Question: find the answer to question b and c with the formula visible on excel Sales growth Tax rate mm- N Income Statement Sales Costs Depreciation

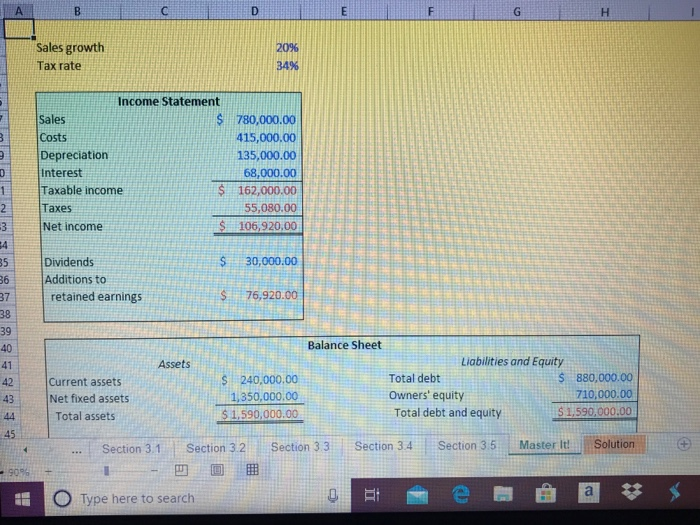

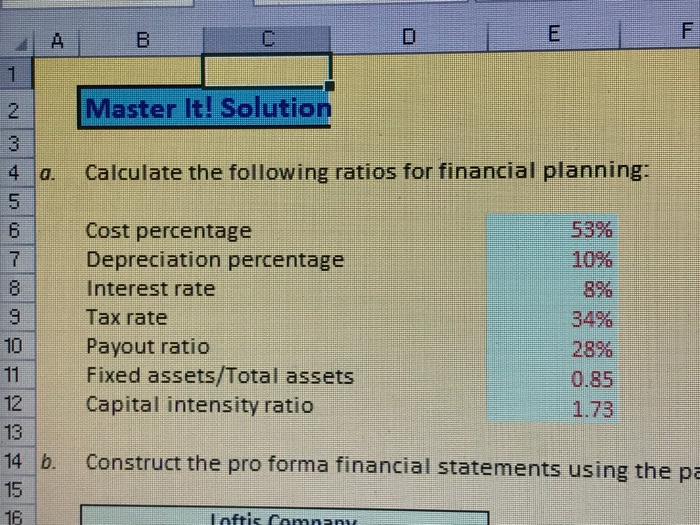

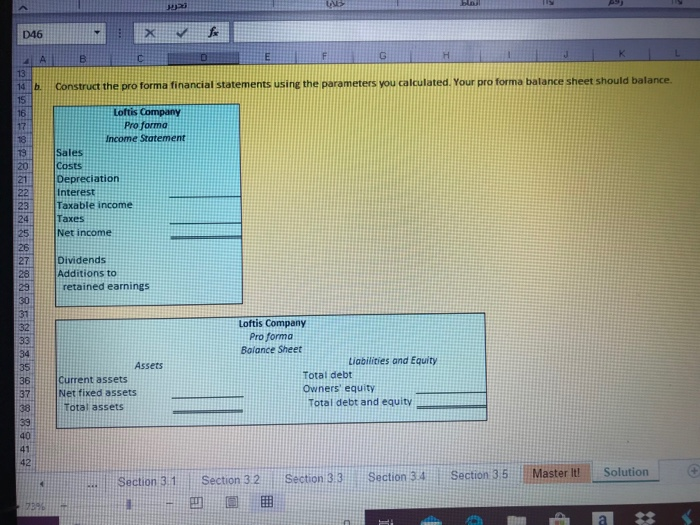

Sales growth Tax rate mm- N Income Statement Sales Costs Depreciation Interest Taxable income Taxes Net income $ 780,000.00 415,000.00 135,000.00 68,000.00 162,000.00 55,080.00 106,920,00 $ 30,000.00 Dividends Additions to retained earnings $ 76,920.00 Balance Sheet S5944 Current assets Net fixed assets Total assets S 240,000.00 1,350,000.00 $ 1,590,000.00 Liabilities and Equity Total debt $ 880,000.00 Owners' equity 710,000.00 Total debt and equity $ 1.590,000.00 Section 3.1 Section 32 Section 33 Section 3.4 Section 3.5 Master It Solution O Type here to search E F Master It! Solution 4 a. + Calculate the following ratios for financial planning: 53% O 109 OO Cost percentage Depreciation percentage Interest rate Tax rate Payout ratio Fixed assets/Total assets Capital intensity ratio 8% 34% 28% 0.85 1.73 14 b. Construct the pro forma financial statements using the pa loftis damnan 046 XV for Construct the pro forma financial statements using the parameters you calculated. Your pro forma balance sheet should balance Loftis Company Pro forma Income Statement Sales Costs Depreciation Interest Taxable income Taxes Net income Dividends Additions to retained earnings Assets Current assets Net fixed assets Total assets Loftis Company Pro forma Balance Sheet Liabilities and Equity Total debt Owners' equity Total debt and equity Section 31 Section 3 2 Section 33 Section 34 Section 35 Master It Solution C. In this financial planning model, show that it is possible to solve algebraically for the amount of new borrowing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts