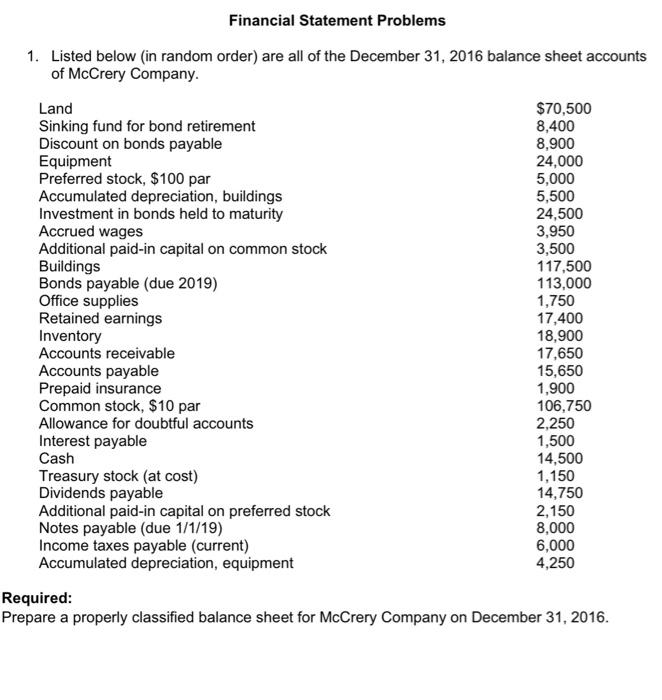

Question: Financial Statement Problems 1. Listed below (in random order) are all of the December 31, 2016 balance sheet accounts of McCrery Company. Land $70,500 8,400

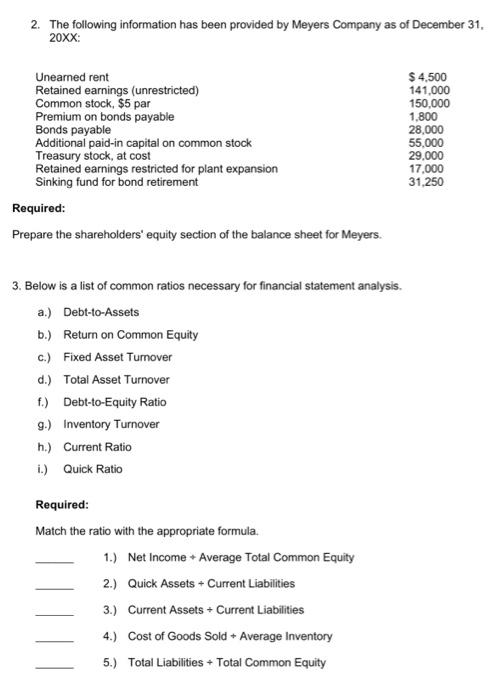

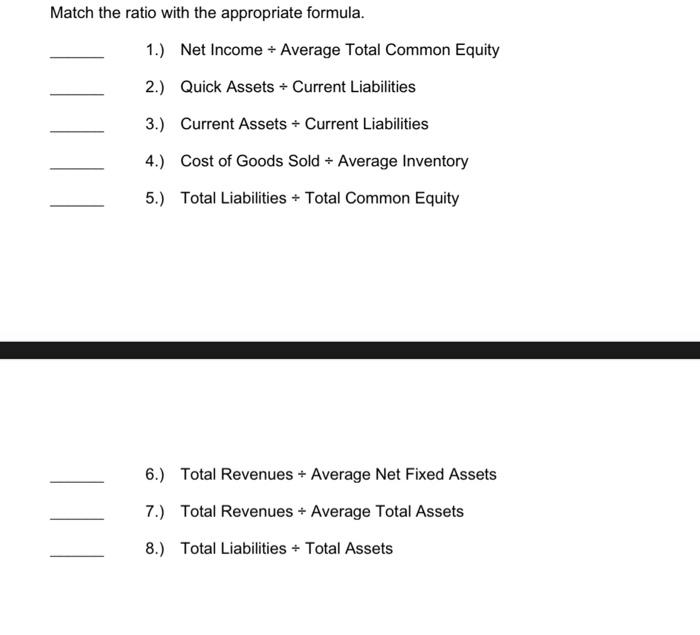

Financial Statement Problems 1. Listed below (in random order) are all of the December 31, 2016 balance sheet accounts of McCrery Company. Land $70,500 8,400 Sinking fund for bond retirement Discount on bonds payable Equipment 8,900 24,000 Preferred stock, $100 par 5,000 Accumulated depreciation, buildings 5,500 24,500 Investment in bonds held to maturity Accrued wages 3,950 3,500 Additional paid-in capital on common stock Buildings 117,500 Bonds payable (due 2019) 113,000 Office supplies 1,750 Retained earnings 17,400 Inventory 18,900 Accounts receivable 17,650 Accounts payable 15,650 Prepaid insurance 1,900 Common stock, $10 par 106,750 Allowance for doubtful accounts 2,250 Interest payable 1,500 Cash 14,500 Treasury stock (at cost) 1,150 Dividends payable 14,750 Additional paid-in capital on preferred stock 2,150 Notes payable (due 1/1/19) 8,000 Income taxes payable (current) 6,000 Accumulated depreciation, equipment 4,250 Required: Prepare a properly classified balance sheet for McCrery Company on December 31, 2016. 2. The following information has been provided by Meyers Company as of December 31, 20XX: Unearned rent $ 4,500 141,000 Retained earnings (unrestricted) Common stock, $5 par Premium on bonds payable Bonds payable 150,000 1,800 28,000 Additional paid-in capital on common stock 55,000 Treasury stock, at cost 29,000 17,000 Retained earnings restricted for plant expansion Sinking fund for bond retirement 31,250 Required: Prepare the shareholders' equity section of the balance sheet for Meyers. 3. Below is a list of common ratios necessary for financial statement analysis. a.) Debt-to-Assets b.) Return on Common Equity c.) Fixed Asset Turnover d.) Total Asset Turnover f.) Debt-to-Equity Ratio g.) Inventory Turnover h.) Current Ratio i.) Quick Ratio Required: Match the ratio with the appropriate formula. 1.) Net Income + Average Total Common Equity 2.) Quick Assets + Current Liabilities 3.) Current Assets + Current Liabilities 4.) Cost of Goods Sold + Average Inventory 5.) Total Liabilities + Total Common Equity Match the ratio with the appropriate formula. 1.) Net Income + Average Total Common Equity 2.) Quick Assets + Current Liabilities 3.) Current Assets + Current Liabilities 4.) Cost of Goods Sold + Average Inventory 5.) Total Liabilities + Total Common Equity 6.) Total Revenues + Average Net Fixed Assets 7.) Total Revenues + Average Total Assets 8.) Total Liabilities + Total Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts