Question: Find Market to book ratios. I keep getting the wrong answer and can't seem to figure it out if anyone can help thank you Cash

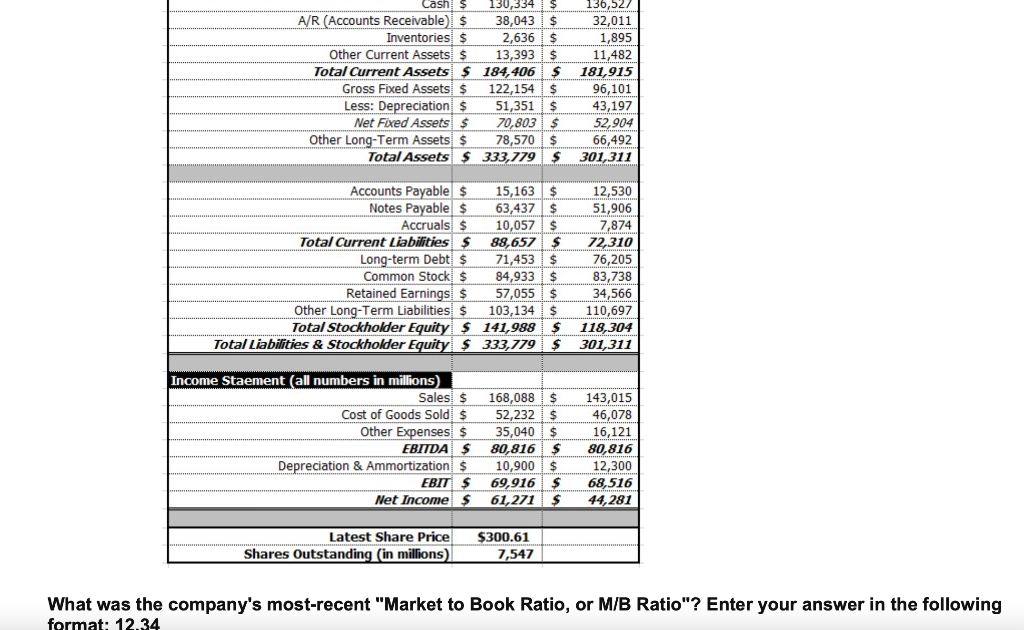

Find Market to book ratios.

I keep getting the wrong answer and can't seem to figure it out if anyone can help thank you

Cash s 130,334 $ 136,527 A/R (Accounts Receivable) $ 38,043 $ 32,011 Inventories $ 2,636 $ 1,895 Other Current Assets $ 13,393 $ 11,482 Total Current Assets $ 184,406 $ 181,915 Gross Fixed Assets $ 122,154 $ 96,101 Less: Depreciation $ 51,351 $ 43,197 Net Fixed Assets $ 70,803 $ 52,904 Other Long-Term Assets $ 78,570 $ 66,492 Total Assets $ 333,779 $ 301,311 Accounts Payable $ 15,163 $ 12,530 Notes Payable $ 63,437 $ 51,906 Accruals $ 10,057 $ 7,874 Total Current Liabilities s 88,657 $ 72,310 Long-term Debt $ 71,453 $ 76,205 Common Stock $ 84,933 $ 83,738 Retained Earnings $ 57,055$ 34,566 Other Long-Term Liabilities $ 103,134 $ 110,697 Total Stockholder Equity $ 141,988 $ 118,304 Total Liabilities & Stockholder Equity $333,779 $ 301,311 Income Staement (all numbers in millions Sales $ 168,088 $ Cost of Goods Sold $ 52,232 $ Other Expenses $ 35,040 $ EBITDA S 80,816 $ Depreciation & Ammortization $ 10,900 $ EBIT $ 69,916 $ Net Income $ 61,271 $ 143,015 46,078 16,121 80,816 12,300 68,516 44,281 Latest Share Price Shares Outstanding in millions) $300.61 7,547 What was the company's most-recent "Market to Book Ratio, or M/B Ratio"? Enter your answer in the following format: 12.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts