Question: Find net income for 2006. Now compute the difference between retained (reinvested) earnings at the beginning of the year and at the end. How closely

Find net income for 2006. Now compute the difference between retained (reinvested) earnings at the beginning of the year and at the end. How closely does this approximate the 2005 net income?

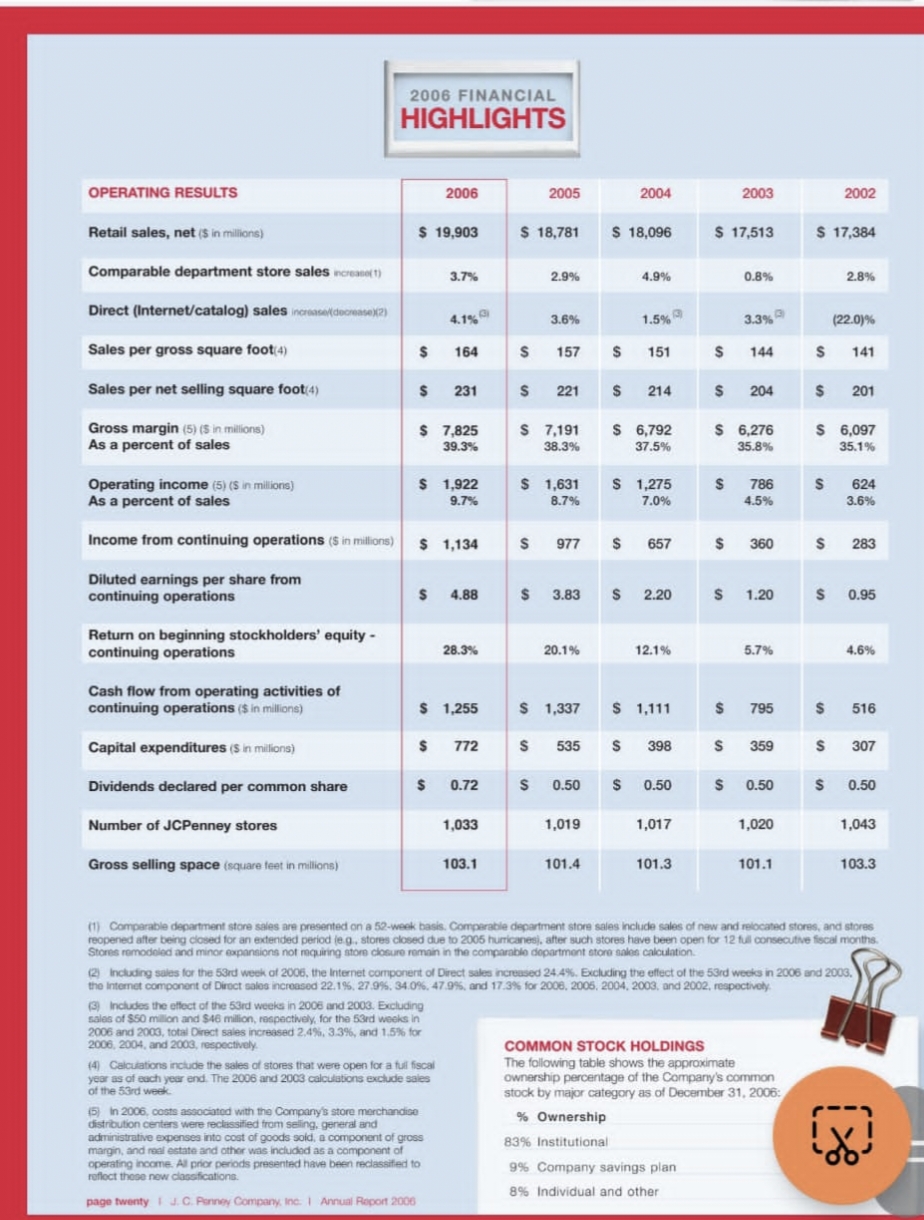

(1) Comparable department store sales are presented on a 52-week basis. Comperable department store sales include sales of new and relocated stores, and stores reopened after being closed for an extended period (e g. stores closed due to 2005 hurricanes), after such stores have been open for 12 full consecutive fiscal months. Stores remodoled and minor expansions not mequiring atore closure remain in the comparablo dopartment etore salos calculation. (2.) Including sales for the 53rd week of 2006, the Irternet componert of Direct sales incruased 24.4\%. Excluding the effect of the 53rd weeks in 2006 and 2003. the internet component of Diroct sales increased 22.1\%,27.9\%,34.0\%.47.9\%, and 17.3\% for 2006, 2006, 2004, 2003, and 2002, respectively (3) Includes the eftect of the 53rd weeks in 2006 and 2003. Excluding sales of $50 millon and $46 milion, respectively for the 53 rd weeks in 2006 and 2003 , total Direct sales increased 2.4\%,3.3\%, and 1.5\% for 2006, 2004, and 2003 , respectively. (4) Calcuations include the sales of stores that were open for a ful fiscal year as of each year end. The 2006 and 2003 calculations exclude sales of the 53rd week. (5) In 2006, costs associoted with the Company's store merchandice distribution centers were reclassified trom seling. gererat and administrative expenses into cost of goods sold, a component of gross margin, and real estate and other was included as a component of operating income. Al prior periods presented have been reclassifed to refloct these new clacsfications. COMMON STOCK HOLDINGS The following table shows the approximate ownership percentage of the Company's common stock by major category as of December 31,2006 : % Ownership 83% Institutional 9% Company savings plan 8% Individual and other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts