Question: FINANCIAL STATEMENTS & NOTES: PAGE 1: PAGE 2-3: PAGE 4-5: PAGE 6-7: PAGE 8-9: PAGE 10-11: PAGE 12-13: PAGE 14: 1. For each company, determine

FINANCIAL STATEMENTS & NOTES:

PAGE 1:

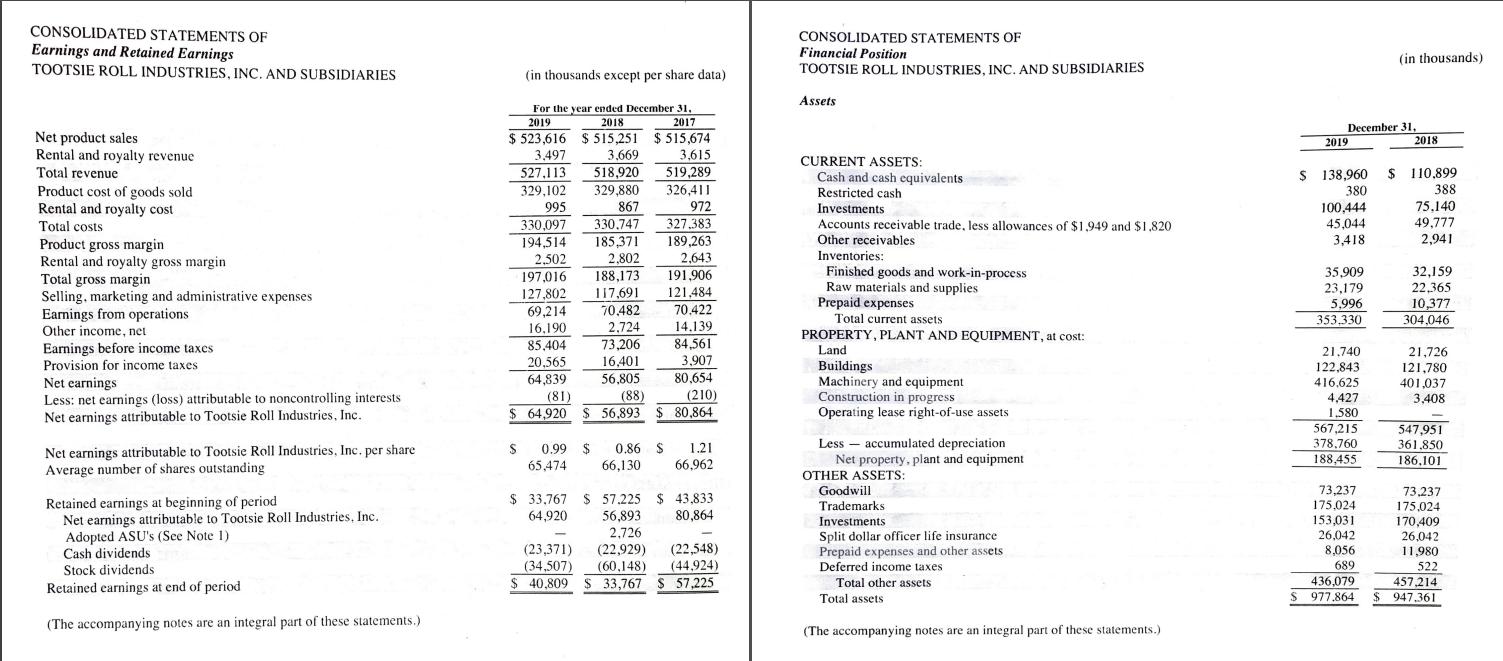

PAGE 2-3:

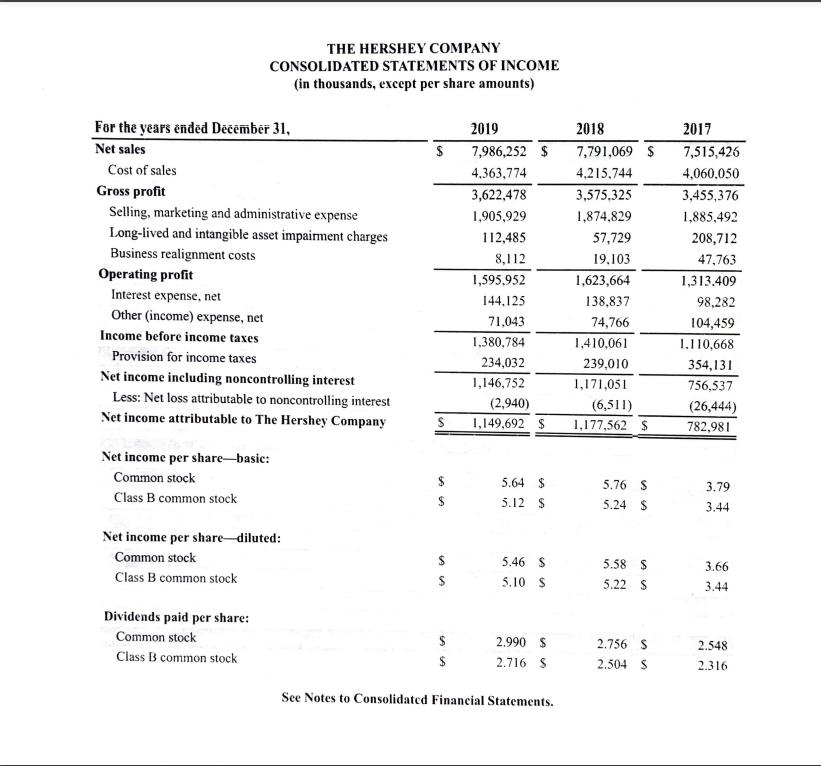

PAGE 4-5:

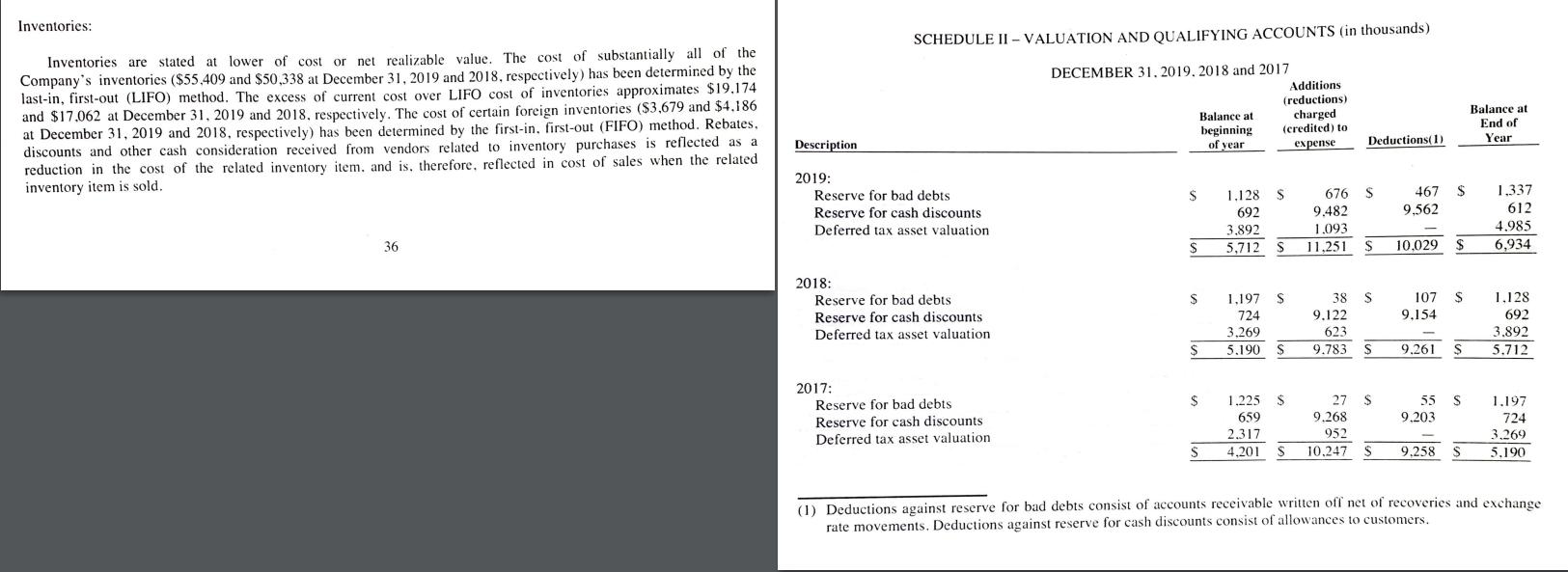

PAGE 4-5:

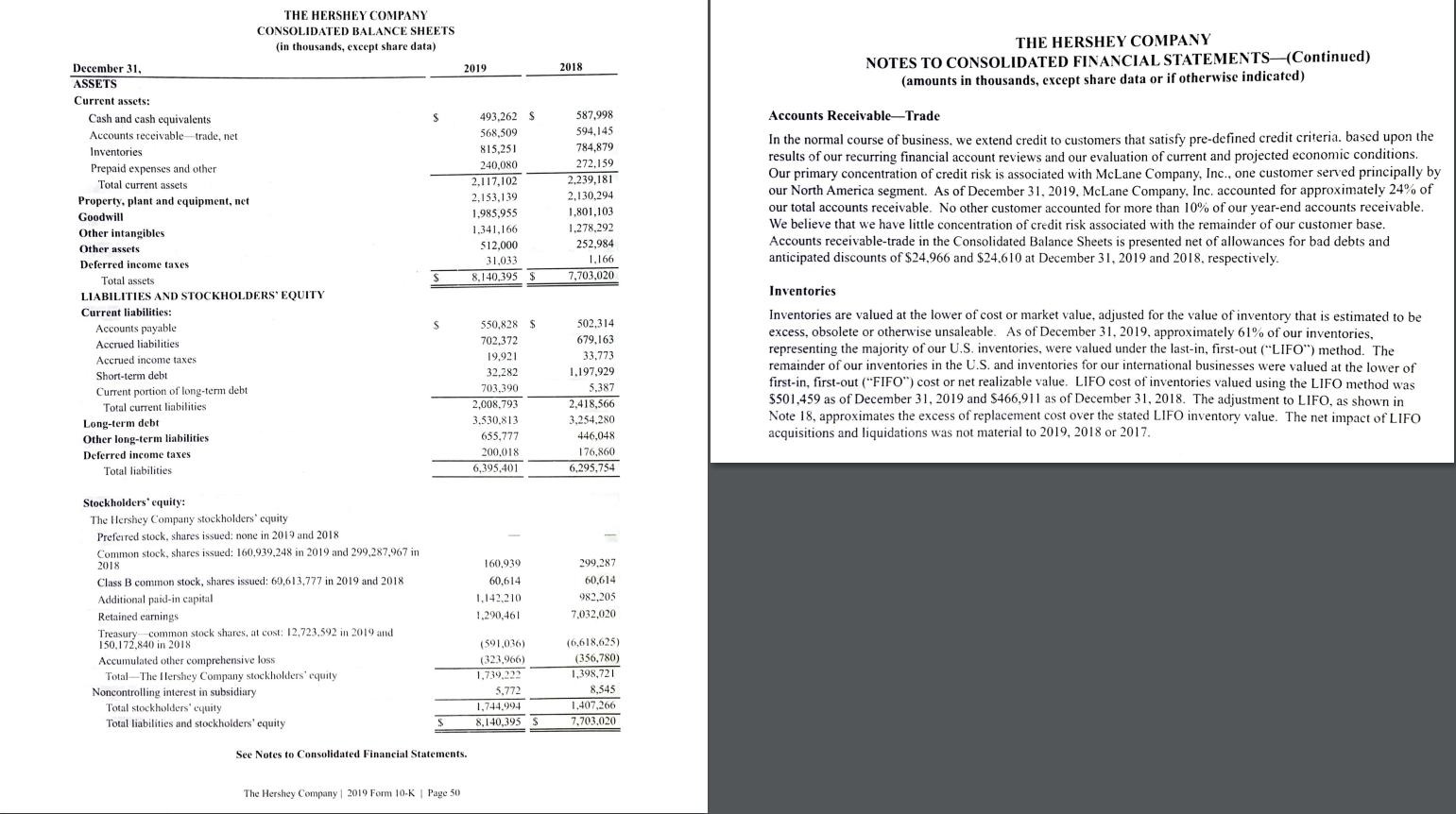

PAGE 6-7:

PAGE 6-7:

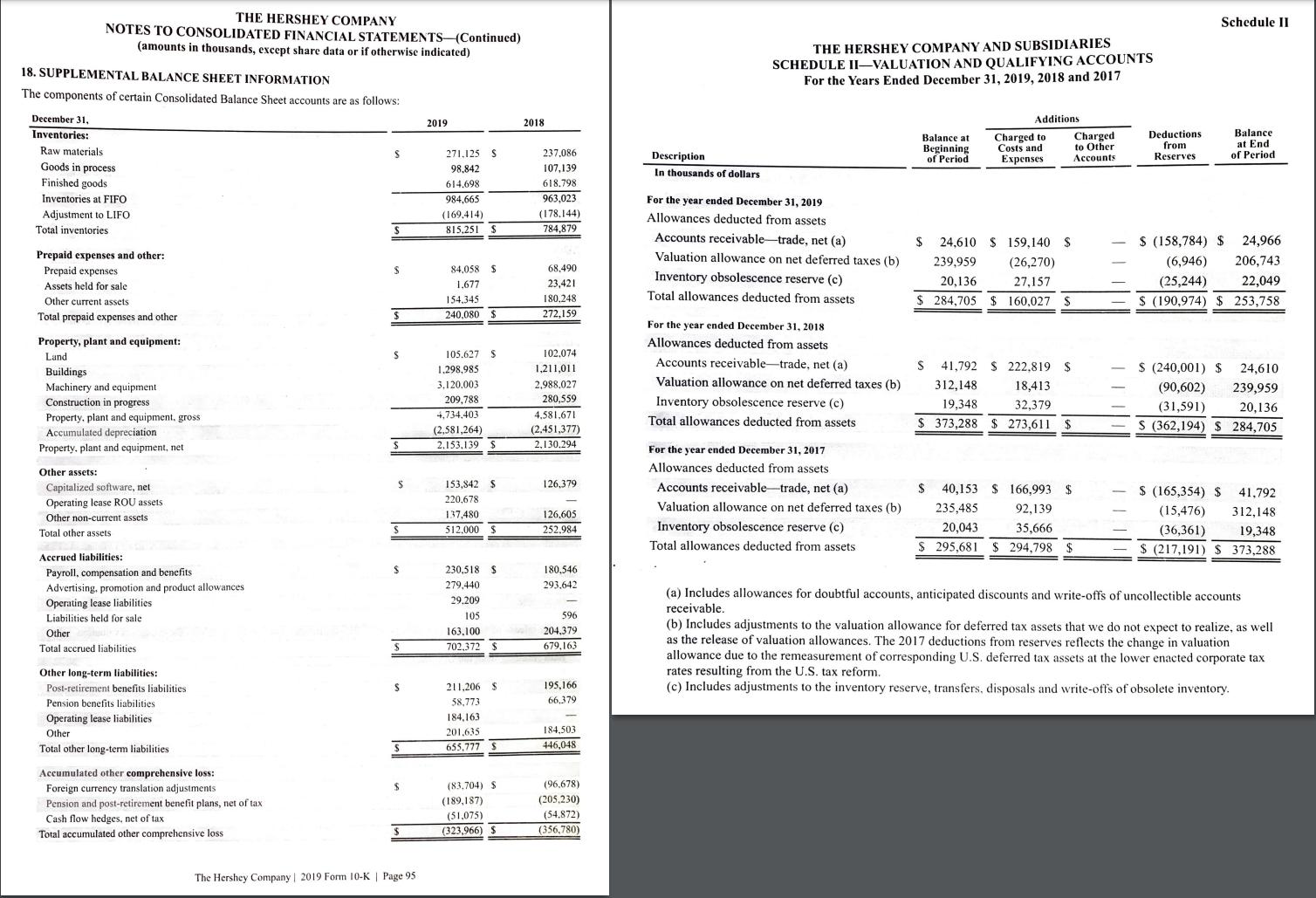

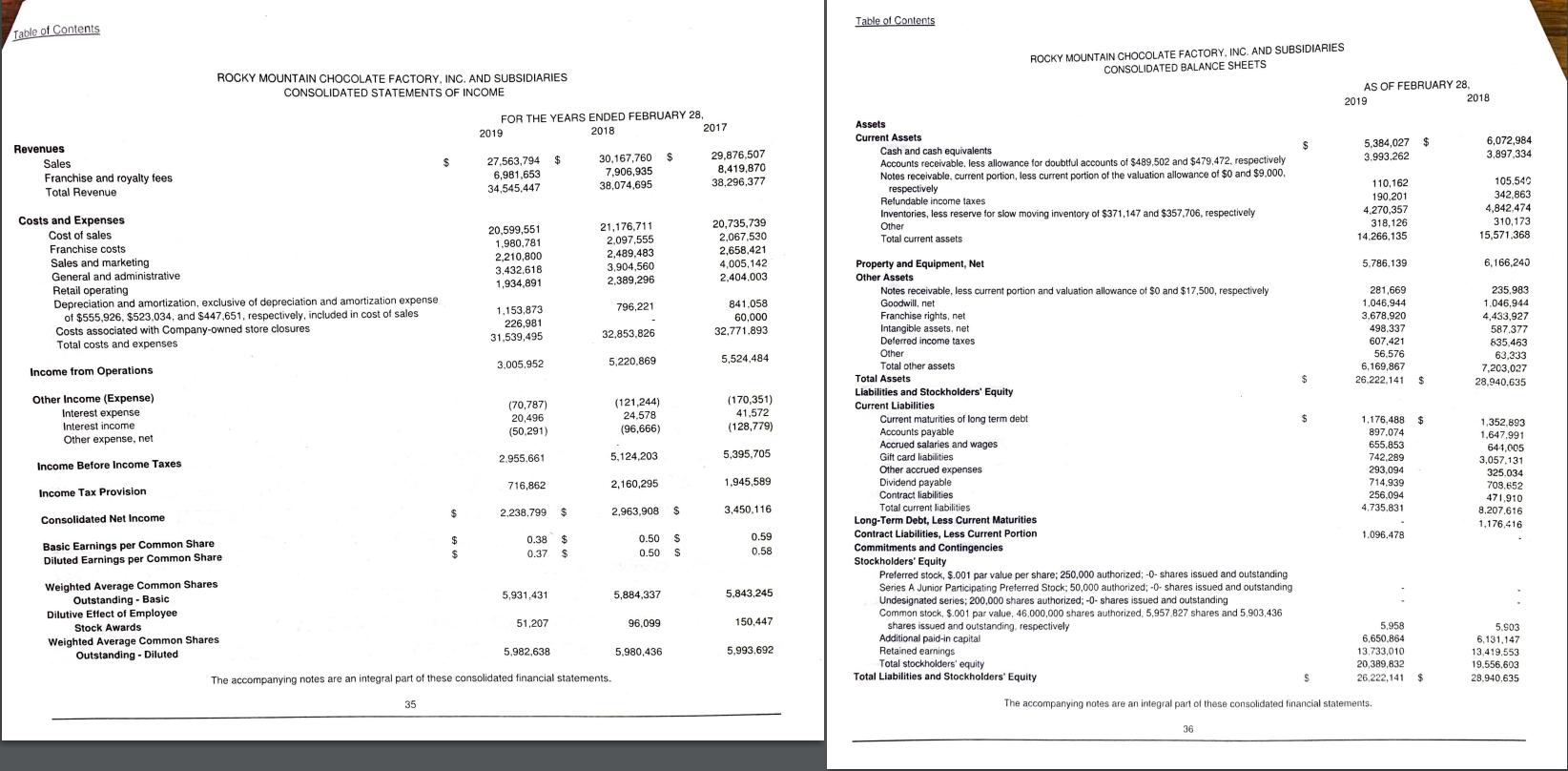

PAGE 8-9:

PAGE 8-9:

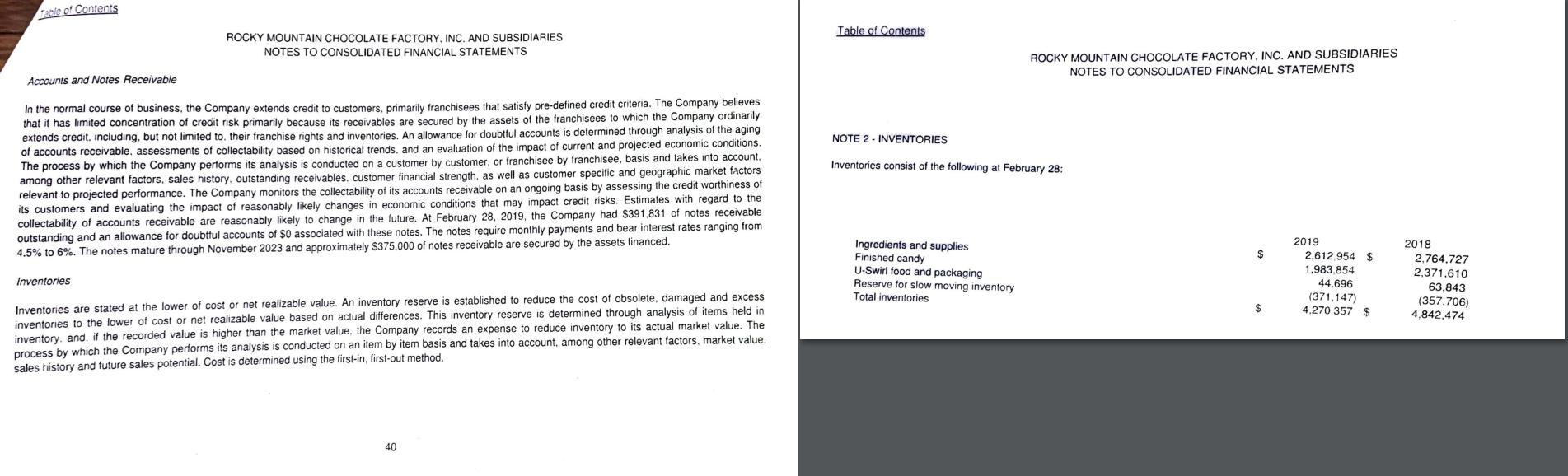

PAGE 10-11:

PAGE 10-11:

PAGE 12-13:

PAGE 12-13:

PAGE 14:

PAGE 14:

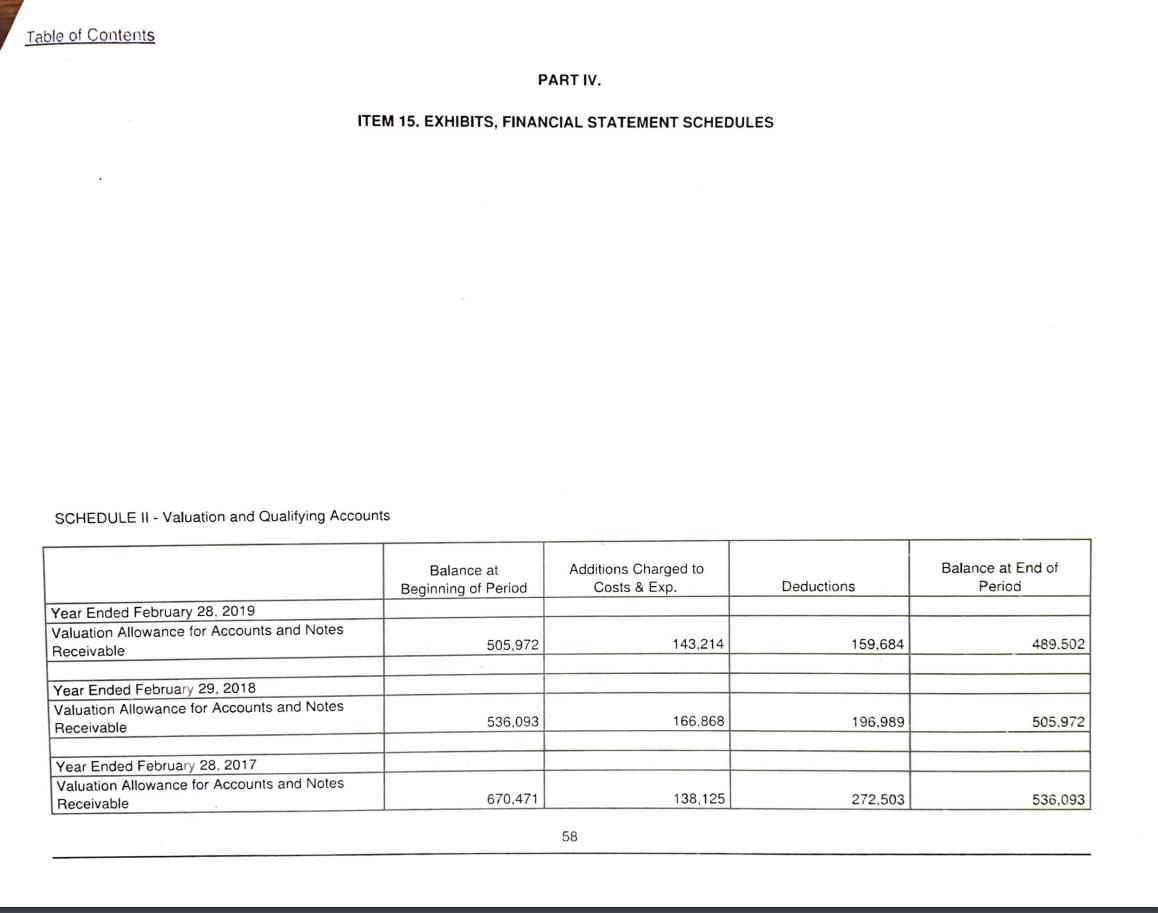

1. For each company, determine the percentage of gross accounts receivable that are estimated to be uncollectible in 2018 and 2019 (hint: the balance sheet reports net accounts receivable, and you will need to determine gross accounts receivable). Compare the results (i.e., are they similar or different). What does this mean? 2. For each company, calculate days collected (sales) for 2019. Which company(s) is doing the best job of collecting accounts receivable? Which company(s) is doing the worst job collecting its accounts receivable? 3. Using the information in Schedule II, analyze the adequacy of the allowance for doubtful accounts and cash (sales) discounts, if applicable. You should compare the 3-year average for the estimated expense (additions) with the 3-year average of write-offs (deductions). Do you have any concerns about the adequacy of the allowance? 4. What method does each company use to determine the cost of the inventory? For each company. determine the percentage of gross inventory that is reserved for obsolescence (if applicable). In addition, determine the percentage of gross inventory for each component (e.g., raw materials, finished goods, etc.). Compare the results (i.e., are they similar or different)? What does this mean? 5. For each company, calculate days held for 2019 as reported regardless of the inventory method. However, if a company uses LIFO, you will need to convert to FIFO and recalculate days held for 2019. Which company experiences a LIFO liquidation? How do you know? Compare the days held using the FIFO calculations. Which company(s) is doing the best job selling its inventory quickly? Which company(s) is doing the worst job selling its inventory quickly? 6. For each company, determine days paid and cash conversion for 2019 (hint: make sure you use the FIFO calculations for days held). Which company(s) is doing the best job of cash conversion? Which company(s) is doing the worst job of cash conversion? 7. Looking at your results, which company(s) would you prefer to invest in? Why?

Step by Step Solution

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Introduction The events surrounding the killing of George Floyd in 2020 ignited widespread protests and discussions about systemic racism and discrimination particularly within law enforcement In resp... View full answer

Get step-by-step solutions from verified subject matter experts