Question: find debt to equity ratio for apendix A and apendix B. for some reason the answers of 1.7% and 2.2% that im getting are not

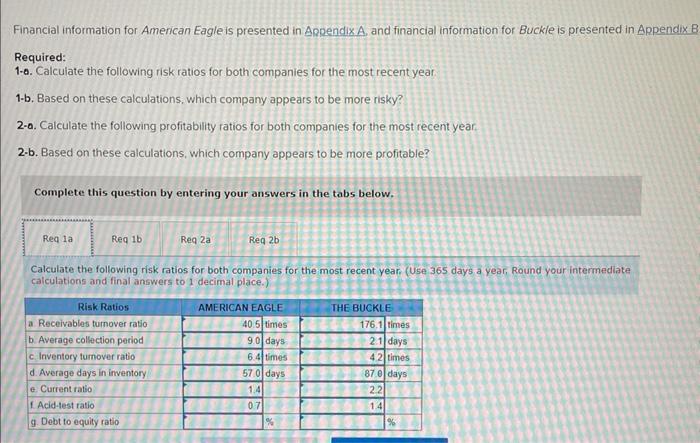

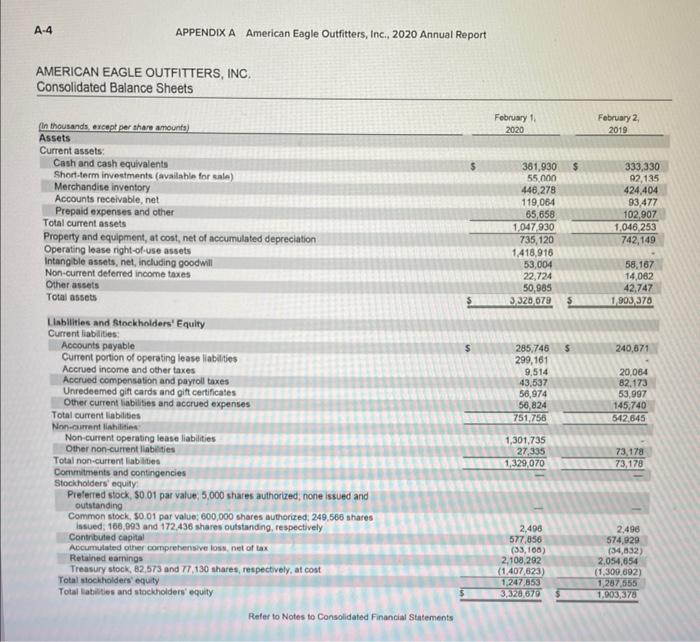

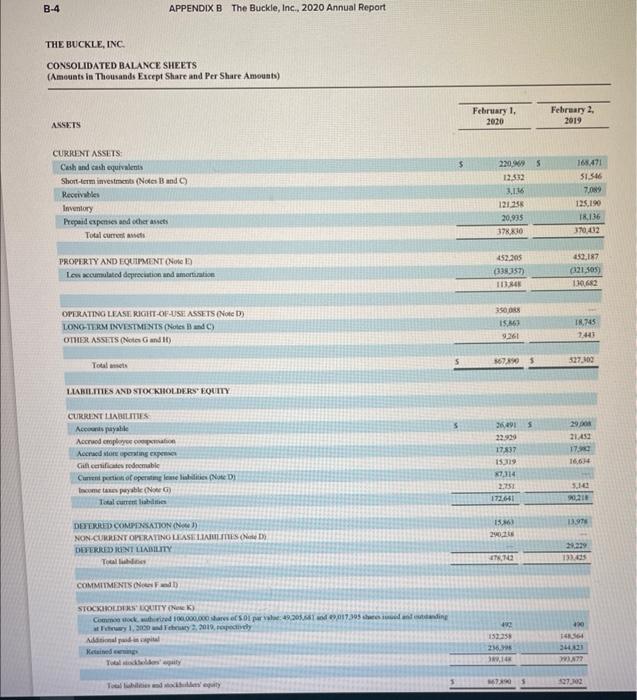

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix Required: 1-. . Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year, 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following risk ratios for both companies for the most recent year. (USE 365 days a year, Round your intermediate calculations and final answers to 1 decimal place.) AMERICAN EAGLE OUTFITTERS, INC, THE BUCKLE. INC. CONSOLIDATED BALANCE SHEETS (Ameusts in Theusands Except Share and Per Share Amvousts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts