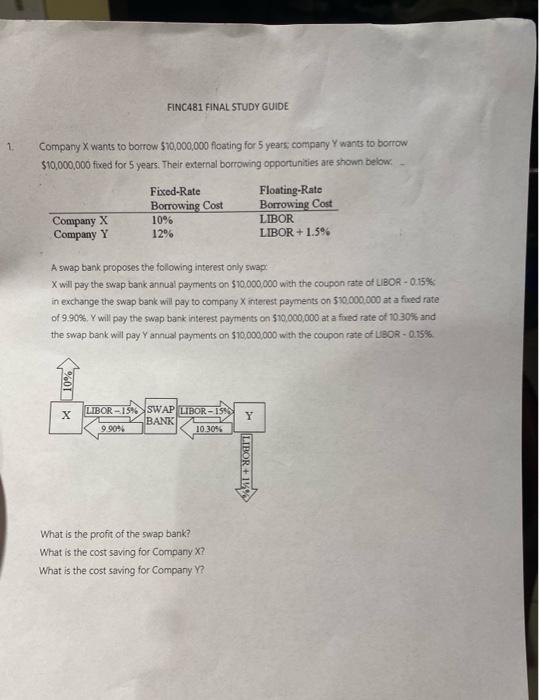

Question: FINC481 FINAL STUDY GUIDE 1 5 Company wants to borrow $10,000,000 floating for 5 years: company Y wants to borrow $10,000,000 fixed for 5 years.

FINC481 FINAL STUDY GUIDE 1 5 Company wants to borrow $10,000,000 floating for 5 years: company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below. Fixed-Rate Borrowing Cost 10% 12% Floating-Rate Borrowing Cost LIBOR LIBOR + 1.5% Company X Company Y A swap bank proposes the following interest only swap X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR -0.15% in exchange the swap bank will pay to company interest payments on 510.000.000 at a feed rate of 9 90% Y will pay the swap bank interest payments on $10,000,000 at a ford rate of 10.30% and the swap bank will pay Yannual payments on $10,000,000 with the coupon rate of UBOR -0.15% x LIBOR - 15% SWAP LIBOR-ISSN BANK 9.9096 10.305 Y Bezess LIBOR + 16% What is the profit of the swap bank? What is the cost saving for Company X? What is the cost saving for Company Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts