Question: find journal entries for each and also record closing entry COMP4-1 (Algo) Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio

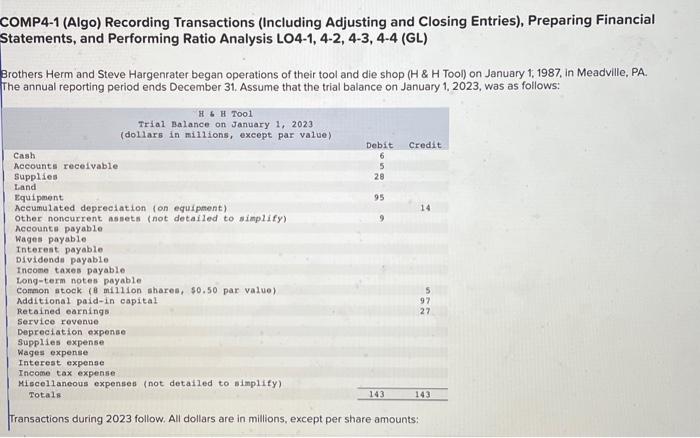

COMP4-1 (Algo) Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio Analysis LO4-1, 4-2, 4-3, 4-4 (GL) Brothers Herm and Steve Hargenrater began operations of their tool and die shop ( H \& Tool) on January 1, 1987, in Meadville, PA. The annual reporting period ends December 31. Assume that the trial balance on January 1, 2023, was as follows: Transactions during 2023 follow. All dollars are in millions, except per share amounts: Transactions during 2023 follow. All dollars are in-millions, except per share amounts: Borrowed $12 cash on a 5-year, 10 percent note payable, dated March 1, 2023. b. Sold 6 million additional shares of common stock for cash at \$1 market value per share on January 1, 2023. c. Purchased land for a future building site: paid cash, $20. 1. Earned $316 in revenues for 2023 , including $66 on credit and the rest in cash. 2. Incurred $106 in wages expense and $42 in miscellaneous expenses for 2023 , with $37 on credit and the rest paid in cash. f. Collected accounts recelvable, $41. 9. Purchased other noncurrent assets, $15cash. 7. Purchased supplies on account for future use, $40. i. Paid accounts payable, $37. j. Declared cash dividends on December 1,$21. k. Signed a three-year $46 service contract to start February 1, 2024. 1. Paid the dividends in (j) on December 31 . Data for adjusting entries: 1. Supplies counted on December 31, 2023, $31. 7. Depreciation for the year on the equipment, \$16. b. Interest accrued on notes payoble (to be computed). p. Woges earned by employees since the December 24 payroll but not yet paid, $18. 7. Income tax expense, $15, payable in 2024 . Prepare journal entries for transactions. Prepare joumai entries for no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter your answers in millions rather than in dollars (for example, 5 million should be entered as 5 rather than 5,000,000 ). COMP4-1 (Algo) Recording Transactions (Including Adjusting and Closing Entries), Preparing Financial Statements, and Performing Ratio Analysis LO4-1, 4-2, 4-3, 4-4 (GL) Brothers Herm and Steve Hargenrater began operations of their tool and die shop ( H \& Tool) on January 1, 1987, in Meadville, PA. The annual reporting period ends December 31. Assume that the trial balance on January 1, 2023, was as follows: Transactions during 2023 follow. All dollars are in millions, except per share amounts: Transactions during 2023 follow. All dollars are in-millions, except per share amounts: Borrowed $12 cash on a 5-year, 10 percent note payable, dated March 1, 2023. b. Sold 6 million additional shares of common stock for cash at \$1 market value per share on January 1, 2023. c. Purchased land for a future building site: paid cash, $20. 1. Earned $316 in revenues for 2023 , including $66 on credit and the rest in cash. 2. Incurred $106 in wages expense and $42 in miscellaneous expenses for 2023 , with $37 on credit and the rest paid in cash. f. Collected accounts recelvable, $41. 9. Purchased other noncurrent assets, $15cash. 7. Purchased supplies on account for future use, $40. i. Paid accounts payable, $37. j. Declared cash dividends on December 1,$21. k. Signed a three-year $46 service contract to start February 1, 2024. 1. Paid the dividends in (j) on December 31 . Data for adjusting entries: 1. Supplies counted on December 31, 2023, $31. 7. Depreciation for the year on the equipment, \$16. b. Interest accrued on notes payoble (to be computed). p. Woges earned by employees since the December 24 payroll but not yet paid, $18. 7. Income tax expense, $15, payable in 2024 . Prepare journal entries for transactions. Prepare joumai entries for no entry is required for a transaction/event, select "No journal entry required" in the first account field, Enter your answers in millions rather than in dollars (for example, 5 million should be entered as 5 rather than 5,000,000 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts