Question: FINC 313 Fall 2018 Assignment #3 Credit Risk Due Date: December 6, 2018 The focus of this assgnment is to understand credit risk, and in

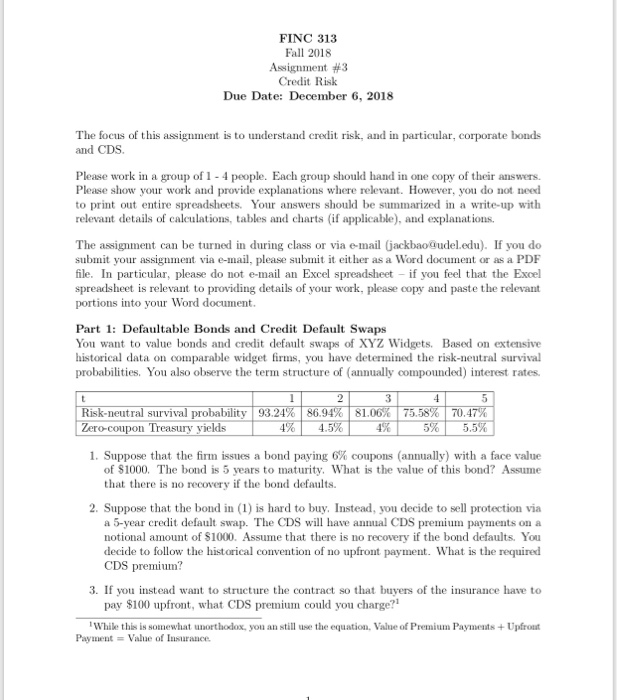

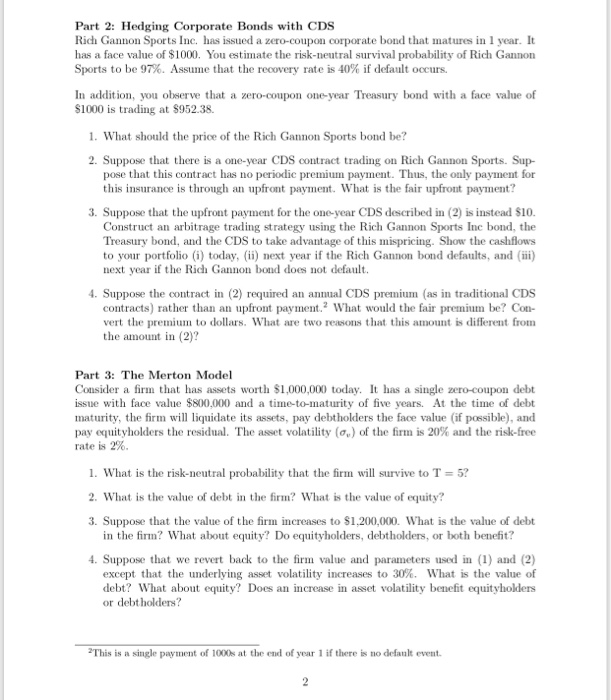

FINC 313 Fall 2018 Assignment #3 Credit Risk Due Date: December 6, 2018 The focus of this assgnment is to understand credit risk, and in particular, corporate bonds and CDS Please work in a group of 1- 4 people. Each group should hand in one copy of their answers. Please show your to print out entire spreadsheets. Your answers should be summarized in a write-up with relevant details of calculations, tables and charts (if applicable), and explanations work and provide explanations where relevant. However, you i do not need The assignment can be turned in during class or via e-mail jackbao@udel.edu. If you do submit your assignment via e-mail, please submit it either as a Word document or as a PDF file. In particular, please do not e-mail an Excel spreadsheet - if you feel that the Excel spreadsheet is relevant to providing details of your work, please copy and paste the relevant portions into your Word document Part 1: Defaultable Bonds and Credit Default Swaps You want to value bonds and credit default swaps of XYZ Widgets. Based on extensive historical data on comparable widget firms, you have determined the risk-neutral survival probabilities. You also observe the term structure of (annually compounded) interest rates Risk-neutral survi obability | 93.24% | 86.9 81 75. 70.4 n Treasury yields 4.5 5.5 I. Suppose that the firm issues a bond paying 6% coupons (annually) with a face value of $1000. The bond is 5 years to maturity. What is the value of this bond? Assume that there is no recovery if the bond defaults. 2. Suppose that the bond in (1) is hard to buy. Instead, you decide to sell protection via a 5-year credit default swap. The CDS will have annual CDS premium payments on a notional amount of $1000. Assume that there is no recovery if the bond defaults. You decide to follow the historical convention of no upfront payment. What is the required premium? 3. If you instead want to structure the contract so that buyers of the insurance have to pay $100 upfront, what CDS premium could you charge?1 While this is somewhat unorthodox, you an still use the equation, Value of Premium Payments +Ufrout Payment Value of Insurance FINC 313 Fall 2018 Assignment #3 Credit Risk Due Date: December 6, 2018 The focus of this assgnment is to understand credit risk, and in particular, corporate bonds and CDS Please work in a group of 1- 4 people. Each group should hand in one copy of their answers. Please show your to print out entire spreadsheets. Your answers should be summarized in a write-up with relevant details of calculations, tables and charts (if applicable), and explanations work and provide explanations where relevant. However, you i do not need The assignment can be turned in during class or via e-mail jackbao@udel.edu. If you do submit your assignment via e-mail, please submit it either as a Word document or as a PDF file. In particular, please do not e-mail an Excel spreadsheet - if you feel that the Excel spreadsheet is relevant to providing details of your work, please copy and paste the relevant portions into your Word document Part 1: Defaultable Bonds and Credit Default Swaps You want to value bonds and credit default swaps of XYZ Widgets. Based on extensive historical data on comparable widget firms, you have determined the risk-neutral survival probabilities. You also observe the term structure of (annually compounded) interest rates Risk-neutral survi obability | 93.24% | 86.9 81 75. 70.4 n Treasury yields 4.5 5.5 I. Suppose that the firm issues a bond paying 6% coupons (annually) with a face value of $1000. The bond is 5 years to maturity. What is the value of this bond? Assume that there is no recovery if the bond defaults. 2. Suppose that the bond in (1) is hard to buy. Instead, you decide to sell protection via a 5-year credit default swap. The CDS will have annual CDS premium payments on a notional amount of $1000. Assume that there is no recovery if the bond defaults. You decide to follow the historical convention of no upfront payment. What is the required premium? 3. If you instead want to structure the contract so that buyers of the insurance have to pay $100 upfront, what CDS premium could you charge?1 While this is somewhat unorthodox, you an still use the equation, Value of Premium Payments +Ufrout Payment Value of Insurance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts