Question: FINC 1010-Exam 3 Fall 2017 MULTIPLE CHOICE. Choose the one alternative ihat best completes ib. Matinen question 1) All of the follow are key characteristics

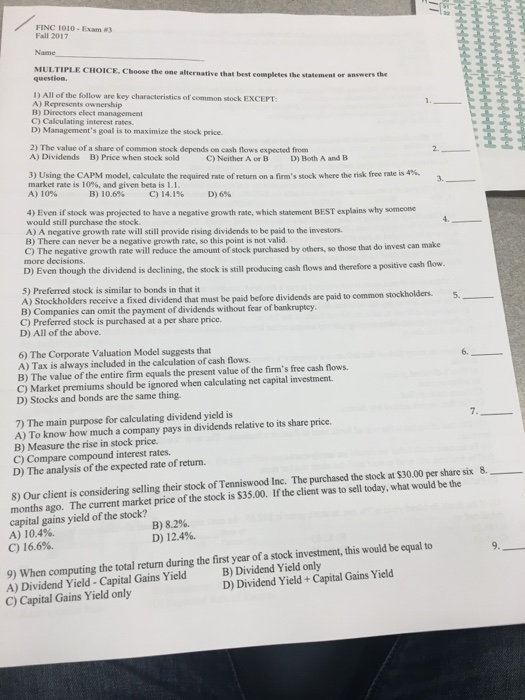

FINC 1010-Exam 3 Fall 2017 MULTIPLE CHOICE. Choose the one alternative ihat best completes ib. Matinen question 1) All of the follow are key characteristics of common stock EXCEPT A) Represents ownership B) Directors elect management C) Calculating interest rates. D) Management's goal is to maximize the stock price. 2) The value of a share of common stock depends on cash flows expected from A) Dividends B) Price when stock sold 2. C) Neither AorB D) Both A and B 3) Using the CAPM model, calculate the required rate of return on a firm's stock where the risk free rate is 4% market rate is 10%, and given beta is 1.I. A) 10% E) 10.6% c) 14.1% D) 6% 4) Even if stock was projected to have a negative growth rate, which statement BEST explains why someone would still purchase the stock. A) A negative growth rate will still provide rising dividends to be paid to the investors. B) There can never be a negative growth rate, so this point is not valid. C) The negative growth rate will reduce the amount of stock purchased by others, so those that do invest can make more decisions D) Even though the dividend is declining, the stock is still producing cash flows and therefore a positive 5) Preferred stock is similar to bonds in that it A) Stockholders receive a fixed dividend that must be paid before dividends are paid to common stockholders. 5 B) Companies can omit the C) Preferred stock is purchased at a per share price. D) All of the above. 6) The Corporate Valuation Model suggests that 6 A) Tax is always included in the calculation of cash flows B) The value of the entire firm equals the present value of the firm's free cash flows. C) Market premiums should be ignored when calculating net capital investment. D) Stocks and bonds are the same thing. 7) The main purpose for calculating dividend yield is A) To know how much a company pays in dividends relative to its share price B) Measure the rise in stock price. C) Compare compound interest rates. D) The analysis of the expected rate of return. 8) Our client is considering selling their stock of Tenniswood Inc. The purchased the stock at $30.00 per share six 8. months ago. The current market price of the stock is $35.00. If the client was to sell today, what would be the capital gains yield of the stock? A) 10.4%. C) 16.6%. B) 8.2%. D) 12.4%. 9) When computing the total return during the first year of a stock investment, this would be equal to A) Dividend Yield-Capital Gains Yield B) Dividend Yield only C) Capital Gains Yield only D) Dividend Yield+ Capital Gains Yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts