Question: Financial Statement (MG-770) Assignment Week 9 - Operating Activities Please answer the following uestions using this document as your template: Complete Questions and Exercises Problems

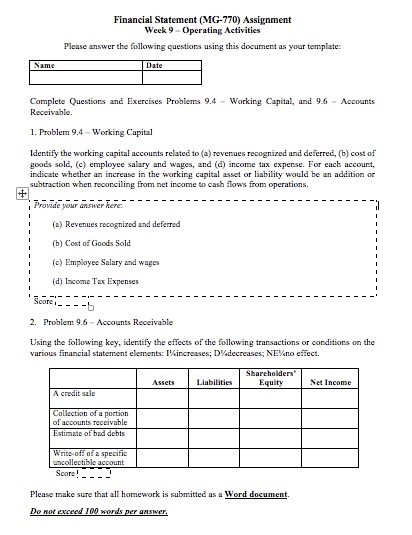

Financial Statement (MG-770) Assignment Week 9 - Operating Activities Please answer the following uestions using this document as your template: Complete Questions and Exercises Problems 9.4 - Working Capital, and 9.6 - Accounts Receivable. 1. Problem 9.4 - Working Capital Identify the working capital accounts related to (a) revenues recognized and deferred, (b) cost of goods sold, (c) employee salary and wages, and (d) income tax expense. For each account, indicate whether an increase in the working capital asset or liability would be an addition or subtraction when reconciling from net income to cash flows from operations. Provide your swer here. (a) Revenues recognized and deferred (b) Cost of Goods Sold (c) Employee Salary and wages (d) Income Tax Expenses 2. Problem 9.6 - Accounts Receivable Using the following key, identify the effects of the following transactions or conditions on the various financial statement elements: [//increases; D\%/iecreases; NE/o effect. Please make sure that all homework is submitted as a Word document. Do not exceed 100 words per answer. Financial Statement (MG-770) Assignment Week 9 - Operating Activities Please answer the following uestions using this document as your template: Complete Questions and Exercises Problems 9.4 - Working Capital, and 9.6 - Accounts Receivable. 1. Problem 9.4 - Working Capital Identify the working capital accounts related to (a) revenues recognized and deferred, (b) cost of goods sold, (c) employee salary and wages, and (d) income tax expense. For each account, indicate whether an increase in the working capital asset or liability would be an addition or subtraction when reconciling from net income to cash flows from operations. Provide your swer here. (a) Revenues recognized and deferred (b) Cost of Goods Sold (c) Employee Salary and wages (d) Income Tax Expenses 2. Problem 9.6 - Accounts Receivable Using the following key, identify the effects of the following transactions or conditions on the various financial statement elements: [//increases; D\%/iecreases; NE/o effect. Please make sure that all homework is submitted as a Word document. Do not exceed 100 words per

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts