Question: Financial Statement Analysis Required: Using the indicated letters, identify the specific effects (ncluding account names and dollar amounts) of the following transactions or conditions on

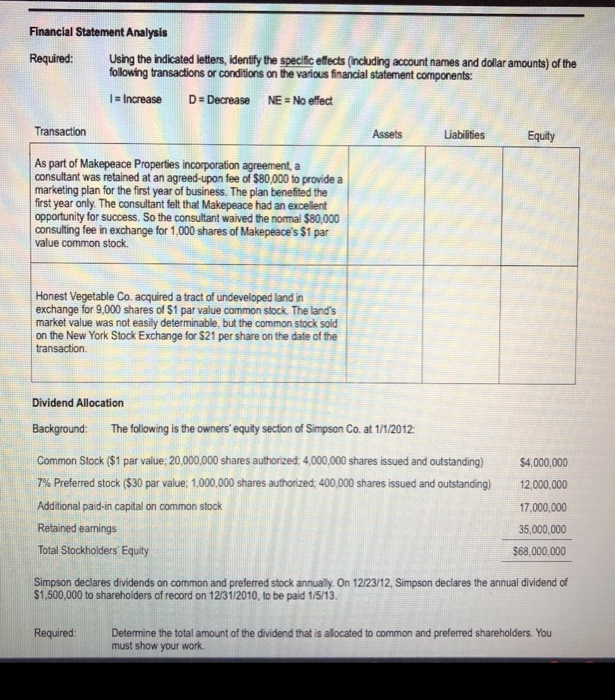

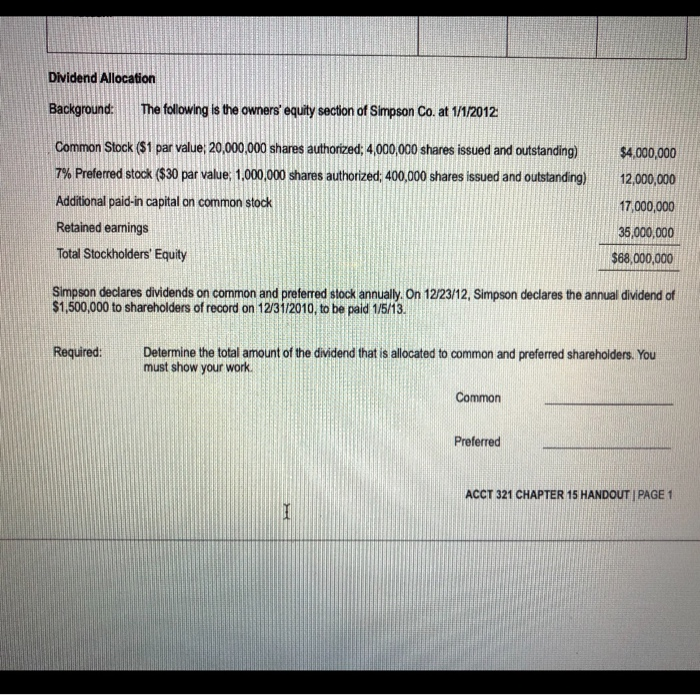

Financial Statement Analysis Required: Using the indicated letters, identify the specific effects (ncluding account names and dollar amounts) of the following transactions or conditions on the various financial statement components: NE No effect 1- Increase D Decrease Transaction Assets Liabilities Equity As part of Makepeace Properties incorporation agreement, a consultant was retained at an agreed-upon fee of $80,000 to provide a marketing plan for the first year of business. The plan benefited the first year only. The consultant felt that Makepeace had an excellent opportunity for success. So the consultant waived the nomal $80,000 consulting fee in exchange for 1,000 shares of Makepeace's $1 par value common stock Honest Vegetable Co. acquired a tract of undeveloped land in exchange for 9,000 shares of $1 par value common stock The land's market value was not easily determinable, but the common stock sold on the New York Stock Exchange for $21 per share on the date of the transaction. Dividend Allocation Background: The following is the owners' equity section of Simpson Co. at 1/1/2012 Common Stock ($1 par value: 20000,000 shares authorized: 4,000,000 shares issued and outstanding) $4,000,000 7% Preferred stock ($30 par value; 1,000,000 shares authorized, 400,000 shares issued and outstanding) 12,000,000 Additional paid-in capital on common stock 17,000,000 Retained earnings 35,000,000 Total Stockholders Equity $68,000,000 Simpson declares dividends on common and preferred stock annually. On 12/23/12, Simpson declares the annual dividend of $1,500,000 to shareholders of record on 12/31/2010, to be paid 1/5/13. Determine the total amount of the dividend that is allocated to common and preferred shareholders. You must show your work Required: Dividend Allocation Background: The following is the owners' equity section of Simpson Co. at 1/1/2012 Common Stock ($1 par value; 20,000,000 shares authorized 4,000,000 shares issued and outstanding) $4,000,000 7% Preferred stock ($30 par value; 1,000,000 shares authorized; 400,000 shares issued and outstanding) 12,000,000 Additional paid-in capital on common stock 17,000,000 Retained eamings 35,000,000 Total Stockholders Equity $68,000,000 Simpson declares dividends on common and preferred stock annually. On 12/23/12, Simpson declares the annual dividend of $1,500,000 to shareholders of record on 12/31/2010, to be paid 1/5/13. Determine the total amount of the dividend that is allocated to common and preferred shareholders. You must show your work. Required: Common Preferred ACCT 321 CHAPTER 15 HANDOUT | PAGE 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts