Question: FINC 4 3 9 0 TVM 1 Practice 1 . Calculate the present value of $ 1 , 0 0 0 to be received at

FINC TVM Practice

Calculate the present value of $ to be received at the end of years. Assume an interest rate of

Tommy Harris is considering an investment that pays annually. How much must he invest today such that he will

have $ in years? round to the nearest dollar

Ray has $ to invest in a small business venture. His partner has promised to pay him back $ in years. What is

the return earned on this investment?

You decide to begin saving towards the purchase of a new car in years. If you put $ at the end of each of the next

years in a savings account paying compounded annually, how much will you accumulate after years?

Wes would like to buy a condo in Florida in six years. He is looking to invest $ today in a stock that is expected to

earn a return of annually. How much will he have at the end of six years? round to nearest dollar

You need to have $ in five years to pay off a home equity loan. You can invest in an account that pays

compounded quarterly. How much will you have to invest today to attain your target in five years?

You are interested in investing $ a gift from your grandparents, for the next four years in a mutual fund that will

earn an annual return of What will your investment be worth at the end of four years?

Joan Alexander wants to go on a long and luxurious vacation in three years. She could earn compounded monthly

in an account if she were to deposit the money today. She needs to have $ in three years. How much will she

have to deposit today?

Ryan Holmes wants to deposit $ in a bank account that pays annually. How many years will it take for his

investment to grow to $ROUND TO THE NEAREST YEAR

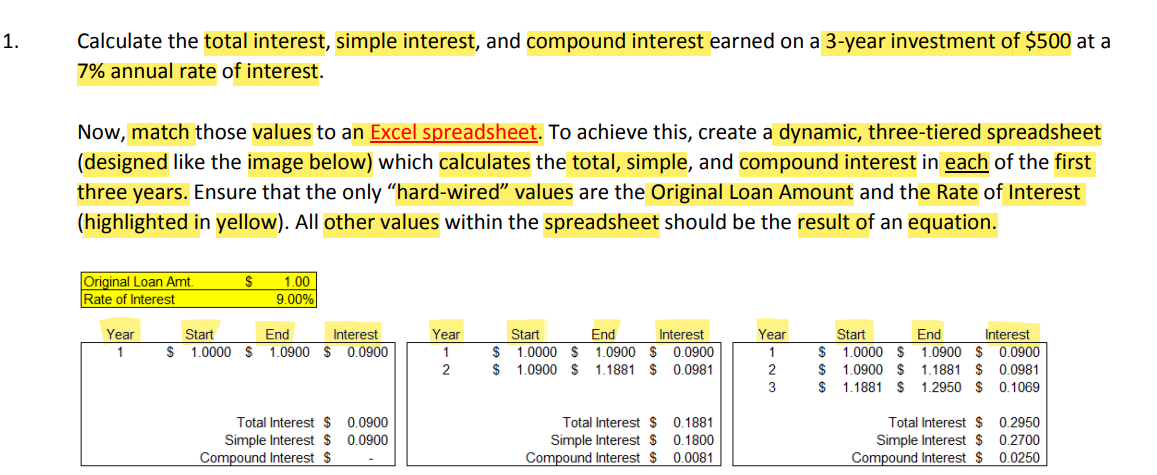

Calculate the total interest, simple interest, and compound interest earned on a year investment of $ at a

annual rate of interest.

Please use three tiered spreadsheet to provide appropriate solutions to problems.

Calculate the total interest, simple interest, and compound interest earned on a year investment of $ at a

annual rate of interest.

Now, match those values to an Excel spreadsheet. To achieve this, create a dynamic, threetiered spreadsheet

designed like the image below which calculates the total, simple, and compound interest in each of the first

three years. Ensure that the only "hardwired" values are the Original Loan Amount and the Rate of Interest

highlighted in yellow All other values within the spreadsheet should be the result of an equation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock