Question: Financial Statement Analysis Please answer all questions THANK YOU! QUESTION 1 Using the information below to answer question 1-3. CSU Corporation began operations on January

Financial Statement Analysis

Please answer all questions

THANK YOU!

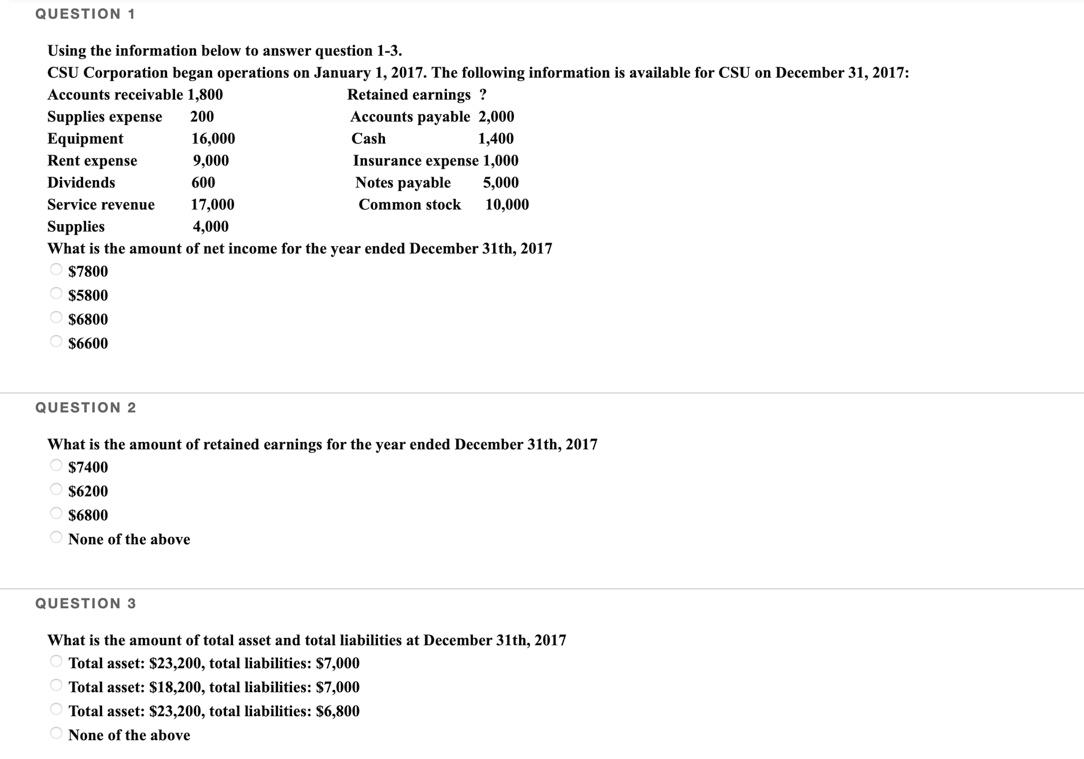

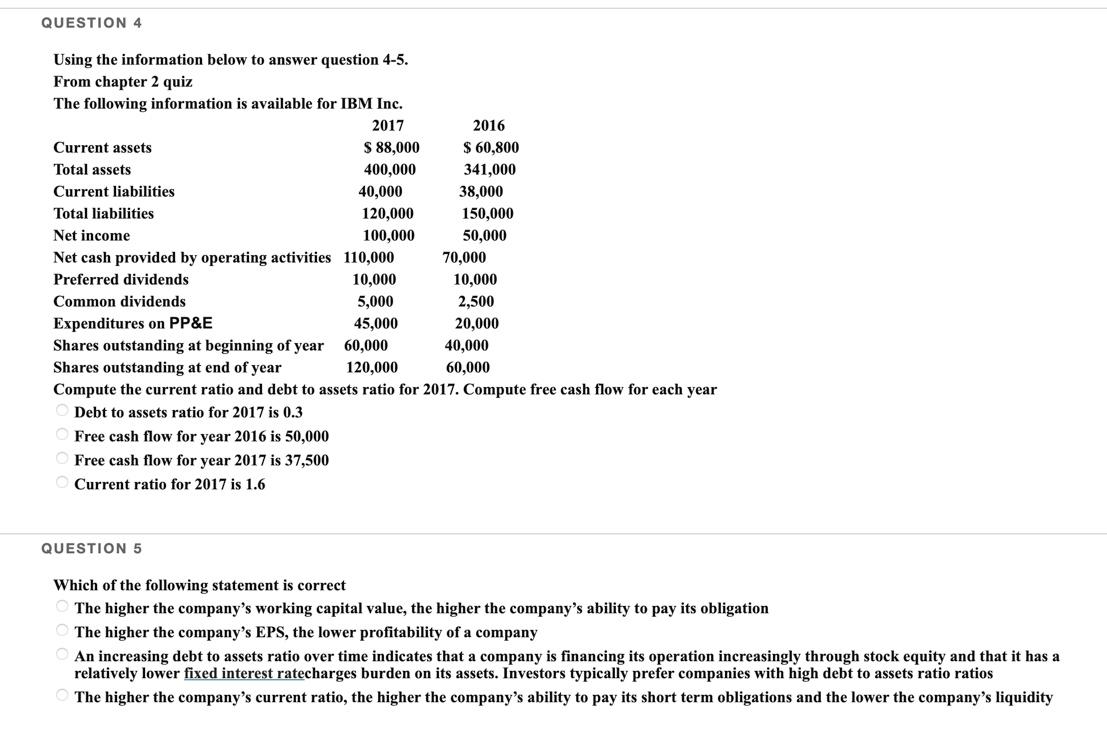

QUESTION 1 Using the information below to answer question 1-3. CSU Corporation began operations on January 1, 2017. The following information is available for CSU on December 31, 2017: Accounts receivable 1,800 Retained earnings ? Supplies expense 200 Accounts payable 2,000 Equipment 16,000 Cash 1,400 Rent expense 9,000 Insurance expense 1,000 Dividends 600 Notes payable 5,000 Service revenue 17,000 Common stock 10,000 Supplies 4,000 What is the amount of net income for the year ended December 31th, 2017 $7800 $5800 $6800 $6600 QUESTION 2 What is the amount of retained earnings for the year ended December 31th, 2017 $7400 $6200 $6800 None of the above QUESTION 3 What is the amount of total asset and total liabilities at December 31th, 2017 Total asset: $23,200, total liabilities: $7,000 Total asset: $18,200, total liabilities: $7,000 Total asset: $23,200, total liabilities: $6,800 None of the above QUESTION 4 Using the information below to answer question 4-5. From chapter 2 quiz The following information is available for IBM Inc. 2017 2016 Current assets S 88,000 $ 60,800 Total assets 400,000 341,000 Current liabilities 40,000 38,000 Total liabilities 120,000 150,000 Net income 100,000 50,000 Net cash provided by operating activities 110,000 70,000 Preferred dividends 10,000 10,000 Common dividends 5,000 2,500 Expenditures on PP&E 45,000 20,000 Shares outstanding at beginning of year 60,000 40,000 Shares outstanding at end of year 120,000 60,000 Compute the current ratio and debt to assets ratio for 2017. Compute free cash flow for each year Debt to assets ratio for 2017 is 0.3 Free cash flow for year 2016 is 50,000 Free cash flow for year 2017 is 37,500 Current ratio for 2017 is 1.6 QUESTION 5 Which of the following statement is correct The higher the company's working capital value, the higher the company's ability to pay its obligation The higher the company's EPS, the lower profitability of a company An increasing debt to assets ratio over time indicates that a company is financing its operation increasingly through stock equity and that it has a relatively lower fixed interest ratecharges burden on its assets. Investors typically prefer companies with high debt to assets ratio ratios The higher the company's current ratio, the higher the company's ability to pay its short term obligations and the lower the company's liquidity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts