Question: FINCH567 HW - Excel F File Home Insert Page Layout Formulas Data Review View Tell me what you want to do. Sign in Share 22

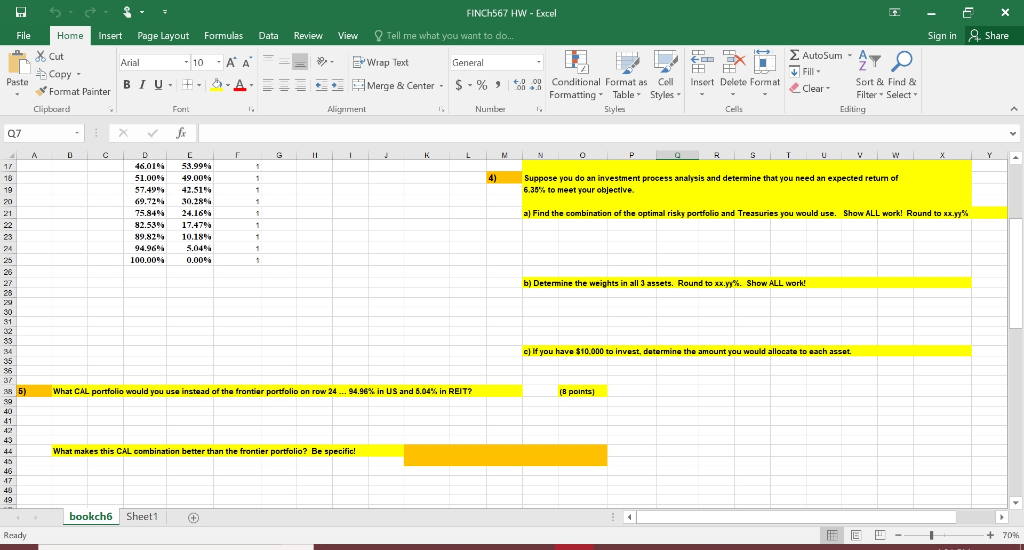

FINCH567 HW - Excel F File Home Insert Page Layout Formulas Data Review View Tell me what you want to do. Sign in Share 22 Wrap Text General Arial - 10 AA BIU - - A X Cut Copy Format Painter Clipboard ET H Insert Delote Format Ayo Paste Merge & Center - Center - $ - % Conditional Format as Coll .000 Formatting Table Styles 14 Styles AutoSum - A Fill - Sort & Find & Clear Filter - Select Editing Font Alignment 1 Number Cells 07 fx A F K N S T W 17 18 19 20 21 1 1 1 1 4) Suppose you do an investment process analysis and determine that you need an expected retum of 6.36% to meet your objective. 1 46.01% 51.00% 57.49% 69.72% 75.84 82.53% 89.829 94.96% 100.00% 53.9906 49.00 42.51% 30.28% 2-4.16% 17.47% 10.18% 3.0496 0.00% 1 a) Find the combination of the optimal risky portfolio and Treasuries you would use. Show ALL work! Round to xx.yy% 23 24 25 1 1 1 1 1 b) Determine the weights in all 3 assets. Round to xx.yy%. Show ALL work! 31 c) If you have $10,000 to invest, determine the amount you would allocate to each asset. 35 96 What CAL portfolio would you use instead of the frontier portfolio on row 24 ... 94.96% in US and 5.04% in REIT? (8 points) 38 5) 99 40 41 42 43 44 45 What makes this CAL combination better than the frontier portfolio? Be specific! .17 40 49 bookch6 Sheet1 + Ready + 70% FINCH567 HW - Excel F File Home Insert Page Layout Formulas Data Review View Tell me what you want to do. Sign in Share 22 Wrap Text General Arial - 10 AA BIU - - A X Cut Copy Format Painter Clipboard ET H Insert Delote Format Ayo Paste Merge & Center - Center - $ - % Conditional Format as Coll .000 Formatting Table Styles 14 Styles AutoSum - A Fill - Sort & Find & Clear Filter - Select Editing Font Alignment 1 Number Cells 07 fx A F K N S T W 17 18 19 20 21 1 1 1 1 4) Suppose you do an investment process analysis and determine that you need an expected retum of 6.36% to meet your objective. 1 46.01% 51.00% 57.49% 69.72% 75.84 82.53% 89.829 94.96% 100.00% 53.9906 49.00 42.51% 30.28% 2-4.16% 17.47% 10.18% 3.0496 0.00% 1 a) Find the combination of the optimal risky portfolio and Treasuries you would use. Show ALL work! Round to xx.yy% 23 24 25 1 1 1 1 1 b) Determine the weights in all 3 assets. Round to xx.yy%. Show ALL work! 31 c) If you have $10,000 to invest, determine the amount you would allocate to each asset. 35 96 What CAL portfolio would you use instead of the frontier portfolio on row 24 ... 94.96% in US and 5.04% in REIT? (8 points) 38 5) 99 40 41 42 43 44 45 What makes this CAL combination better than the frontier portfolio? Be specific! .17 40 49 bookch6 Sheet1 + Ready + 70%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts