Question: FINC 101a Quiz (from chapter 8) er8). Students' names: 1. Wha t would you pay today for a stock that is expected to make a

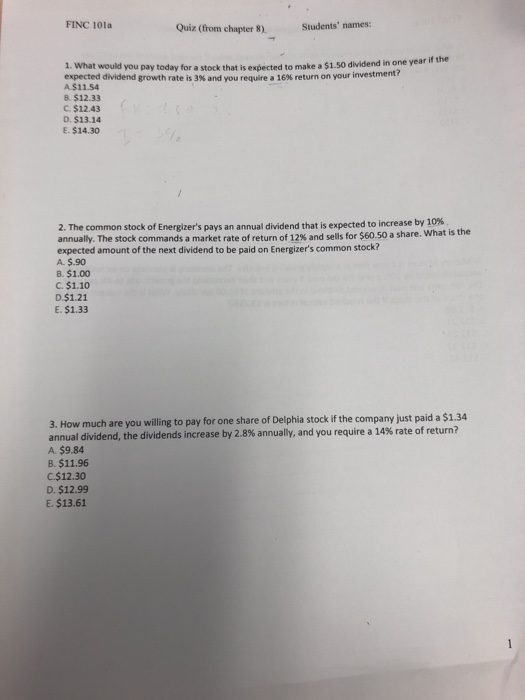

FINC 101a Quiz (from chapter 8) er8). Students' names: 1. Wha t would you pay today for a stock that is expected to make a $1.50 dividend in one year if the expected dividend growth rate is 3% and you require a 16% return on your investment A $11.54 8. $12.33 C. $12.43 D. $13.14 E.$14.30 2. The common stock of Energizer's pays an annual dividend tha annually. The expected amount of the next dividend to be paid on Energizer's common stock? A. $.90 B. $1.00 C. $1.10 D $1.21 E.$1.33 t is expected to increase by 10% are. What is the stock commands a market ra 3. How much are you willing to pay for one share of Delphia stock if the company just paid a $1.34 annual dividend, the dividends increase by 2.8% annually, and you require a 14% rate of return? A. $9.84 B. $11.96 C$12.30 D. $12.99 E. $13.61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts