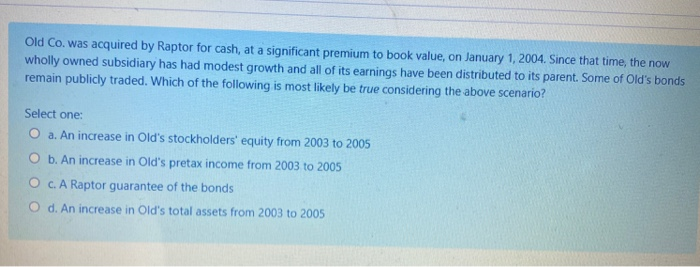

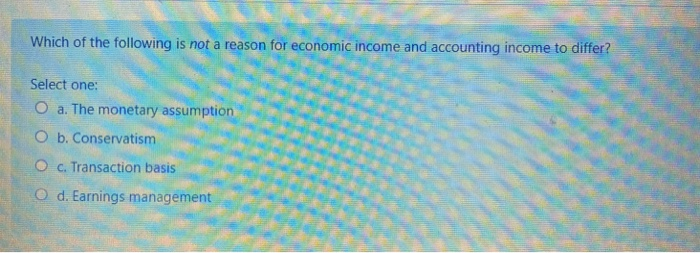

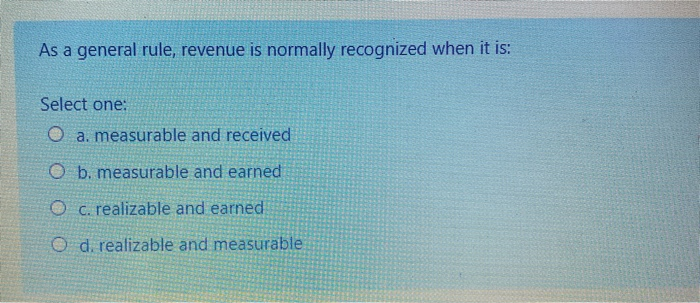

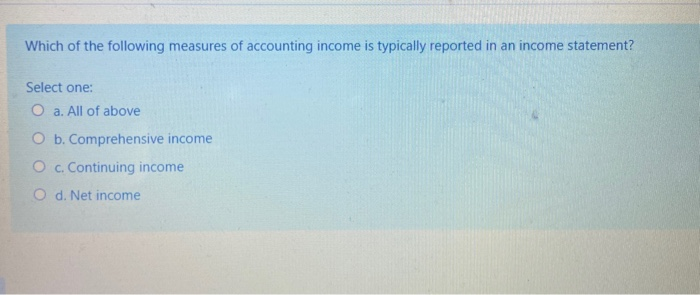

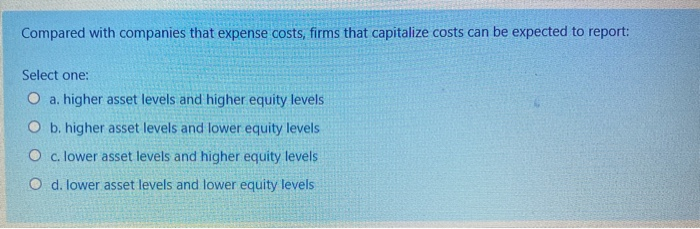

Old Co. was acquired by Raptor for cash, at a significant premium to book value, on January 1, 2004. Since that time, the now wholly owned subsidiary has had modest growth and all of its earnings have been distributed to its parent. Some of Old's bonds remain publicly traded. Which of the following is most likely be true considering the above scenario? Select one: O a. An increase in Old's stockholders' equity from 2003 to 2005 O b. An increase in Old's pretax income from 2003 to 2005 O c. A Raptor guarantee of the bonds O d. An increase in Old's total assets from 2003 to 2005 Which of the following is not a reason for economic income and accounting income to differ? Select one: O a. The monetary assumption O b. Conservatism O c. Transaction basis O d. Earnings management As a general rule, revenue is normally recognized when it is: Select one: O a. measurable and received O b. measurable and earned O c. realizable and earned O d. realizable and measurable Which of the following measures of accounting income is typically reported in an income statement? Select one: O a. All of above O b. Comprehensive income O c. Continuing income O d. Net income Compared with companies that expense costs, firms that capitalize costs can be expected to report: Select one: O a higher asset levels and higher equity levels O b. higher asset levels and lower equity levels O c. lower asset levels and higher equity levels O d. lower asset levels and lower equity levels

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts