Question: Financial Statement Analysis Project This project is to be used in conjunction with the Brickey Electronics Financial Statements we converted into excel in class. Completing

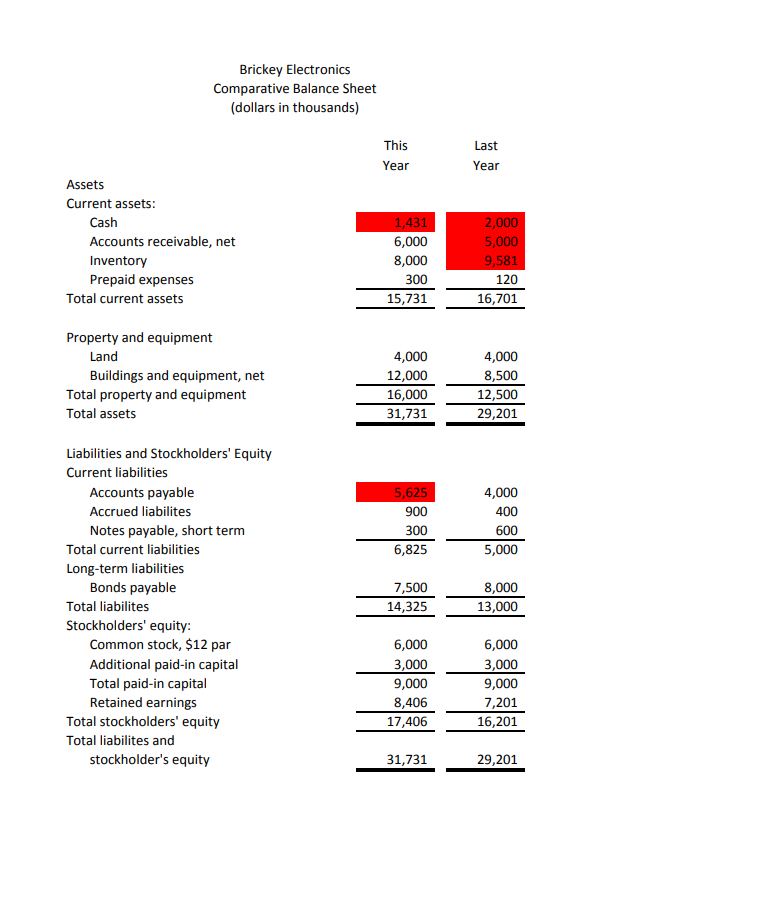

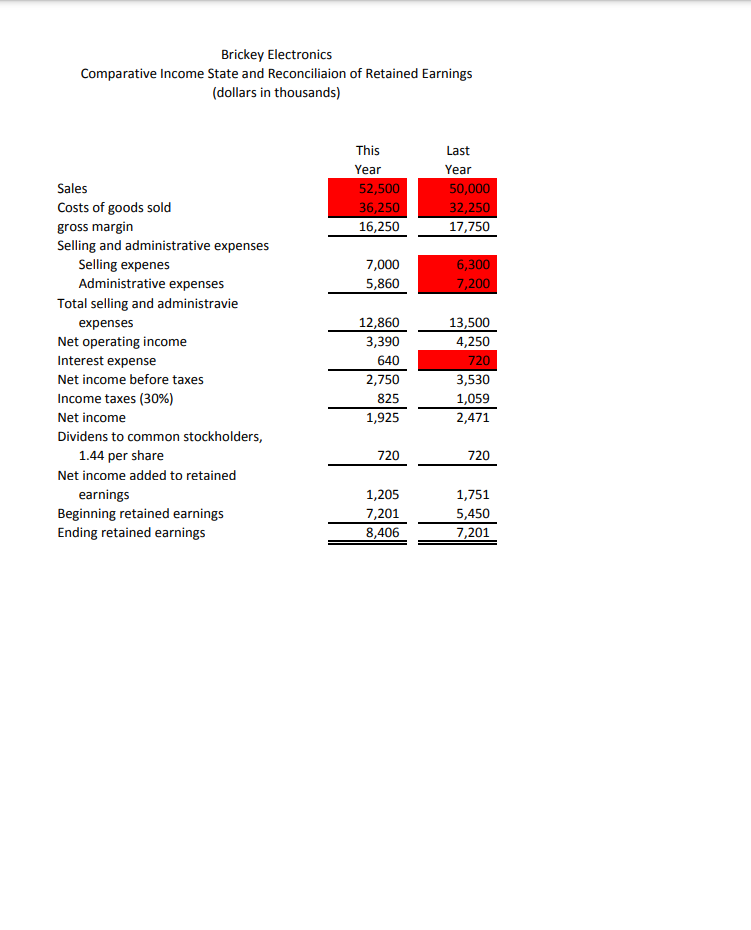

Financial Statement Analysis Project This project is to be used in conjunction with the Brickey Electronics Financial Statements we converted into excel in class. Completing this assignment in excel is not required, but it is encouraged. Some of the numbers have been changed in Brickey's financial statements. The changes are highlighted in red on the FS Analysis pdf included with the assignment posting. Either use the attached pdf or make the changes to the Brickey Electronics financial statements you have in Microsoft excel. Refer to chapter 15 for ratios that we may not have covered in class as well as additional information about financial statement analysis. Requirement 1 Perform a horizontal analysis of the financial statements, both income statement and balance sheet, for amount change and percentage change. Requirement 2 Calculate the following ratios for Brickey Electronics for This Year. Hint: Last year's ending balance is the same as this year's beginning balance when calculating averages. -Working capital -Current Ratio -Accounts receivable turnover -Average collection period -Inventory turnover -Average sale period -Operating cycle -Total asset turnover -Times interest earned -Debt-to-equity ratio -Equity multiplier -Net profit margin percentage -Return on equity -Earnings per share -Price-earnings ratio - Assume a $25 per share market price -Dividend yield ratio Requirement 3 For each Liquidity and Asset Management measure, decide if a higher or lower result is more desirable and give a brief description of what the measurement represents. Only do this for the Liquidity and Asset Management measures. Brickey Electronics Comparative Balance Sheet (dollars in thousands) \begin{tabular}{ll} This & Last \\ Year & Year \end{tabular} Assets Current assets: Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Property and equipment Land Buildings and equipment, net Total property and equipment Total assets Liabilities and Stockholders' Equity Current liabilities Accounts payable Accrued liabilites Notes payable, short term Total current liabilities Long-term liabilities Bonds payable Total liabilites Stockholders' equity: Common stock, \$12 par Additional paid-in capital Total paid-in capital Retained earnings Total stockholders' equity Total liabilites and stockholder's equity \begin{tabular}{rr} 1,431 & 2,000 \\ 6,000 & 5,000 \\ 8,000 & 9,581 \\ 300 & 120 \\ \hline 15,731 & 16,701 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 4,000 & 4,000 \\ \hline 12,000 & 8,500 \\ \hline 16,000 & 12,500 \\ \hline 31,731 & 29,201 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 5,625 & 4,000 \\ \hline 900 & 400 \\ \hline 300 & 600 \\ \hline 6,825 & 5,000 \\ \hline 7,500 & 8,000 \\ \hline 14,325 & 13,000 \\ \hline 6,000 & 6,000 \\ \hline 3,000 & 3,000 \\ \hline 9,000 & 9,000 \\ \hline 8,406 & 7,201 \\ \hline 17,406 & 16,201 \\ \hline \end{tabular} 31,731 29,201 Brickey Electronics Comparative Income State and Reconciliaion of Retained Earnings (dollars in thousands)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts