Question: FINC 5810 8. You are evaluating a project that is expected to return $100,000, $250,000, and $200,000 in years 1,2, and 3, respectively. Looking at

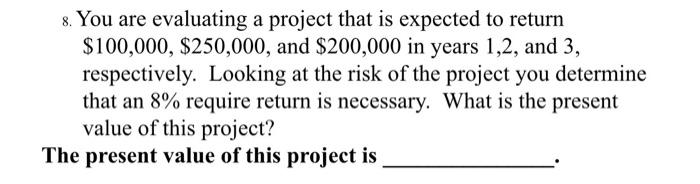

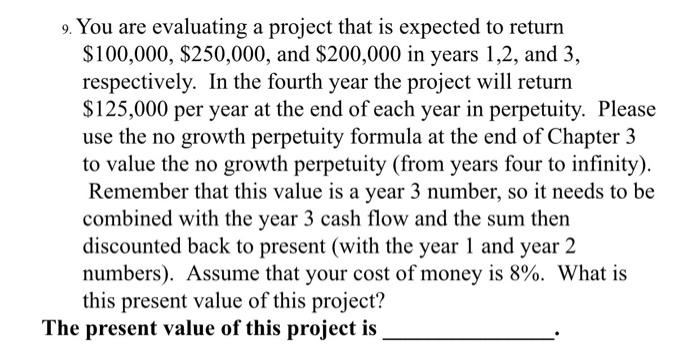

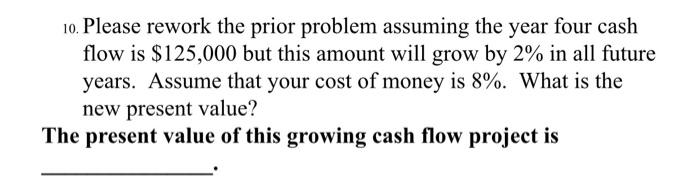

8. You are evaluating a project that is expected to return $100,000, $250,000, and $200,000 in years 1,2, and 3, respectively. Looking at the risk of the project you determine that an 8% require return is necessary. What is the present value of this project? The present value of this project is 9. You are evaluating a project that is expected to return $100,000, $250,000, and $200,000 in years 1,2, and 3, respectively. In the fourth year the project will return $125,000 per year at the end of each year in perpetuity. Please use the no growth perpetuity formula at the end of Chapter 3 to value the no growth perpetuity (from years four to infinity). Remember that this value is a year 3 number, so it needs to be combined with the year 3 cash flow and the sum then discounted back to present (with the year 1 and year 2 numbers). Assume that your cost of money is 8%. What is this present value of this project? The present value of this project is 10. Please rework the prior problem assuming the year four cash flow is $125,000 but this amount will grow by 2% in all future years. Assume that your cost of money is 8%. What is the new present value? The present value of this growing cash flow project is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts