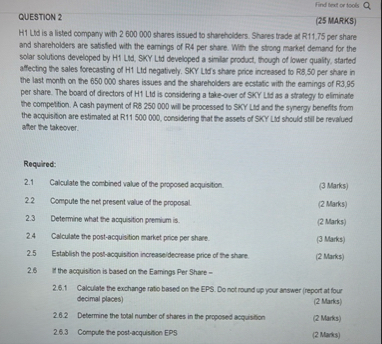

Question: Find leat or tools QUESTION 2 ( 2 5 MARKS ) H 1 Lid is a listed company with 2 6 0 0 0 0

Find leat or tools

QUESTION

MARKS

H Lid is a listed company with shares issued to shareholders. Shares trade at R per share and shareholders are satisfed with the earnings of R per share. With the stong market demand for the solar solutions developed by H LAd, SKY Lid developed a simlar product, though of lower quality, started affecting the sales forecasting of H Ltd negatively. SKY LUs's share price increased to R per share in the last month on the shares issues and the sharehoiders are ecstatic with the eamings of R per share. The board of directors of H Lid is considering a taieover of SKY Les as a strategy to elminate the competition. A cash payment of R will be processed to SKY Les and the synergy benefits from the acquisition are estimated at R consisering that the assets of SXY tut should stit be revalued atter the takeover.

Required:

Calculate the combined value of the proposed acquistion.

Marks

Compute the net present value of the proposal.

Marks

Determine what the acquisition premium is

Marks

Calculate the postacquistion market price per share.

Marks

Establish the postacquistion increaseldecrease price of the share.

Marks

It the acquistion is based on the Earings Per Share

Calculate the exchange ratio based on the EPS. Donot round up your answer report at four decimal places

Marks

Determine the total number of shares in the proposed acquistion

Marks

Compute the postacquistion EPS

Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock